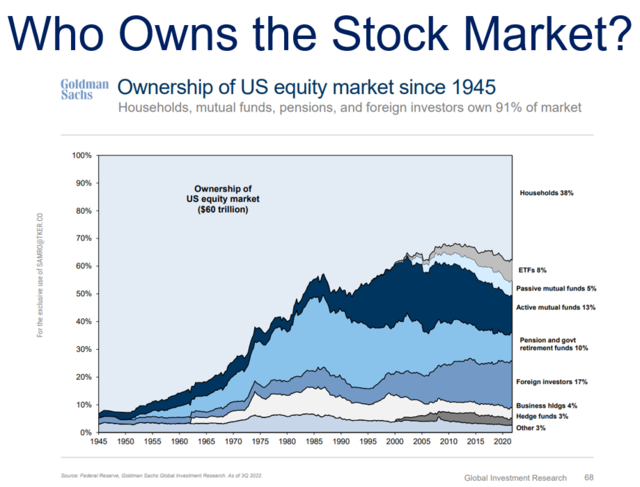

Are you looking to diversify your investment portfolio by buying US stocks? Whether you're a foreign investor or simply interested in investing in the world's largest stock market, here's a comprehensive guide on how to buy US stocks internationally.

Understanding the Basics

What are US stocks? US stocks represent ownership in a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. By purchasing stocks, you become a shareholder and have a claim on the company's assets and earnings.

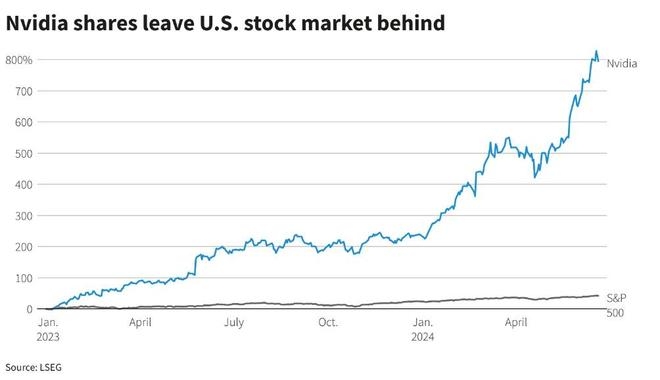

Why invest in US stocks? The US stock market is known for its liquidity, diversification opportunities, and innovation. It offers access to some of the world's most successful companies, including tech giants like Apple, Microsoft, and Google.

Steps to Buy US Stocks Internationally

1. Open a Brokerage Account

The first step is to open a brokerage account with a reputable brokerage firm. This account will serve as your gateway to the US stock market. Here are a few key points to consider:

- Research brokers: Look for brokers that offer international trading capabilities and have a strong track record of customer service.

- Compare fees: Consider the fees associated with trading, including commission rates, account maintenance fees, and currency conversion fees.

- Choose the right account type: Depending on your investment goals, you may need a standard brokerage account, a retirement account, or a margin account.

2. Fund Your Account

Once your brokerage account is open, you'll need to fund it with the currency you want to trade in. This could be your local currency or USD. Here's how to do it:

- Transfer funds: You can transfer funds from your bank account or use a wire transfer.

- Currency conversion: Be aware of currency conversion fees and exchange rates when transferring funds.

3. Research and Analyze Stocks

Before investing, it's crucial to research and analyze potential stocks. Here are some tips:

- Understand the company: Research the company's financials, business model, and management team.

- Analyze the market: Look at the stock's price history, valuation metrics, and industry trends.

- Use tools: Utilize stock research tools and financial news websites to stay informed.

4. Place Your Order

Once you've identified a stock you want to buy, you can place an order through your brokerage account. Here are the types of orders you can place:

- Market order: Buy or sell a stock at the current market price.

- Limit order: Buy or sell a stock at a specified price or better.

- Stop order: Buy or sell a stock when it reaches a certain price level.

Case Study: Investing in Apple (AAPL)

Consider the case of investing in Apple (AAPL), one of the most valuable companies in the world. By following the steps outlined above, a foreign investor could easily purchase Apple stocks through a US brokerage account. This would allow them to benefit from Apple's growth and innovation, even though they are based internationally.

Conclusion

Buying US stocks internationally can be a lucrative investment opportunity. By following these steps and conducting thorough research, you can successfully invest in the US stock market. Remember to choose a reputable broker, fund your account, and stay informed about the companies you're investing in. Happy investing!