Are you a Canadian investor looking to expand your portfolio with US stocks? The thought of buying stocks from across the border might seem daunting, but it's actually quite straightforward. In this article, we'll guide you through the process of buying US stocks in Canada, helping you to make informed decisions and grow your wealth.

Understanding the Basics

Before diving into the process, it's essential to understand the basics. The US stock market is one of the largest and most diverse in the world, offering a wide range of investment opportunities. By investing in US stocks, you can gain exposure to different sectors, industries, and geographical regions, potentially enhancing your portfolio's performance.

Choosing a Brokerage

The first step in buying US stocks in Canada is to choose a brokerage firm. There are several reputable brokerage firms that offer services for Canadian investors, including TD Ameritrade, Questrade, and Interactive Brokers. Each brokerage has its own set of fees, trading platforms, and customer support, so it's important to do your research and select the one that best fits your needs.

Opening an Account

Once you've chosen a brokerage, you'll need to open an account. This process typically involves providing personal information, verifying your identity, and funding your account. Some brokers may require additional documentation, such as a Social Insurance Number (SIN) or a Tax Identification Number (TIN), so be prepared to provide this information when opening your account.

Understanding the Risks

Before investing in US stocks, it's crucial to understand the risks involved. The US stock market can be volatile, and the value of your investments can fluctuate significantly. Additionally, currency exchange rates can impact the returns on your investments. Be sure to do your research and understand the risks before making any investment decisions.

Navigating the Trading Platform

Once your account is open, you'll have access to the brokerage's trading platform. Most platforms are user-friendly and offer a range of tools and resources to help you make informed investment decisions. Familiarize yourself with the platform's features, such as stock quotes, charting tools, and portfolio tracking.

Finding US Stocks to Invest In

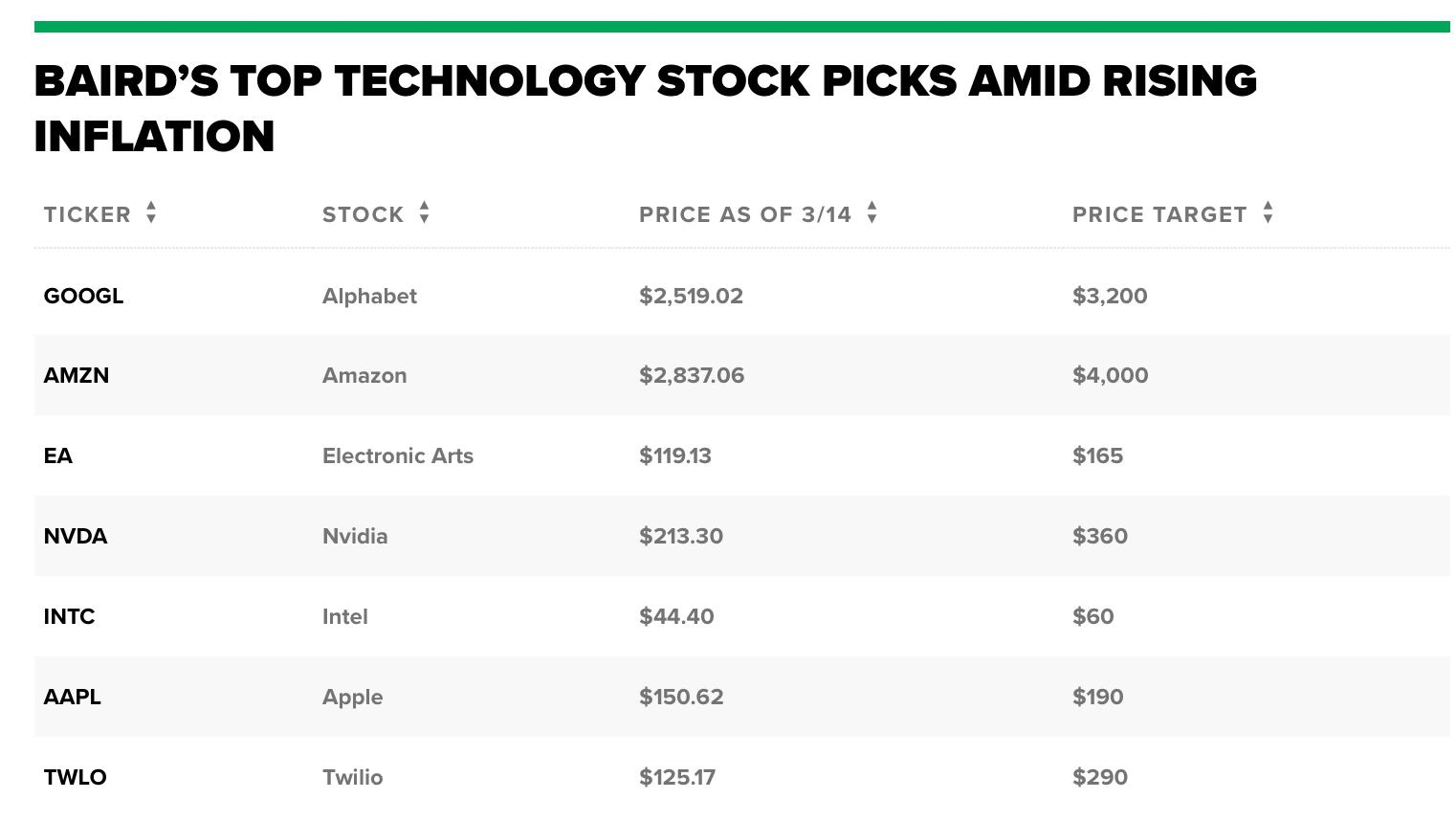

When looking for US stocks to invest in, consider your investment goals, risk tolerance, and time horizon. You can research individual companies or invest in a diversified portfolio through exchange-traded funds (ETFs) or mutual funds. Some popular US stocks among Canadian investors include Apple, Microsoft, and Amazon.

Monitoring Your Investments

Once you've invested in US stocks, it's important to monitor your portfolio regularly. Keep an eye on market trends, company news, and economic indicators that may impact the performance of your investments. Many brokers offer alerts and notifications to help you stay informed.

Case Study: Investing in US Stocks

Let's say you're a Canadian investor with a moderate risk tolerance and a long-term investment horizon. You decide to invest in a mix of US stocks and ETFs. After researching different companies and sectors, you decide to invest in Apple, Microsoft, and the S&P 500 ETF. Over the next five years, your investments grow significantly, thanks to the strong performance of these companies and the overall US stock market.

By following these steps, you can successfully buy US stocks in Canada and potentially grow your wealth. Remember to do your research, understand the risks, and stay informed to make the best investment decisions for your portfolio.