Introduction

In the financial world, market sentiment plays a pivotal role in shaping investor behavior and, ultimately, stock market trends. As we approach October 2025, understanding the prevailing market sentiment towards US stocks becomes crucial for investors and market analysts alike. This article delves into the key factors influencing market sentiment, recent stock market performance, and potential future trends.

Historical Context and Current Market Sentiment

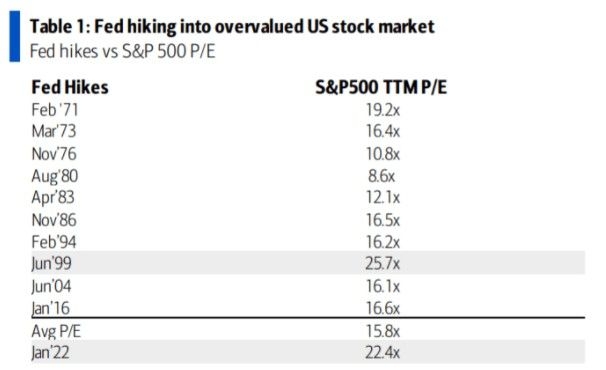

Over the past decade, market sentiment towards US stocks has fluctuated significantly. Economic downturns, political uncertainties, and technological advancements have all contributed to these shifts. As we stand at the threshold of October 2025, the current market sentiment reflects a mix of optimism and caution.

Economic Factors Influencing Market Sentiment

One of the primary drivers of market sentiment is the economic landscape. In October 2025, the US economy is expected to be recovering from the recent economic downturn, with a growing emphasis on job creation and consumer spending. This recovery is underpinned by various factors, including:

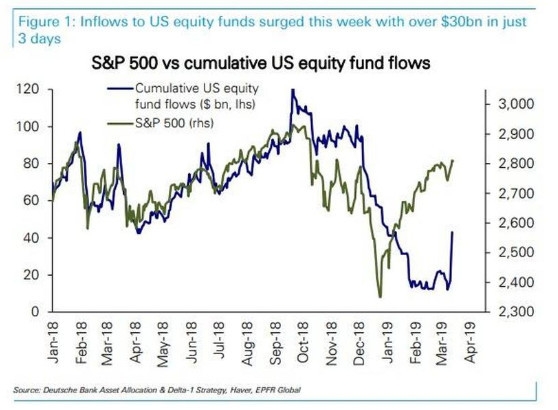

- Low Interest Rates: The Federal Reserve's decision to maintain low interest rates has encouraged borrowing and investment, fostering a positive economic environment.

- Corporate Earnings: Companies have reported robust earnings, driven by strong demand and increased productivity.

- Consumer Confidence: Consumer spending has remained resilient, supported by low unemployment rates and rising household incomes.

Technological Advancements and Market Sentiment

Technological advancements have also played a significant role in shaping market sentiment. In October 2025, the tech sector continues to dominate the stock market, driven by innovations in artificial intelligence, machine learning, and blockchain technology. This growth has instilled optimism among investors, as they see potential for long-term gains.

Political Factors Influencing Market Sentiment

Political factors remain a key concern for investors. In October 2025, the upcoming midterm elections are expected to have a significant impact on market sentiment. Political uncertainties, including trade disputes and policy changes, can lead to volatility in the stock market. However, investors are generally optimistic about the potential for a positive outcome in the upcoming elections.

Recent Stock Market Performance

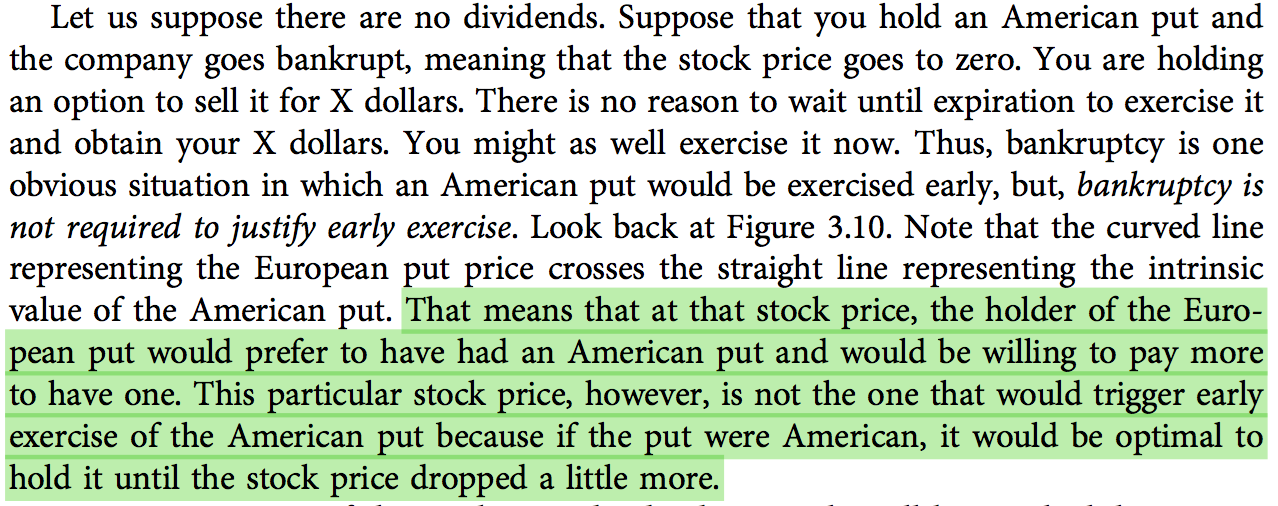

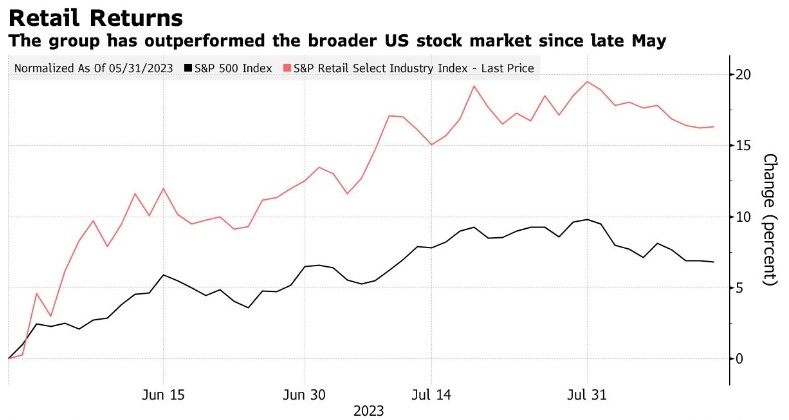

The US stock market has experienced a strong rally in recent months, with the S&P 500 Index reaching record highs. This performance is largely attributed to the positive economic and political outlook, as well as the resilience of the tech sector. However, it is important to note that the market has also experienced periods of volatility, particularly in the face of political and economic uncertainties.

Potential Future Trends

Looking ahead, the market sentiment towards US stocks is expected to remain cautiously optimistic. Key factors that could influence future trends include:

- Economic Growth: The pace of economic growth will continue to play a significant role in shaping market sentiment. A strong economy is likely to support the stock market, while a slowing economy could lead to increased volatility.

- Tech Sector Growth: The tech sector is expected to remain a dominant force in the stock market, with innovations and new technologies driving growth.

- Political and Economic Uncertainties: Political and economic uncertainties, such as trade disputes and policy changes, will continue to influence market sentiment.

Case Study: The Impact of Economic Downturns on Market Sentiment

In 2008, the global financial crisis led to a severe economic downturn, causing significant volatility in the stock market. During this period, market sentiment was predominantly negative, with investors selling off stocks and seeking safe-haven assets. However, as the economy began to recover, market sentiment shifted towards optimism, with investors returning to the stock market.

Conclusion

Understanding market sentiment is crucial for investors and market analysts looking to make informed decisions. In October 2025, the market sentiment towards US stocks is cautiously optimistic, driven by strong economic fundamentals and technological advancements. However, it is important to remain vigilant of potential risks, such as political and economic uncertainties. By staying informed and adapting to changing market conditions, investors can navigate the complex world of US stocks.