The upcoming US elections have become a focal point for investors across the globe, especially those with a stake in the Indian and Chinese stock markets. As the world's two most populous countries, India and China play a significant role in the global economy. The outcome of the US elections could have profound implications for these markets, affecting everything from trade policies to investor sentiment. This article delves into the potential impact of the US elections on the Indian and Chinese stock markets.

Trade Policies and Tariffs

One of the most immediate concerns for investors in both India and China is the potential for changes in trade policies. The current administration has imposed tariffs on a range of goods from these countries, leading to increased costs and reduced demand. A change in administration could result in a shift in these policies, which could have a significant impact on the stock markets.

If the Democratic candidate wins, there may be a push to negotiate trade deals that benefit India and China, potentially easing tariffs and improving market sentiment. Conversely, a Republican win could lead to a continuation or even intensification of trade tensions, negatively affecting the stock markets.

Investor Sentiment

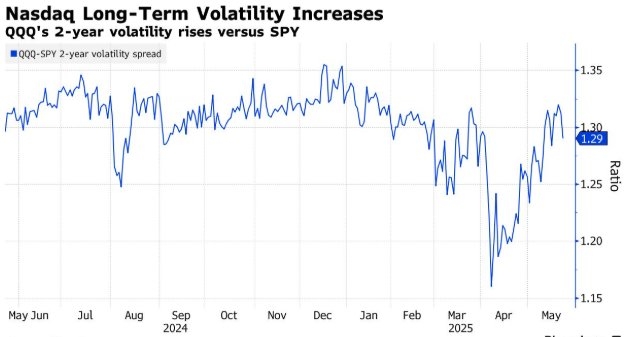

The US elections also have the potential to influence investor sentiment in both India and China. Historically, market volatility tends to increase in the lead-up to major elections. This can be attributed to uncertainty about the future direction of policies and the potential for market disruptions.

For instance, if the polls show a tight race, investors may become more cautious, leading to a sell-off in stocks. However, if one candidate appears to be leading, investors may become more optimistic, leading to a rally in the stock markets.

Economic Policies

The economic policies of the incoming administration could also have a significant impact on the Indian and Chinese stock markets. For example, a focus on infrastructure spending could boost demand for goods and services, benefiting companies in both countries.

If the new administration focuses on clean energy, this could benefit Indian and Chinese companies in the renewable energy sector. Conversely, a focus on traditional energy sources could have the opposite effect.

Case Studies

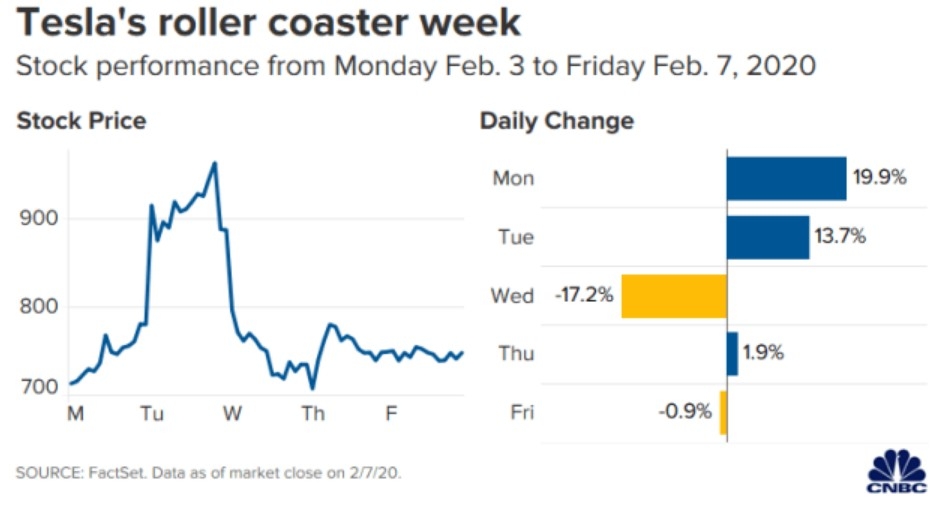

A recent case study from the 2016 US elections illustrates the potential impact of the elections on the Indian and Chinese stock markets. In the months leading up to the election, the Indian and Chinese stock markets experienced significant volatility. This was attributed to uncertainty about the future direction of trade policies and the potential for changes in economic policies.

After the election, the stock markets in both countries initially reacted negatively to the victory of the Republican candidate. However, over time, the markets recovered and even experienced gains, driven by a combination of improved investor sentiment and positive economic data.

Conclusion

The upcoming US elections have the potential to significantly impact the Indian and Chinese stock markets. While the exact outcome is uncertain, investors should be aware of the potential risks and opportunities that could arise from a change in administration. By closely monitoring the election results and understanding the potential implications for trade policies and economic policies, investors can make more informed decisions.