Hyundai Motor Company, a leading global automaker, has long been a topic of interest for investors and car enthusiasts alike. One common question that often arises is whether Hyundai stock is traded in the United States. In this article, we will delve into this topic, providing you with all the necessary information to make an informed decision.

Hyundai Stock: An Overview

Hyundai Motor Company, commonly known as Hyundai, is a South Korean multinational automotive manufacturer. The company has a significant presence in the global market, with a diverse range of vehicles that cater to various consumer needs. With its headquarters in Seoul, South Korea, Hyundai operates in over 200 countries and regions worldwide.

Trading Hyundai Stock in the US

Yes, Hyundai stock is indeed traded in the United States. The company's shares are listed on the New York Stock Exchange (NYSE) under the ticker symbol "HYMLF." This listing allows U.S. investors to buy and sell Hyundai shares directly from the stock exchange.

Why Invest in Hyundai Stock?

Investing in Hyundai stock can be an attractive option for several reasons. Firstly, the company has a strong presence in the global automotive market, which has been steadily growing over the years. This growth potential makes Hyundai an appealing investment for those looking to capitalize on the automotive industry's expansion.

Secondly, Hyundai has a reputation for producing high-quality vehicles at competitive prices. The company's commitment to innovation and technological advancements has helped it maintain a competitive edge in the market. This focus on quality and innovation has also contributed to the company's strong financial performance.

Key Factors to Consider When Investing in Hyundai Stock

Before investing in Hyundai stock, it is essential to consider several key factors:

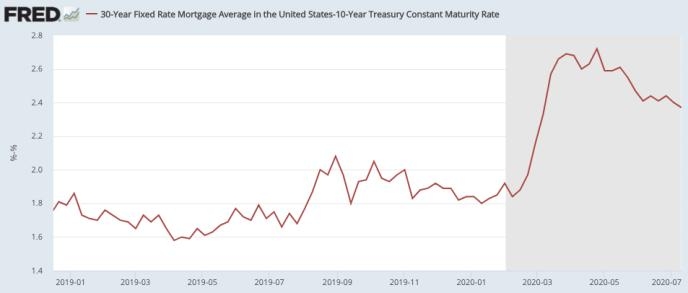

Economic Conditions: Economic factors, such as inflation, interest rates, and trade policies, can significantly impact the automotive industry and, consequently, Hyundai's performance.

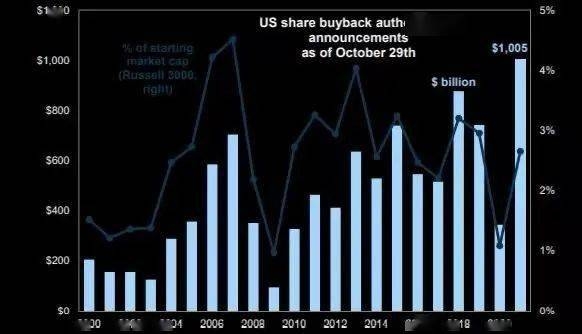

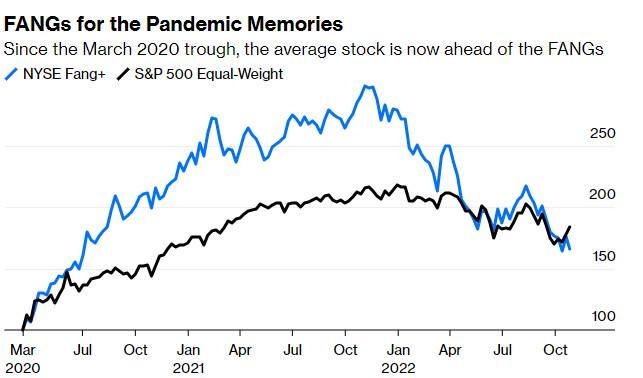

Competition: The automotive industry is highly competitive, with numerous players vying for market share. It is crucial to assess Hyundai's competitive position and its ability to maintain its market share in the face of increasing competition.

Technological Advancements: Hyundai's commitment to innovation and technological advancements can be a significant driver of growth. It is essential to stay informed about the company's latest developments and how they may impact its future performance.

Regulatory Environment: The automotive industry is subject to various regulations, which can impact the company's operations and profitability. Keeping abreast of regulatory changes is crucial for making informed investment decisions.

Conclusion

In conclusion, Hyundai stock is indeed traded in the United States, offering U.S. investors the opportunity to invest in a leading global automaker. With its strong market presence, commitment to innovation, and competitive edge, Hyundai presents an attractive investment opportunity. However, it is crucial to consider various factors before investing, including economic conditions, competition, technological advancements, and the regulatory environment. By staying informed and making informed decisions, investors can maximize their chances of success in the dynamic automotive industry.