In the ever-evolving world of stock market investments, staying ahead of the curve is crucial. If you're looking to buy stocks today, understanding the current market trends and identifying promising stocks is essential. This article delves into the latest US market analysis, highlighting stocks that could be worth your investment today.

Top Stocks to Consider

Technology Sector

- Tesla (TSLA): As the world's leading electric vehicle (EV) manufacturer, Tesla continues to dominate the market. With its innovative products and growing customer base, TSLA is a strong candidate for investment.

- Microsoft (MSFT): A tech giant with a diverse portfolio of products and services, Microsoft has consistently shown resilience in the face of market fluctuations. Its cloud computing arm, Azure, has been a significant driver of growth.

Healthcare Sector

- Moderna (MRNA): This biotechnology company has gained significant attention for its COVID-19 vaccine, mRNA-1273. As the global demand for vaccines continues to rise, MRNA could be a valuable investment.

- AbbVie (ABBV): A leader in biopharmaceuticals, AbbVie has a strong pipeline of innovative drugs and a robust financial position. Its focus on rare diseases and immunology makes it a compelling investment opportunity.

Consumer Goods Sector

- Procter & Gamble (PG): As one of the world's largest consumer goods companies, P&G offers a diverse range of products across various categories. Its strong brand presence and global market reach make it a stable investment.

- Nike (NKE): A dominant player in the athletic footwear and apparel market, Nike has a loyal customer base and a strong brand image. Its focus on innovation and expansion into new markets makes it an attractive investment.

Market Trends to Watch

Economic Recovery: As the global economy gradually recovers from the COVID-19 pandemic, certain sectors are expected to benefit significantly. Investors should keep an eye on companies with strong fundamentals and a solid recovery strategy.

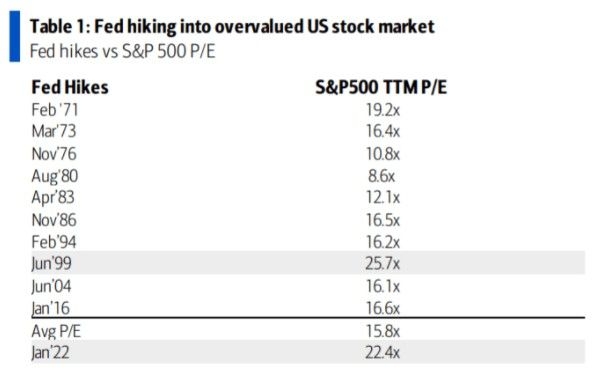

Inflation Concerns: Rising inflation rates have become a major concern for investors. Companies with pricing power and strong balance sheets may be better positioned to navigate this challenging environment.

Technology Disruption: The rapid pace of technological advancements continues to disrupt various industries. Companies at the forefront of innovation are likely to outperform their peers.

Case Study: Amazon (AMZN)

Amazon, the world's largest online retailer, has been a prime example of a company capitalizing on market trends. By leveraging technology and data analytics, Amazon has transformed the retail industry. Its Prime membership program has been a significant driver of growth, offering customers convenience and value. As the company continues to expand into new markets and categories, AMZN remains a compelling investment opportunity.

In conclusion, when considering stocks to buy today, it's essential to conduct thorough market analysis and stay informed about the latest trends. By focusing on sectors with strong growth potential and companies with solid fundamentals, investors can make informed decisions and potentially achieve significant returns.