Are you considering investing in U.S. stocks but are unsure if it's possible within your Tax-Free Savings Account (TFSA)? You're not alone. Many Canadians are intrigued by the potential of investing in U.S. markets but have questions about the rules and regulations surrounding their TFSA. In this article, we'll explore whether you can trade U.S. stocks within your TFSA, the rules you need to follow, and some key considerations to keep in mind.

Understanding TFSA and U.S. Stocks

A Tax-Free Savings Account, or TFSA, is a registered account in Canada that allows you to invest your money tax-free, meaning you won't pay taxes on any income or capital gains earned within the account. U.S. stocks refer to shares of companies that are listed and traded on U.S. stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Can You Trade U.S. Stocks in Your TFSA?

The short answer is yes, you can trade U.S. stocks within your TFSA. However, there are a few important rules to keep in mind:

Qualified Investments: The Canada Revenue Agency (CRA) requires that all investments held within a TFSA be "qualified investments." This includes stocks, bonds, mutual funds, and other securities, but not real estate or precious metals. As long as the U.S. stocks you're considering are considered qualified investments in Canada, you can hold them in your TFSA.

Reporting Requirements: While you can trade U.S. stocks within your TFSA, you must report any U.S. tax withheld on your Canadian income tax return. This means you'll need to keep track of any foreign tax withheld and claim it on your tax return.

Currency Exchange: When trading U.S. stocks within your TFSA, you'll need to be aware of currency exchange rates. While your TFSA is in Canadian dollars, the value of your U.S. stocks will be based on the current exchange rate.

Key Considerations for Trading U.S. Stocks in Your TFSA

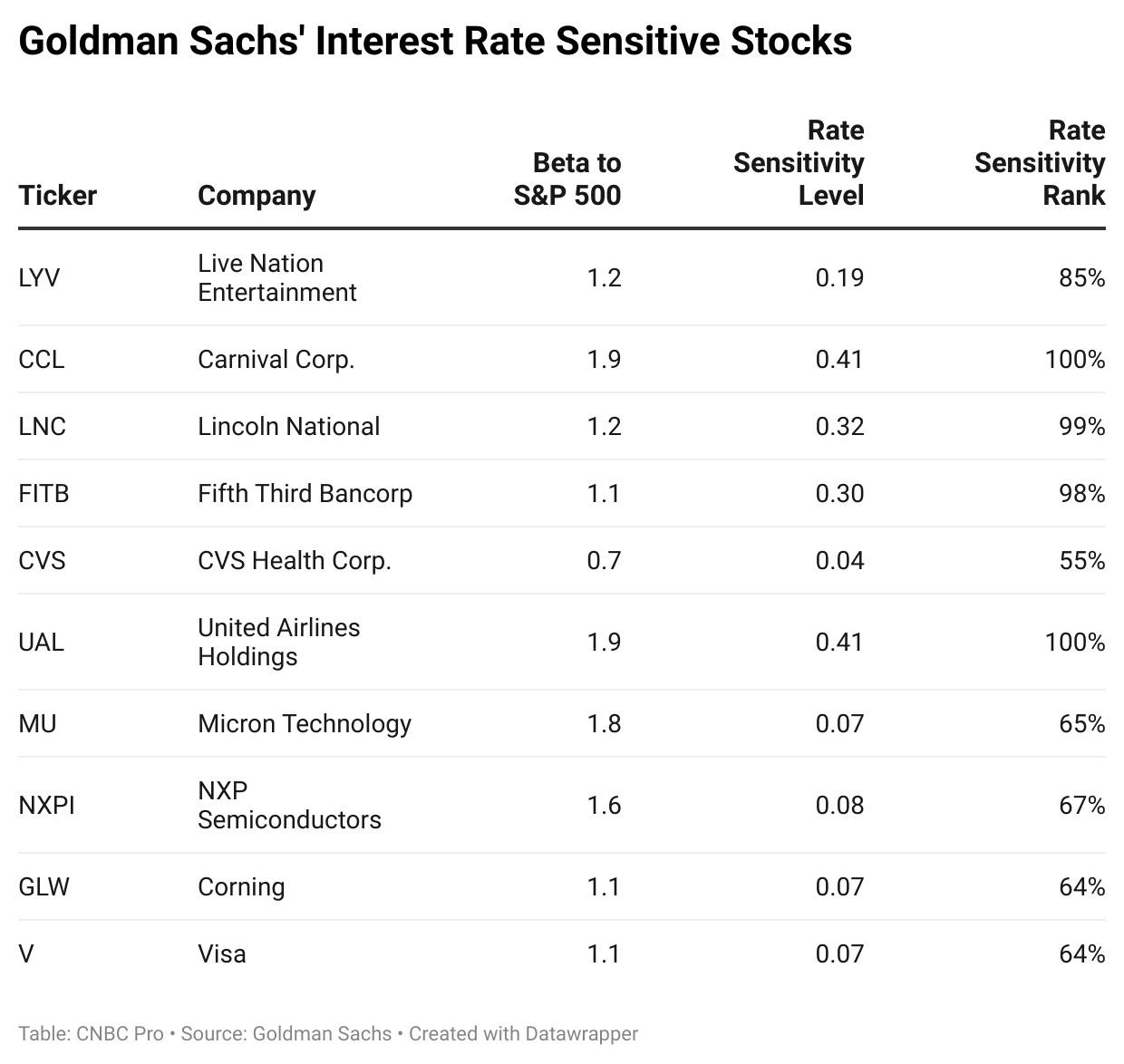

Diversification: Investing in U.S. stocks can offer diversification to your TFSA portfolio, as it allows you to invest in a different market and potentially benefit from different economic conditions.

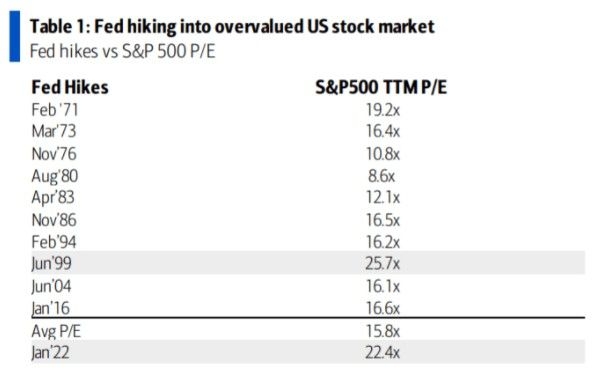

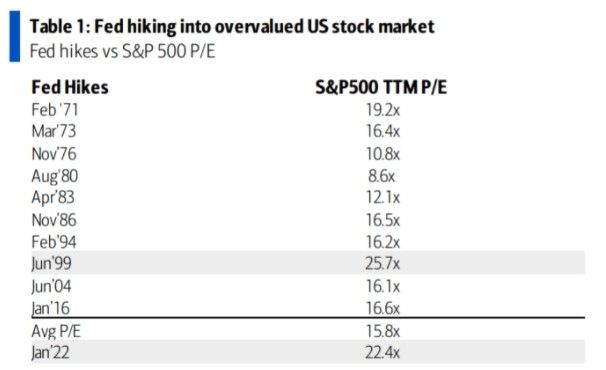

Potential for Higher Returns: The U.S. stock market has historically offered higher returns than the Canadian market. This can make U.S. stocks an attractive option for investors looking to grow their TFSA.

Risk: As with any investment, trading U.S. stocks in your TFSA carries risks. It's important to do thorough research and understand the potential risks before making any investment decisions.

Case Study: Investing in U.S. Stocks in a TFSA

Let's consider a hypothetical scenario: John is a Canadian investor looking to grow his TFSA. He has

In conclusion, trading U.S. stocks within your TFSA is possible, but it's important to understand the rules and regulations surrounding qualified investments and reporting requirements. With proper research and careful consideration, investing in U.S. stocks can be a valuable addition to your TFSA portfolio.