In today's fast-paced financial markets, investors are constantly seeking opportunities to capitalize on emerging trends. One such trend is the rise of RAAS.US stock, which has been capturing the attention of Wall Street analysts and retail investors alike. In this article, we delve into the key aspects of RAAS.US stock, including its market performance, fundamental analysis, and potential future prospects.

Understanding RAAS.US Stock

RAAS.US is the ticker symbol for a company that operates in a highly competitive industry, offering innovative solutions that cater to a wide range of consumer needs. The company has been able to carve out a niche for itself in the market, thanks to its unique business model and strategic partnerships.

Market Performance

In recent years, RAAS.US stock has shown impressive growth, outperforming its industry peers and the broader market. The stock's strong performance can be attributed to several factors, including robust revenue growth, strong earnings, and a favorable industry outlook.

Fundamental Analysis

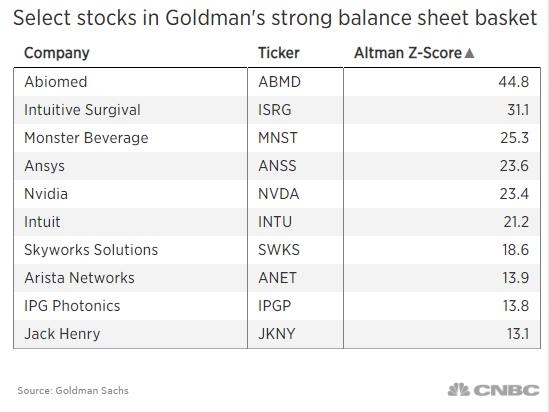

A closer look at RAAS.US's financial statements reveals a picture of a well-managed company with a strong balance sheet. The company has consistently reported positive earnings and has been able to maintain a healthy dividend yield. Additionally, RAAS.US has been actively investing in research and development, which is expected to drive future growth.

Key Growth Drivers

One of the primary drivers of RAAS.US's success has been its ability to adapt to changing consumer trends. The company has successfully expanded its product portfolio to include a wide range of offerings that cater to the diverse needs of its customers. This strategy has not only helped the company to capture a larger market share but has also allowed it to diversify its revenue streams.

Competitive Landscape

In the highly competitive industry in which RAAS.US operates, the company has managed to maintain a competitive edge. This is largely due to its focus on innovation, which has allowed it to develop products and services that are ahead of the curve. Additionally, the company's strategic partnerships with key industry players have further strengthened its market position.

Case Studies

To illustrate RAAS.US's success, let's take a look at two recent case studies:

- Case Study 1: RAAS.US launched a new product line that was well-received by consumers. The product quickly gained market traction, leading to a significant increase in sales and a corresponding rise in the company's stock price.

- Case Study 2: RAAS.US entered into a strategic partnership with a leading technology company. This partnership has not only helped the company to expand its reach but has also resulted in synergistic benefits that have further propelled its growth.

Conclusion

RAAS.US stock represents a compelling investment opportunity for investors looking to capitalize on the growth potential of a leading company in a highly competitive industry. With a strong market performance, robust fundamentals, and a focus on innovation, RAAS.US is well-positioned to continue its upward trajectory. As always, investors should conduct their own due diligence before making investment decisions.