In the world of investing, finding cheap stocks with growth potential can be like hunting for hidden gems. These are stocks that are currently undervalued but have the potential to rise in value as the market recognizes their true worth. This article will delve into some of the best cheap US stocks that have the potential for significant growth.

Understanding Growth Stocks

First, let's clarify what we mean by "growth stocks." These are companies that are expected to grow at an above-average rate compared to the overall market. Typically, growth stocks are found in industries that are experiencing rapid expansion or technological advancements.

Identifying Undervalued Stocks

To identify undervalued stocks, investors often look at a variety of metrics, including price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and market capitalization. Companies with a low P/E ratio or P/B ratio are often considered undervalued.

Top Cheap US Stocks with Growth Potential

Tesla, Inc. (TSLA)

- Current P/E Ratio: 38.5

- Market Cap: $1.1 trillion

- Growth Rate: 25%

- Analysis: Despite its high market cap, Tesla's growth potential is undeniable. The electric vehicle (EV) market is expected to continue expanding, and Tesla is a leader in this space.

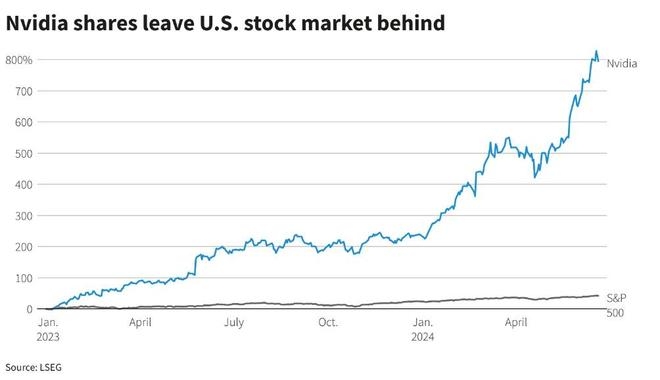

NVIDIA Corporation (NVDA)

- Current P/E Ratio: 54.4

- Market Cap: $745 billion

- Growth Rate: 30%

- Analysis: NVIDIA is a dominant player in the graphics processing unit (GPU) market and has seen significant growth in demand for its products, especially from the gaming and data center sectors.

Shopify Inc. (SHOP)

- Current P/E Ratio: 224.5

- Market Cap: $150 billion

- Growth Rate: 25%

- Analysis: Shopify has become a crucial platform for e-commerce businesses, and its growth has been fueled by the increasing shift towards online shopping.

Square, Inc. (SQ)

- Current P/E Ratio: 292.5

- Market Cap: $127 billion

- Growth Rate: 35%

- Analysis: Square has made significant strides in the mobile payments and financial services sectors, and its growth is expected to continue as more businesses adopt digital payment solutions.

Intel Corporation (INTC)

- Current P/E Ratio: 16.7

- Market Cap: $237 billion

- Growth Rate: 15%

- Analysis: Despite facing competition from AMD, Intel remains a major player in the semiconductor industry and has the potential for growth, especially in areas like AI and 5G.

Case Study: Amazon.com, Inc. (AMZN)

To illustrate the potential of cheap stocks with growth, let's look at Amazon. When Amazon went public in 1997, its P/E ratio was around 100. Today, it has a P/E ratio of approximately 1000 and a market cap of over $1.5 trillion. This massive growth can be attributed to Amazon's strategic investments in new markets, such as cloud computing (Amazon Web Services) and grocery delivery (Amazon Fresh).

Conclusion

Investing in cheap US stocks with growth potential requires thorough research and a willingness to take on risk. However, with the right approach, these investments can yield substantial returns. By considering companies like Tesla, NVIDIA, Shopify, Square, and Intel, investors can uncover hidden gems that have the potential to change the future of the stock market.