Are you new to the world of investing and looking to understand the US stock market? You've come to the right place. The stock market can be a complex and intimidating place, but with the right knowledge and guidance, it can also be a powerful tool for building wealth. In this comprehensive guide, we'll delve into the basics of the US stock market, including how it works, the different types of stocks, and strategies for investing successfully.

What is the US Stock Market?

The US stock market is a marketplace where shares of publicly-traded companies are bought and sold. It provides a platform for investors to buy a portion of a company, known as a stock, and potentially profit from the company's growth and success. The most well-known stock exchanges in the US are the New York Stock Exchange (NYSE) and the Nasdaq.

Understanding Stock Market Indices

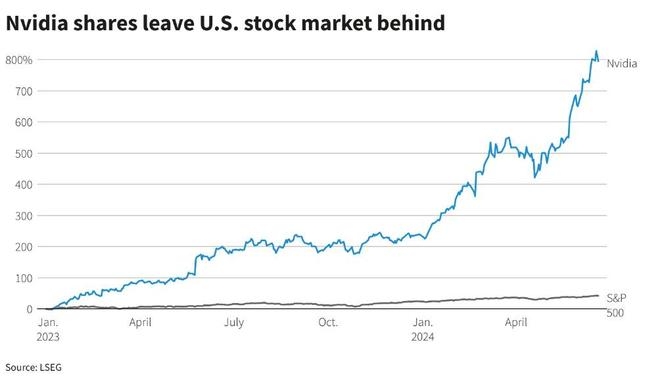

Before diving into individual stocks, it's important to understand stock market indices. These indices are a measure of the overall performance of a group of stocks. Some of the most popular indices include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite.

- S&P 500: This index tracks the performance of 500 large companies listed on the NYSE and Nasdaq. It's often considered a benchmark for the US stock market.

- Dow Jones Industrial Average (DJIA): This index tracks the performance of 30 large, publicly-traded companies in the US. It's one of the oldest and most widely followed stock market indices.

- Nasdaq Composite: This index tracks the performance of all companies listed on the Nasdaq exchange, which includes many technology companies.

Types of Stocks

There are several types of stocks to consider when investing in the US stock market:

- Common Stocks: These are the most common type of stock, representing ownership in a company. Common stockholders have voting rights and can receive dividends, but they're last in line to receive assets in the event of bankruptcy.

- Preferred Stocks: These stocks provide fixed dividends and have a higher claim on assets than common stocks. However, preferred stockholders typically don't have voting rights.

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a long history of profitability. They're often considered a safer investment than smaller, riskier companies.

- Growth Stocks: These stocks are from companies with high growth potential. They may not pay dividends and can be riskier, but they offer the potential for significant capital gains.

Investing Strategies

When investing in the US stock market, it's important to have a clear strategy. Here are some common strategies:

- Diversification: This involves investing in a variety of stocks across different industries and sectors to reduce risk.

- Value Investing: This strategy involves buying stocks that are undervalued by the market, based on fundamental analysis.

- Growth Investing: This strategy focuses on investing in companies with high growth potential, often at higher valuations.

- Income Investing: This involves investing in stocks that pay regular dividends, providing a steady income stream.

Case Study: Apple Inc.

A great example of a successful stock investment is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. By investing in Apple's common stock, investors have seen significant returns over the years, despite the company facing various challenges and market fluctuations.

In conclusion, understanding the US stock market is crucial for anyone looking to invest successfully. By familiarizing yourself with the basics, different types of stocks, and investing strategies, you can make informed decisions and potentially build wealth over time. Remember to do your research, stay patient, and maintain a diversified portfolio. Happy investing!