In the ever-evolving world of technology, South Korea's LG Corporation has emerged as a major player. For investors looking to capitalize on this global trend, understanding the value of LG stock in US dollars is crucial. This article delves into the intricacies of LG's stock market performance, its significance in the global market, and the factors influencing its value in US dollars.

The Importance of LG Corporation

LG Corporation, founded in 1947, is one of South Korea's largest multinational companies. The company's core businesses include electronics, chemicals, and telecommunications. With a strong presence in various markets, LG has become a household name across the globe. From smartphones to home appliances, LG offers a wide range of products that cater to the needs of millions of consumers.

Understanding LG Stock

LG's stock is traded on the Korea Exchange, with the ticker symbol 066570.KS. For investors in the United States, accessing this stock requires purchasing it through a brokerage that offers international trading services. The stock price is typically quoted in South Korean won, but to understand its value in US dollars, you'll need to convert the won price using the current exchange rate.

Factors Influencing LG Stock Value in US Dollars

Several factors can influence the value of LG stock in US dollars. These include:

- Economic Conditions: Economic downturns can negatively impact the stock market, including LG's stock. Conversely, strong economic growth can lead to increased investor confidence and higher stock prices.

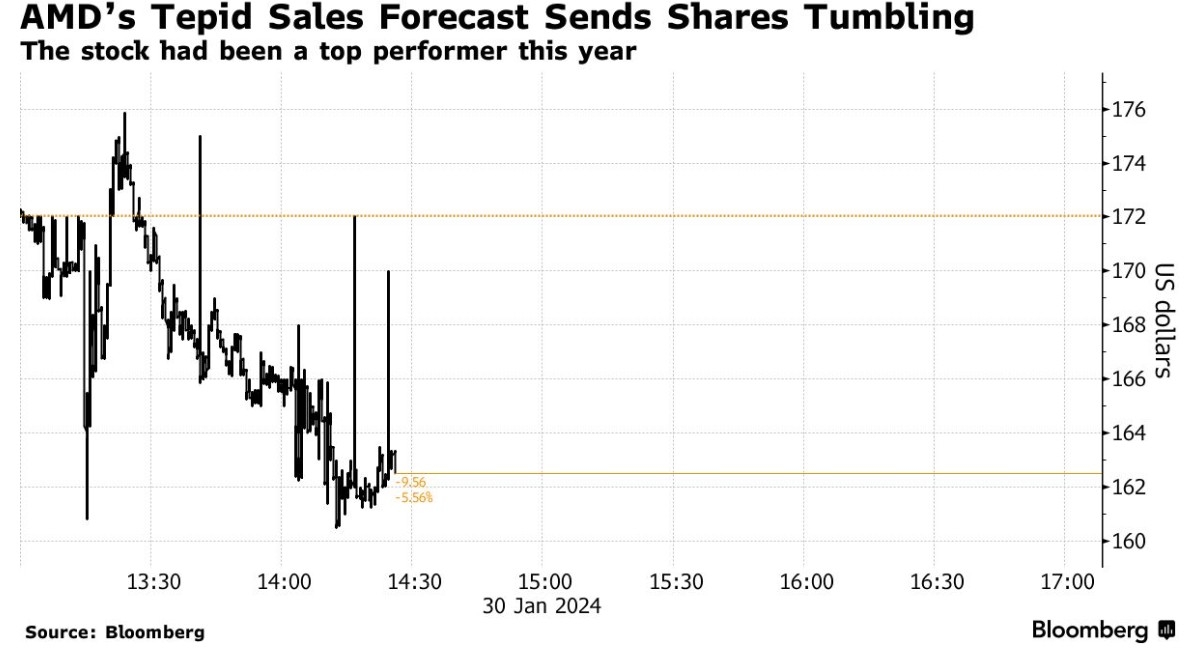

- Company Performance: LG's financial performance, including revenue, earnings, and growth prospects, plays a crucial role in determining its stock value. Strong financial results can lead to higher stock prices, while poor performance can result in a decline.

- Market Sentiment: Investor sentiment towards LG and the overall technology sector can also impact stock prices. Positive news, such as successful product launches or partnerships, can boost investor confidence and drive up stock prices.

- Exchange Rate Fluctuations: As LG stock is priced in South Korean won, exchange rate fluctuations can significantly impact its value in US dollars. A stronger won can make LG stock more expensive in US dollars, while a weaker won can make it more affordable.

Case Study: LG Electronics' Smartphone Division

One of LG's most notable divisions is its smartphone business. Over the years, LG has faced intense competition from other major players like Samsung and Apple. While the company has had its share of challenges, it has also made significant strides in the market.

In 2019, LG launched the LG V50 ThinQ, a high-end smartphone that received positive reviews for its innovative features and design. However, despite the strong product, the division's revenue and profitability remained under pressure. This highlights the importance of balancing innovation with market demand and profitability.

Conclusion

Understanding the value of LG stock in US dollars requires a comprehensive understanding of the company's performance, market conditions, and exchange rate fluctuations. By staying informed and monitoring these factors, investors can make more informed decisions about their investments in LG Corporation.