In a volatile yet dynamic session, the US stock market saw a series of significant movements on July 26, 2025. This article delves into the latest news and insights, highlighting key developments and providing an overview of market trends.

Tech Giants Dominate the Day

The tech sector was a major highlight of the day, with leading companies like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) leading the charge. Apple's stock surged on strong quarterly earnings and a positive outlook for the upcoming fiscal year. The tech giant reported revenue and earnings that exceeded Wall Street expectations, prompting a surge in its stock price.

Microsoft, on the other hand, saw its shares rise following the release of its latest earnings report. The company's cloud services business, Azure, reported significant growth, contributing to the overall positive performance. Microsoft's shares closed at a new all-time high, reflecting investors' confidence in the company's long-term prospects.

Amazon also reported robust quarterly results, with revenue and earnings surpassing market expectations. The e-commerce giant's cloud computing arm, Amazon Web Services (AWS), continued to drive growth, leading to a strong overall performance. Investors were particularly impressed by Amazon's commitment to innovation and expansion into new markets, driving its stock price higher.

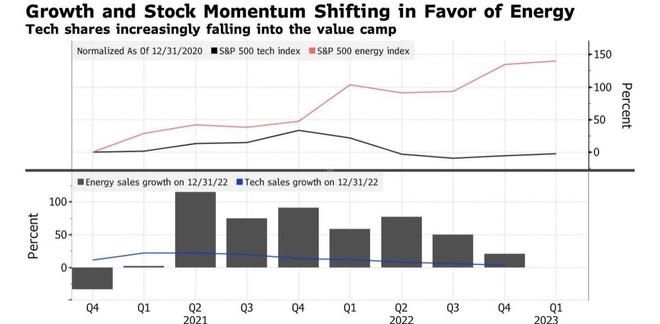

Energy Sector Shakes Off Volatility

The energy sector, which has been experiencing significant volatility in recent months, saw a bit of stability on July 26, 2025. Oil prices stabilized after a volatile few weeks, leading to a positive impact on energy stocks. ExxonMobil (XOM) and Chevron (CVX) were among the biggest gainers in the sector, with both companies reporting solid earnings and positive outlooks.

ExxonMobil, the world's largest publicly traded oil and gas company, reported earnings that were in line with market expectations. The company's exploration and production segment continued to perform well, despite challenges in certain regions. Chevron also reported strong earnings, with a particular focus on its oil production in the Permian Basin.

Financials Sector Undergoes Modest Decline

The financial sector, which has been a major driver of the stock market's overall performance in recent months, saw a modest decline on July 26, 2025. JPMorgan Chase (JPM), Bank of America (BAC), and Goldman Sachs (GS) reported solid earnings, but the overall sector was negatively impacted by concerns over rising interest rates and economic uncertainty.

JPMorgan Chase reported earnings that exceeded market expectations, with strong performance across its various business segments. However, concerns over rising interest rates and potential economic challenges led to a slight decline in the stock price. Similarly, Bank of America and Goldman Sachs reported strong earnings, but their stock prices also experienced slight declines.

Consumer Discretionary Sector Holds Strong

The consumer discretionary sector, which includes companies in the retail, automotive, and leisure industries, held strong on July 26, 2025. Retail giant Walmart (WMT) reported solid earnings, driven by strong online sales and a robust grocery business. The company's focus on innovation and expansion into new markets continued to drive investor confidence.

Automaker Tesla (TSLA) also reported strong earnings, with a particular emphasis on its growing production of electric vehicles. The company's commitment to sustainable transportation and its leadership in the electric vehicle market continued to attract investor interest. Additionally, leisure company Disney (DIS) reported a strong quarter, driven by increased attendance at its theme parks and strong performance from its streaming service, Disney+.

Conclusion

The US stock market saw a range of movements on July 26, 2025, with tech giants leading the way. The energy sector experienced stability, while the financials sector saw a modest decline. The consumer discretionary sector held strong, driven by robust earnings from companies like Walmart and Tesla. As investors continue to navigate the complex and dynamic market landscape, these trends will be closely monitored for further insights and opportunities.