Are US stocks falling? It's a question that has been on the minds of investors worldwide. The stock market is a dynamic place, and with its constant fluctuations, it's essential to stay informed about the latest trends and factors influencing the market. In this article, we will explore the factors contributing to the current state of the US stock market and provide insights into whether stocks are indeed falling.

Economic Factors

One of the primary factors contributing to the recent fluctuations in the US stock market is the economic landscape. The Federal Reserve's decision to raise interest rates has been a significant driver behind the market's uncertainty. As interest rates increase, borrowing costs rise, which can lead to a slowdown in economic growth. This, in turn, can impact the profitability of companies, causing investors to reassess their investments.

Tech Stocks

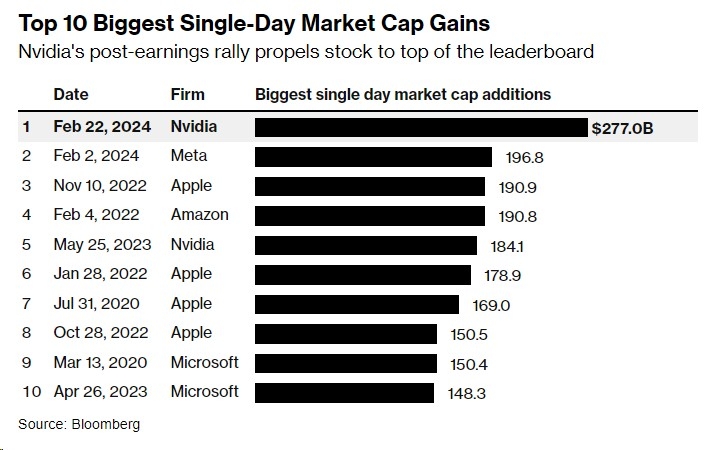

The tech sector has been a major component of the US stock market, and it has experienced significant volatility. Companies like Apple, Microsoft, and Amazon have seen their stock prices fluctuate, and many investors are wondering whether this is a sign of a broader trend. The decline in tech stocks can be attributed to various factors, including concerns about valuation, increased regulation, and the impact of the global pandemic on the industry.

Inflation Concerns

Another factor contributing to the falling stock market is inflation. Rising inflation can erode purchasing power and increase the cost of living, leading to lower consumer spending. As a result, companies may face challenges in maintaining their profitability, causing investors to question the long-term sustainability of their investments.

Geopolitical Tensions

Geopolitical tensions have also played a role in the falling US stock market. The ongoing conflict in Eastern Europe and the potential for supply chain disruptions have caused investors to worry about the global economic outlook. As a result, many are looking to diversify their portfolios and reduce their exposure to risky assets.

Market Trends

Looking at the broader market trends, it's evident that the US stock market has experienced a downturn in recent months. The S&P 500, a widely followed index of large-cap US companies, has fallen by nearly 10% year-to-date. This decline can be attributed to a combination of the factors mentioned above.

Case Studies

To provide some context, let's look at a couple of case studies. Tech giant Apple has seen its stock price fall by approximately 15% over the past year. This decline can be attributed to concerns about valuation, as well as increased competition in the smartphone market. Similarly, Microsoft has also experienced a decline in its stock price, falling by about 10% year-to-date.

Conclusion

In conclusion, the current state of the US stock market is a complex issue influenced by a variety of factors. While the market has experienced a downturn in recent months, it's essential to recognize that the stock market is a long-term investment vehicle. Investors should remain vigilant about the factors influencing the market and consider diversifying their portfolios to mitigate risks.

Key Takeaways:

- Economic factors, such as interest rate hikes, inflation, and geopolitical tensions, have contributed to the falling US stock market.

- The tech sector has experienced significant volatility, with companies like Apple and Microsoft seeing their stock prices decline.

- It's crucial for investors to remain informed about market trends and consider diversifying their portfolios to mitigate risks.