Are you looking to invest in the steel industry? If so, you've likely come across the term "US Steel stock name." But what does it mean, and how can you make an informed decision about investing in this company? In this article, we'll explore the US Steel stock name, its history, and its potential as an investment opportunity.

Understanding the US Steel Stock Name

The US Steel stock name refers to the ticker symbol for United States Steel Corporation, which is a Fortune 500 company based in Pittsburgh, Pennsylvania. The ticker symbol is X, and it is listed on the New York Stock Exchange (NYSE). As one of the largest steel producers in the world, US Steel has a significant impact on the global steel market.

History of US Steel

US Steel was founded in 1901 by Andrew Carnegie, a famous industrialist and philanthropist. The company was created to consolidate the steel industry and eliminate competition. Over the years, US Steel has grown and expanded, becoming one of the most significant players in the industry.

Why Invest in US Steel?

Investing in US Steel can be a smart move for several reasons. Firstly, the steel industry is essential to many sectors of the economy, including construction, manufacturing, and transportation. As these sectors grow, so does the demand for steel, which can lead to increased profits for US Steel.

Secondly, US Steel has a strong track record of innovation and technological advancements. The company has invested heavily in research and development, which has helped it maintain a competitive edge in the market.

Thirdly, US Steel has a diverse portfolio of products and services, which allows the company to adapt to changing market conditions and customer needs.

Case Study: US Steel's Response to the Great Recession

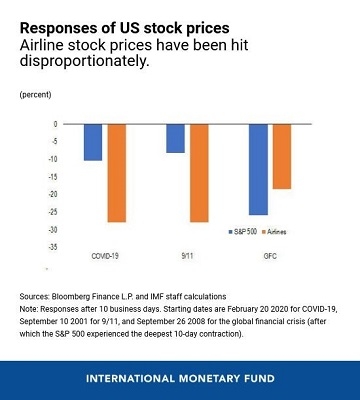

One example of US Steel's resilience is its response to the Great Recession of 2008. During this period, the global steel market faced significant challenges, including falling demand and high levels of debt. Despite these challenges, US Steel managed to navigate the downturn and emerge stronger than ever.

The company's strategic focus on cost reduction, innovation, and diversification played a crucial role in its success. By streamlining operations and reducing its debt burden, US Steel was able to maintain its market position and capitalize on opportunities as the economy began to recover.

What to Consider Before Investing

Before investing in US Steel, there are a few factors to consider. Firstly, the steel industry is subject to significant price volatility, which can impact the company's earnings. Secondly, the company's exposure to global markets means it is susceptible to economic and political risks.

Additionally, it's essential to conduct thorough research and consider your investment goals and risk tolerance. While US Steel has a strong track record, investing in any company carries risks, and it's crucial to understand these risks before making a decision.

Conclusion

The US Steel stock name, represented by the ticker symbol X, is a significant investment opportunity in the steel industry. With a strong history, a focus on innovation, and a diverse portfolio, US Steel has the potential to be a valuable addition to your investment portfolio. However, as with any investment, it's crucial to conduct thorough research and consider your risk tolerance before making a decision.