Investing in the stock market can be a thrilling endeavor, but it requires knowledge and a solid understanding of the companies you're considering. One such company that has piqued the interest of many investors is CRDL, a U.S.-based stock. In this article, we'll delve into what CRDL is all about, its stock performance, and what you need to know before considering an investment.

Understanding CRDL

CRDL, short for Cradle, is a publicly-traded company based in the United States. The company operates in the technology sector, specializing in innovative solutions and services. With a focus on cutting-edge technology, CRDL has made a name for itself in the industry.

Stock Performance

When it comes to CRDL stock, it's essential to look at its performance over time. The stock has experienced fluctuations, much like any other publicly-traded company. To gain a better understanding of its performance, let's take a look at some key factors:

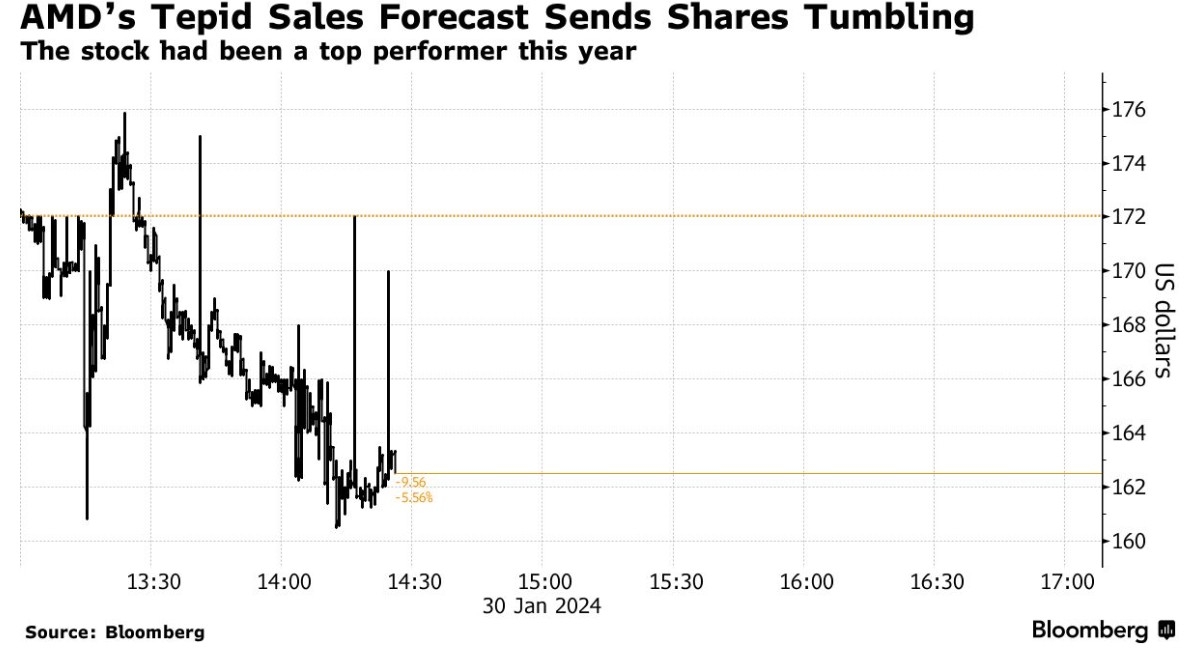

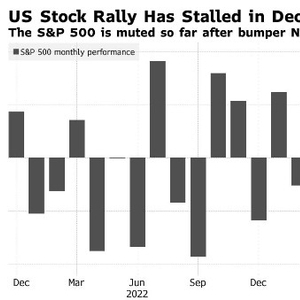

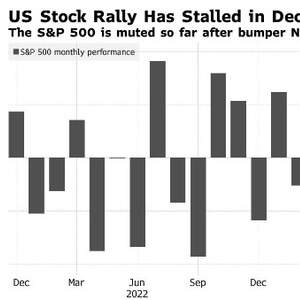

- Market Trends: CRDL's stock has been influenced by broader market trends. During periods of economic growth and optimism, the stock tends to perform well. Conversely, during downturns, it may experience some downward pressure.

- Quarterly Earnings: One of the most crucial aspects of analyzing a stock is to look at the company's quarterly earnings reports. CRDL has consistently reported positive earnings, which has helped boost investor confidence.

- Dividends: CRDL has also been known to pay dividends to its shareholders. This is a positive sign, as it indicates that the company is generating sufficient profits to distribute to its investors.

Factors to Consider Before Investing in CRDL Stock

Before investing in CRDL stock, there are several factors you should consider:

- Industry Outlook: The technology sector is highly competitive and can be volatile. It's crucial to research the industry's outlook and understand how CRDL fits into the bigger picture.

- Management Team: A strong and experienced management team can make a significant difference in a company's success. Research the background and track record of CRDL's management team.

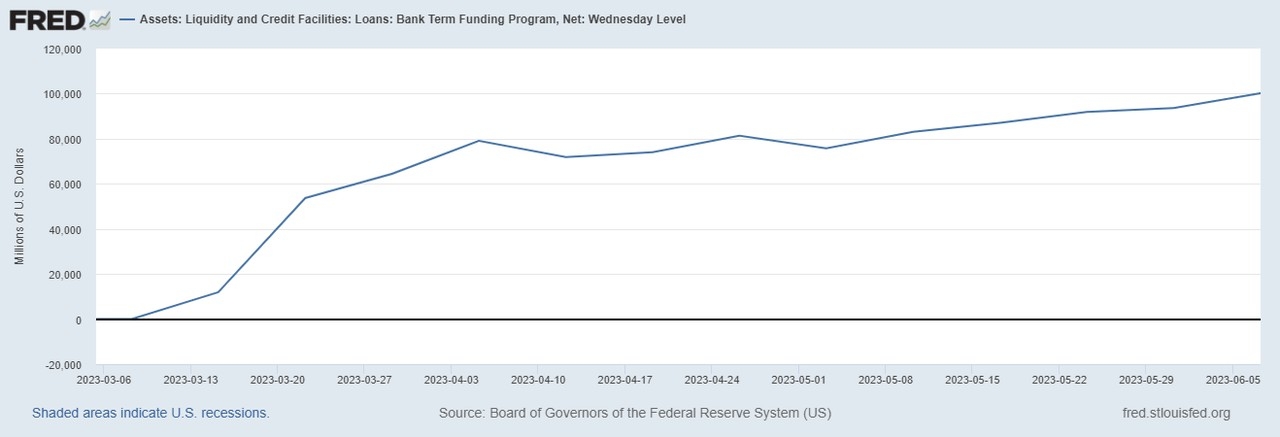

- Financial Health: Look at CRDL's financial statements to gauge its overall financial health. This includes analyzing revenue growth, profitability, and debt levels.

- Competitors: Understanding CRDL's competitors can help you better assess its market position and potential for growth.

Case Studies

To illustrate the potential of CRDL stock, let's consider a few case studies:

- Case Study 1: An investor who bought CRDL stock at

10 per share and held onto it for five years saw the stock appreciate to 20 per share, resulting in a 100% return. - Case Study 2: Another investor who conducted thorough research and considered various factors before investing in CRDL stock ended up with a 50% return over a three-year period.

Conclusion

Investing in CRDL stock can be a wise decision for those who are willing to do their homework and understand the risks involved. By considering the factors mentioned above and staying informed about market trends, you can make an informed decision about whether CRDL is the right investment for you.