The US Stock Market: A Vast Landscape of Opportunities

The United States stock market, often referred to as the most robust and diverse in the world, has been a cornerstone of global finance for centuries. With thousands of companies listed, it presents an array of opportunities for investors. But how many companies are actually on the US stock market? This article delves into the vast landscape of the US stock market, exploring its size, composition, and the factors that contribute to its remarkable growth.

The Size of the US Stock Market

The US stock market is a behemoth, with a total market capitalization that surpasses $40 trillion. This colossal figure is a testament to the sheer number of companies listed on major exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. As of 2021, there are approximately 3,800 companies listed on the NYSE and another 3,800 on the NASDAQ.

Composition of the US Stock Market

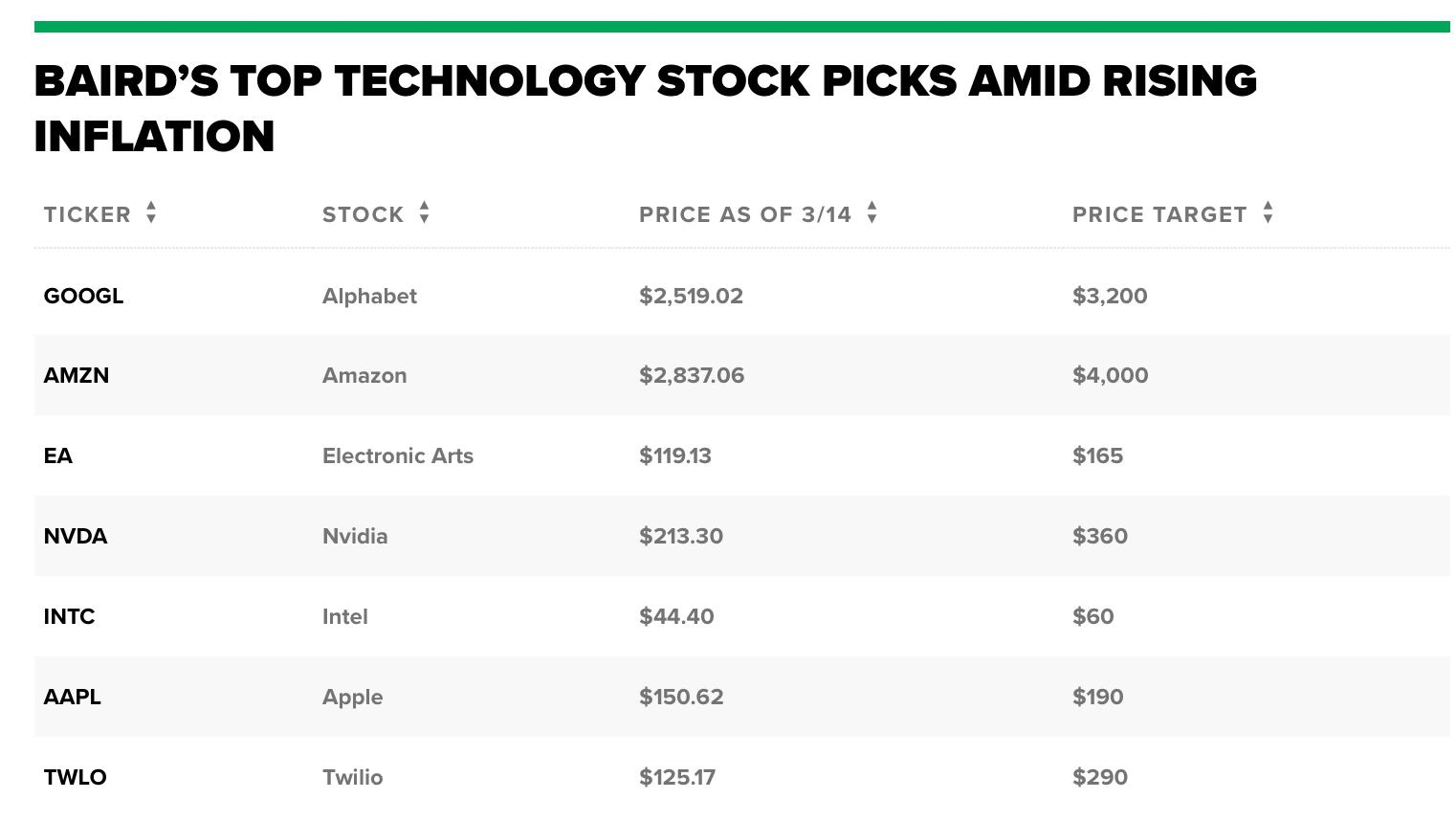

The composition of the US stock market is incredibly diverse, spanning various industries and sectors. From tech giants like Apple and Microsoft to financial institutions like JPMorgan Chase and Bank of America, the market offers exposure to a wide range of companies. Here are some key sectors represented:

- Technology: This sector includes major players like Apple, Google, and Facebook. It has been a significant driver of growth in the US stock market.

- Healthcare: The healthcare sector encompasses pharmaceutical companies, biotech firms, and medical device manufacturers. Companies like Johnson & Johnson and Pfizer are key players.

- Finance: The financial sector includes banks, insurance companies, and investment firms. Major players include JPMorgan Chase, Wells Fargo, and Bank of America.

- Consumer Goods: This sector includes companies that produce goods and services for consumers, such as Procter & Gamble and Coca-Cola.

- Energy: The energy sector includes oil and gas companies, as well as renewable energy firms. ExxonMobil and Chevron are among the major players.

Factors Contributing to the Growth of the US Stock Market

Several factors have contributed to the growth and success of the US stock market:

- Innovation: The US is known for its entrepreneurial spirit and innovation, which has led to the rise of numerous successful companies.

- Regulation: The US has a well-regulated financial system that protects investors and fosters market stability.

- Diversification: The US stock market's diverse composition allows investors to spread their risk across various sectors and industries.

- Global Influence: As the world's largest economy, the US stock market has a significant influence on global markets.

Case Studies

To illustrate the impact of the US stock market, let's consider a few notable case studies:

- Apple: Apple, Inc. has become one of the most valuable companies in the world, with a market capitalization exceeding $2 trillion. Its success in the technology sector has made it a staple in the US stock market.

- Amazon: Amazon.com, Inc. has revolutionized the retail industry and become a dominant force in the e-commerce sector. Its market capitalization has exceeded $1.5 trillion.

- Facebook: Facebook, Inc., now known as Meta Platforms, Inc., has become a global leader in social media. Its market capitalization has exceeded $500 billion.

In conclusion, the US stock market is a vast and dynamic landscape, with thousands of companies offering opportunities for investors. Understanding its size, composition, and contributing factors can help investors navigate this complex market and make informed decisions. Whether you're a seasoned investor or just starting out, the US stock market offers a world of possibilities.