Are you looking to diversify your investment portfolio and consider investing in US stocks from India? With the increasing globalization of the stock market, it has become easier than ever to invest in foreign markets. In this article, we will guide you through the process of investing in US stocks from India, including the necessary steps and considerations.

Understanding the Basics

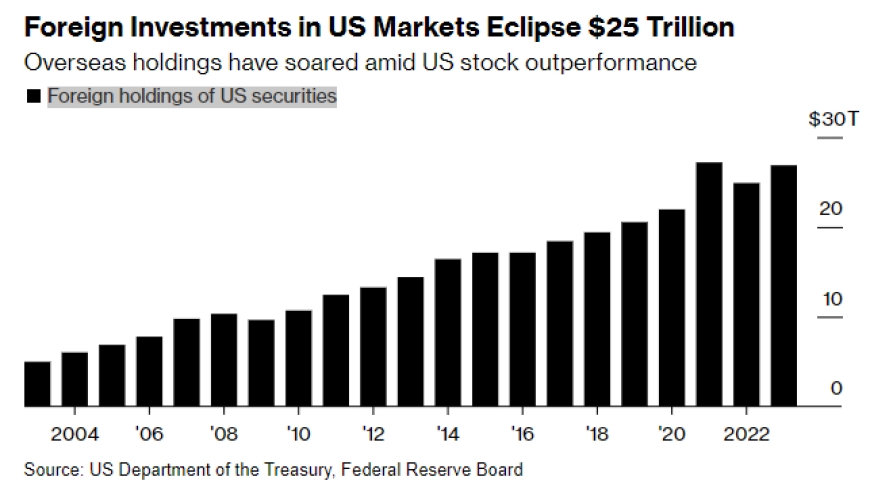

Before diving into the process, it's important to understand the basics of investing in US stocks. The US stock market is one of the largest and most liquid markets in the world, offering a wide range of companies across various sectors. Investing in US stocks can provide opportunities for high returns and diversification, but it also comes with its own set of risks.

Opening a Brokerage Account

The first step in investing in US stocks from India is to open a brokerage account. This account will allow you to buy and sell stocks in the US market. There are several brokerage firms in India that offer services for investing in US stocks. Some popular options include:

- Zerodha

- Upstox

- Angel One

When choosing a brokerage firm, consider factors such as fees, customer service, and the ease of use of their platform. Make sure to read reviews and compare different brokers to find the one that best suits your needs.

Understanding the Risks

Investing in US stocks from India involves certain risks, including currency risk and regulatory risk. It's important to understand these risks and how they can impact your investment. Here are some key risks to consider:

- Currency Risk: The value of the Indian rupee (INR) can fluctuate against the US dollar (USD), impacting the value of your investments. It's important to monitor exchange rates and consider how currency fluctuations may affect your returns.

- Regulatory Risk: The US regulatory environment is different from that in India. Make sure to understand the rules and regulations governing investments in the US market.

Research and Analysis

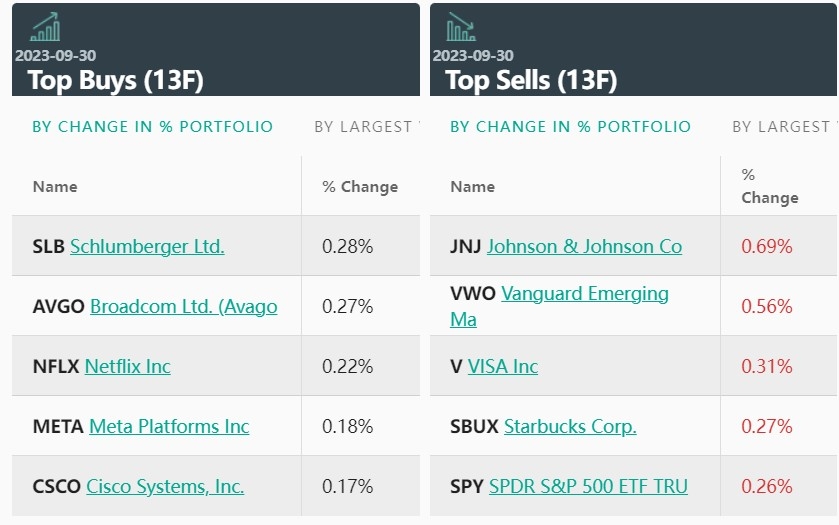

Before investing in any stock, it's crucial to conduct thorough research and analysis. This includes:

- Company Analysis: Evaluate the financial health, growth prospects, and management of the company you are considering investing in.

- Market Analysis: Understand the overall market conditions and trends that may impact the performance of your investments.

Tax Considerations

Investing in US stocks from India also involves tax implications. Here are some key tax considerations:

- Capital Gains Tax: If you sell a US stock for a profit, you may be subject to capital gains tax in India.

- Withholding Tax: The US may withhold a portion of your dividends as withholding tax. However, you may be eligible for a tax credit in India.

Diversification

Diversifying your investment portfolio is crucial to mitigate risks. Consider investing in a mix of sectors and companies to spread out your risks.

Case Study: Investing in Apple Inc.

Let's take a look at a hypothetical case study. Suppose you want to invest in Apple Inc. (AAPL), one of the most popular companies in the world.

- Open a brokerage account with a firm that offers US stock trading.

- Conduct research on Apple Inc., including financial statements, market trends, and management quality.

- Monitor your investment regularly and stay informed about any news or developments that may impact the company's performance.

Conclusion

Investing in US stocks from India can be a great way to diversify your portfolio and potentially earn high returns. However, it's important to do thorough research, understand the risks, and consider tax implications before investing. By following the steps outlined in this article, you can get started on your journey to investing in US stocks from India.