Understanding the Possibilities and Regulations

Have you ever wondered if international students can invest in U.S. stocks? The answer is a resounding yes, but it's essential to understand the regulations and requirements involved. Investing in U.S. stocks can be a valuable opportunity for international students to grow their wealth and gain exposure to the global market. In this article, we'll explore the ins and outs of buying U.S. stocks for international students.

Eligibility and Requirements

The first thing to consider is whether you are eligible to buy U.S. stocks. Generally, international students with a valid visa, such as an F-1 or J-1 visa, are allowed to invest in U.S. securities. However, there are a few key requirements you need to meet:

- Adequate Financial Resources: You must have sufficient financial resources to cover your living expenses and tuition fees without engaging in unauthorized employment.

- No Unauthorized Employment: You cannot work off-campus without specific authorization from the Department of Homeland Security (DHS).

If you meet these requirements, you can proceed with opening a brokerage account and investing in U.S. stocks.

Opening a Brokerage Account

To buy U.S. stocks, you'll need to open a brokerage account. A brokerage account is a type of financial account that allows you to buy and sell stocks, bonds, and other securities. Here are the steps to open a brokerage account:

- Research Brokerage Firms: There are many brokerage firms to choose from, so it's important to do your research and select one that meets your needs. Consider factors such as fees, customer service, and available investment options.

- Provide Required Documentation: You'll need to provide identification documents, such as a passport, visa, and student ID. You may also need to provide proof of address and financial statements.

- Fund Your Account: Once your account is approved, you can fund it with cash or securities to start buying U.S. stocks.

Types of U.S. Stocks

There are several types of U.S. stocks you can invest in, including:

- Common Stocks: These represent ownership in a company and entitle you to vote on company matters.

- Preferred Stocks: These offer a fixed dividend and typically have priority over common shareholders in terms of asset distribution in case of bankruptcy.

- American Depositary Receipts (ADRs): These are U.S.-traded shares of foreign companies that allow you to invest in foreign stocks without dealing with foreign currency exchanges.

Risks and Considerations

While investing in U.S. stocks can be beneficial, it's crucial to be aware of the risks involved. Some factors to consider include:

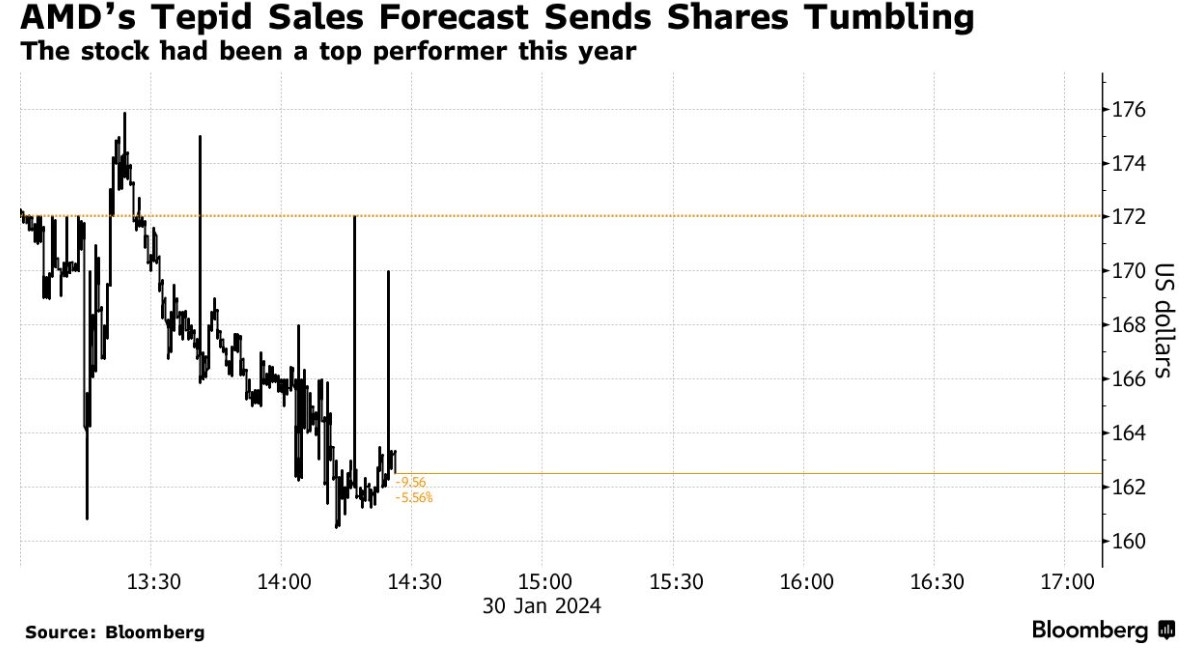

- Market Volatility: Stock markets can be unpredictable, and you may experience fluctuations in your investment value.

- Currency Exchange Rates: If you're investing in U.S. stocks using a different currency, exchange rate fluctuations can impact your returns.

- Tax Implications: Be sure to consult with a tax professional to understand the tax implications of investing in U.S. stocks as an international student.

Conclusion

In conclusion, international students can buy U.S. stocks if they meet the necessary requirements and open a brokerage account. By understanding the regulations and risks involved, you can make informed decisions and potentially grow your wealth through investing. Remember to do your research and consult with financial professionals to ensure you're making the best investment choices for your situation.