In recent years, the concept of a trade war has become a hot topic in global economics. As tensions rise between major economies, investors are increasingly concerned about the potential impact on the US stock market. This article delves into the possible effects of a trade war on the US stock market, offering insights into how investors can navigate these challenging times.

Understanding the Trade War

A trade war refers to a situation where countries impose tariffs and other trade barriers on each other's goods and services. This can lead to a decrease in international trade, higher prices for consumers, and reduced economic growth. The US has been engaged in trade disputes with various countries, including China, the EU, and Mexico.

Potential Effects on the US Stock Market

Stock Valuations: A trade war can lead to lower stock valuations as investors become wary of the economic uncertainty. Companies that rely heavily on international trade may see their earnings and revenue decline, affecting their stock prices.

Sector Impact: Different sectors of the stock market are affected differently by trade wars. Industries that are heavily exposed to international trade, such as technology, automotive, and agriculture, may experience significant declines. On the other hand, sectors like energy and healthcare may benefit from increased domestic production and reduced imports.

Consumer Sentiment: A trade war can lead to higher prices for goods and services, impacting consumer sentiment. This can lead to a decrease in consumer spending, which is a major driver of the US economy and stock market.

Interest Rates: Central banks, including the Federal Reserve, may respond to a trade war by adjusting interest rates. Higher interest rates can make borrowing more expensive, impacting corporate earnings and stock prices.

Case Studies

To illustrate the potential impact of a trade war on the US stock market, let's look at a few case studies:

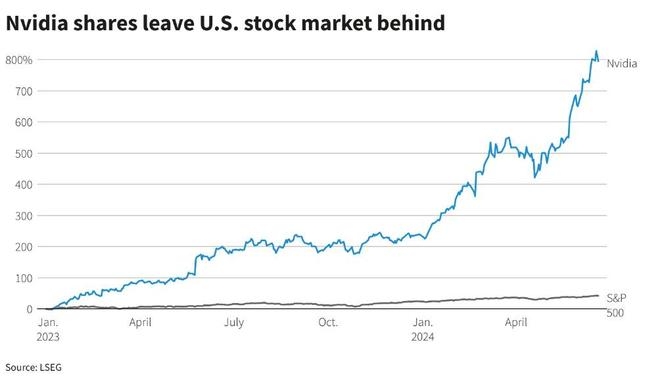

2018 US-China Trade Dispute: In 2018, the US and China engaged in a trade war, imposing tariffs on each other's goods. This led to a decline in the stock market, particularly in sectors exposed to international trade, such as technology and automotive.

2020 US-EU Trade Dispute: In 2020, the US and the EU clashed over aircraft subsidies, leading to retaliatory tariffs. This resulted in a decrease in the stock market, particularly in the aerospace industry.

Navigating the Trade War

Investors should consider the following strategies to navigate the challenges posed by a trade war:

Diversification: Diversifying your portfolio across different sectors and asset classes can help mitigate the impact of a trade war on your investments.

Focus on Domestic Companies: Investing in companies with a strong domestic presence can help protect against the negative effects of international trade disputes.

Monitor Economic Indicators: Keeping a close eye on economic indicators, such as GDP growth, consumer spending, and corporate earnings, can provide valuable insights into the potential impact of a trade war on the stock market.

In conclusion, a trade war can have a significant impact on the US stock market. By understanding the potential effects and adopting appropriate investment strategies, investors can navigate these challenging times and protect their portfolios.