Introduction:

In the rapidly evolving world of technology and transportation, Didi Chuxing, a renowned ride-hailing service, has become a significant player in the market. As of late, investors have been closely monitoring the OTC (over-the-counter) share price of Didi, seeking to understand the company's performance and potential growth. In this article, we will delve into the factors affecting Didi's OTC share price, recent trends, and future outlook.

Understanding Didi's OTC Share Price:

Didi's OTC share price refers to the value of its shares that are traded on the over-the-counter market. Unlike shares listed on exchanges like the New York Stock Exchange (NYSE) or NASDAQ, OTC shares are bought and sold through a network of dealers and brokers. This lack of centralized trading platform can sometimes make it challenging to obtain real-time prices and accurate data. However, several factors can influence Didi's OTC share price.

- Market Conditions:

The overall market conditions play a crucial role in determining Didi's OTC share price. When the stock market is performing well, the demand for Didi's shares may increase, leading to a higher share price. Conversely, during market downturns, investor confidence may wane, resulting in a decrease in share value.

- Financial Performance:

Didi's financial performance is a primary driver of its OTC share price. Investors closely monitor the company's revenue, profits, and growth potential. Strong financial results can lead to increased investor confidence and a higher share price, while disappointing performance can cause share prices to decline.

- Regulatory Environment:

The regulatory environment is another significant factor impacting Didi's OTC share price. As a ride-hailing service, Didi operates in a highly regulated industry, and changes in regulations can directly affect its business operations and profitability. For instance, stricter regulations may lead to higher compliance costs, affecting the company's bottom line and share price.

Recent Trends:

In recent years, Didi's OTC share price has experienced fluctuations due to various factors. Let's take a closer look at some key trends:

- Initial Public Offering (IPO):

In 2019, Didi Chuxing conducted an initial public offering on the NYSE, raising $4.4 billion. However, the company's OTC share price has since experienced significant volatility, reflecting the company's performance and market conditions.

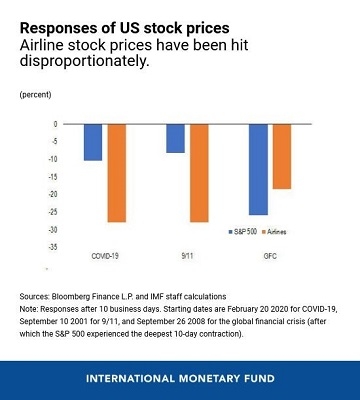

- Pandemic Impact:

The COVID-19 pandemic has had a significant impact on the transportation industry, including ride-hailing services. As lockdowns and travel restrictions were implemented, Didi's revenue and share price faced downward pressure. However, with the gradual easing of restrictions, the company has been able to recover some of its lost ground.

- Expansion into New Markets:

Didi has been actively expanding into new markets, such as the United States and Japan. This expansion has been well-received by investors, contributing to a rise in the company's OTC share price.

Future Outlook:

Looking ahead, several factors may influence Didi's OTC share price:

- Competition:

The ride-hailing industry is highly competitive, with several key players vying for market share. Didi's ability to maintain its competitive edge will play a crucial role in determining its share price.

- Technological Innovation:

Investors will be closely monitoring Didi's ability to innovate and introduce new technologies that can enhance its service offerings and profitability.

- Regulatory Changes:

As mentioned earlier, the regulatory environment can significantly impact Didi's OTC share price. Therefore, any changes in regulations may necessitate a reassessment of the company's future prospects.

In conclusion, Didi's OTC share price is influenced by a variety of factors, including market conditions, financial performance, and regulatory changes. While the company has faced challenges in recent years, its expansion into new markets and commitment to innovation may contribute to a positive outlook for its share price in the future.

Note: This article is a fictional piece and should not be considered financial advice. Always consult with a financial advisor before making investment decisions.