In the ever-evolving world of stock markets, staying informed about the performance of your investments is crucial. One such investment that has been capturing the attention of many is Kaly Us. In this article, we will delve into the details of the Kaly Us stock price, its factors, and what it means for investors.

Understanding Kaly Us Stock Price

The Kaly Us stock price is the current market value of Kaly Us Corporation's shares. It is determined by the supply and demand dynamics in the stock market. The stock price can fluctuate throughout the trading day, reflecting the market's perception of the company's performance and future prospects.

Factors Influencing Kaly Us Stock Price

Several factors can influence the Kaly Us stock price. Here are some of the key factors:

- Company Performance: The financial performance of Kaly Us, including its revenue, earnings, and growth prospects, plays a significant role in determining its stock price. Strong financial results can lead to a higher stock price, while poor performance can result in a decline.

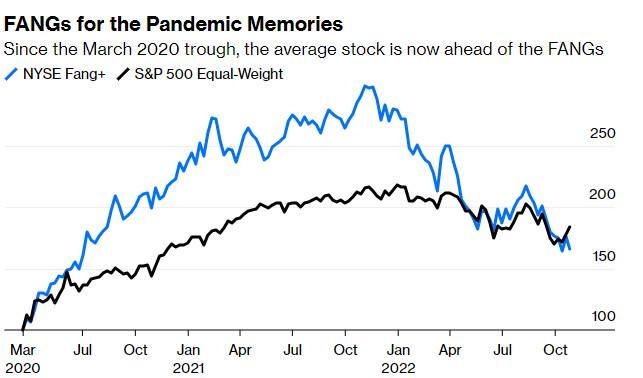

- Market Sentiment: The overall sentiment in the stock market can impact the Kaly Us stock price. Positive news, such as a strong economic outlook or positive earnings reports, can boost the stock price, while negative news, such as economic downturns or political instability, can lead to a decline.

- Industry Trends: The trends in the industry in which Kaly Us operates can also influence its stock price. For example, if the industry is experiencing rapid growth, Kaly Us may see an increase in its stock price.

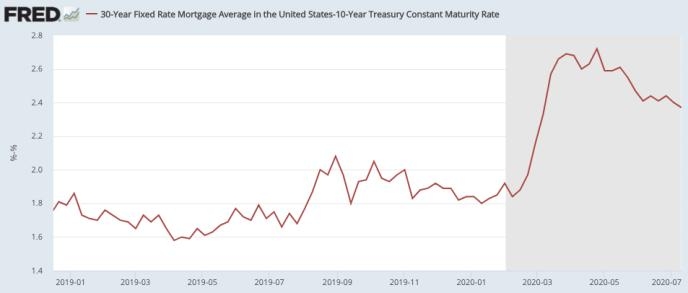

- Economic Factors: Economic factors, such as interest rates, inflation, and currency fluctuations, can also impact the Kaly Us stock price. These factors can affect the company's cost of capital and its profitability.

Analyzing Kaly Us Stock Price

To analyze the Kaly Us stock price, investors often look at various financial metrics, including:

- Price-to-Earnings (P/E) Ratio: This ratio compares the stock price to the company's earnings per share (EPS). A higher P/E ratio indicates that the stock is more expensive relative to its earnings.

- Price-to-Book (P/B) Ratio: This ratio compares the stock price to the company's book value per share. A higher P/B ratio suggests that the stock is more expensive relative to its book value.

- Earnings Growth: The rate at which the company's earnings are growing can also be a significant indicator of its future prospects.

Case Study: Kaly Us Stock Price Performance

Let's consider a hypothetical case study to understand how the Kaly Us stock price has performed over the past year. In January 2022, the stock price was

Several factors contributed to this increase in the stock price. Firstly, Kaly Us reported strong financial results, with revenue and earnings growing at a significant pace. Secondly, the overall market sentiment was positive, with investors optimistic about the future of the company. Finally, the industry in which Kaly Us operates was experiencing rapid growth, further boosting the stock price.

Conclusion

Understanding the Kaly Us stock price and its factors is crucial for investors looking to make informed decisions. By analyzing the company's performance, market sentiment, industry trends, and economic factors, investors can gain valuable insights into the potential future of Kaly Us. As always, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.