Introduction: Recessions are an inevitable part of the economic cycle, and their impact on the US stock market can be profound. Understanding how recessions affect the stock market is crucial for investors and traders alike. In this article, we will explore the relationship between recessions and the US stock market, examining the factors that drive stock prices during economic downturns and the strategies investors can employ to navigate these challenging times.

The Impact of Recessions on the US Stock Market: During a recession, the US stock market often experiences a significant decline in stock prices. This is primarily due to several factors:

Economic Slowdown: Recessions are characterized by a slowdown in economic growth, leading to reduced corporate earnings. As companies report lower profits, investors become cautious and sell off their stocks, causing prices to fall.

Consumer Spending: Recessions typically lead to a decrease in consumer spending as people become more cautious with their finances. This decline in consumer spending affects the revenue of companies, further driving down stock prices.

Interest Rates: During recessions, the Federal Reserve often lowers interest rates to stimulate the economy. However, lower interest rates can also lead to inflation, which erodes the purchasing power of investors' portfolios.

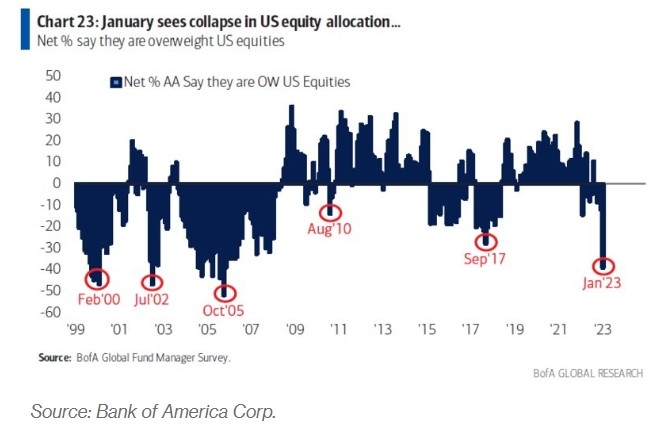

Investor Sentiment: Recessions often create a negative sentiment among investors, leading to panic selling and a further decline in stock prices.

Strategies for Navigating Recessions: Despite the challenges posed by recessions, there are strategies investors can employ to mitigate the impact on their portfolios:

Diversification: Diversifying your investments across various asset classes, including stocks, bonds, and commodities, can help reduce the risk of a downturn in any single market.

Value Investing: Investing in undervalued stocks with strong fundamentals can be a good strategy during recessions. These companies may be overlooked by the market due to broader economic concerns but may offer long-term growth potential.

Inflation-Protected Securities: Investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can help protect your portfolio against the eroding effects of inflation.

Cash Reserves: Maintaining a cash reserve can provide a cushion during economic downturns. This allows investors to take advantage of opportunities that arise when stock prices are low.

Case Studies:

2008 Financial Crisis: The 2008 financial crisis is a prime example of how recessions can severely impact the stock market. The S&P 500 Index fell by nearly 50% from its peak in October 2007 to its trough in March 2009. However, investors who maintained a diversified portfolio and had adequate cash reserves were better positioned to recover from the downturn.

2020 COVID-19 Pandemic: The COVID-19 pandemic caused a significant recession in 2020, leading to a sharp decline in the stock market. However, the S&P 500 Index quickly recovered, posting a positive return for the year. This highlights the importance of long-term perspective and the resilience of the stock market.

Conclusion: Recessions can be a challenging time for the US stock market, but understanding their impact and employing appropriate strategies can help investors navigate these turbulent periods. By diversifying their portfolios, focusing on value investing, and maintaining cash reserves, investors can mitigate the risks associated with recessions and position themselves for long-term success.