In the world of international investments, converting Canadian dollars to American dollars to purchase US stocks is a common strategy for Canadian investors looking to diversify their portfolios. This guide will walk you through the process, highlight key considerations, and provide insights into how you can make informed decisions when buying US stock in Canadian dollars.

Understanding the Market Dynamics

The US stock market is known for its liquidity, diversity, and high-growth potential. However, for Canadian investors, buying US stocks in Canadian dollars means navigating exchange rates and understanding the potential risks and rewards. Here’s what you need to know:

1. The Role of Exchange Rates

When you convert Canadian dollars to American dollars, the exchange rate plays a critical role. The exchange rate determines how much USD you receive for each CAD you exchange. This can significantly impact your investment returns, so staying informed about currency movements is essential.

2. Exchange Rate Volatility

The value of the Canadian dollar relative to the US dollar can fluctuate significantly, leading to potential gains or losses when converting currency. It’s important to keep an eye on the market to understand when it might be a good time to convert.

3. Brokerage Fees

When buying US stocks in Canadian dollars, you’ll likely incur brokerage fees. These fees can vary depending on your brokerage firm, so it’s important to consider them when budgeting for your investments.

Strategies for Buying US Stock in Canadian Dollars

Now that we’ve covered the basics, let’s look at some strategies you can use to make the most of your US stock investments in Canadian dollars:

1. Dollar-Cost Averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. Dollar-cost averaging can help reduce the impact of market volatility and potentially lead to better returns over time.

2. Dividend Reinvestment Plans (DRIPs)

A DRIP allows you to reinvest dividends you receive from US stocks into additional shares of the same company. This can be a powerful way to compound your returns over time.

3. Consider Tax Implications

When buying US stocks in Canadian dollars, it’s important to consider the potential tax implications. Keep in mind that dividends received from US stocks are typically subject to Canadian income tax.

Case Studies: Successful Investments in US Stocks

Let’s look at a few case studies to understand the potential of buying US stocks in Canadian dollars:

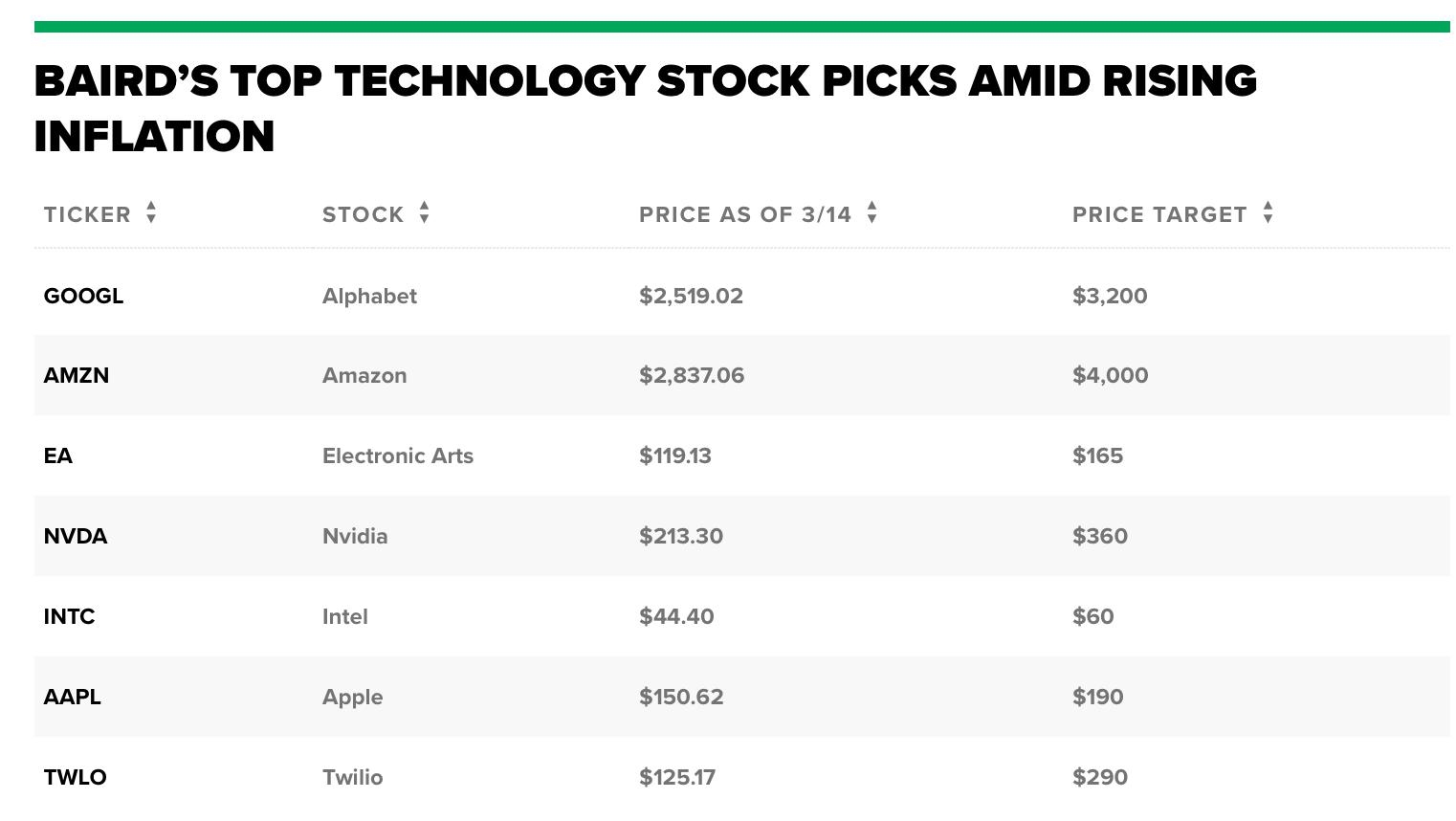

Apple Inc. (AAPL): A classic example of a US stock that has delivered significant returns for investors over the years. If you had invested

10,000 CAD in Apple in 2004, it would be worth over 500,000 CAD today.Amazon.com Inc. (AMZN): Another high-performing US stock that has seen significant growth. A

10,000 CAD investment in 1997 would be worth over 20 million CAD today.

Conclusion

Buying US stock in Canadian dollars can be a smart investment strategy for Canadian investors looking to diversify their portfolios. By understanding the market dynamics, implementing effective strategies, and staying informed about exchange rates and tax implications, you can maximize your returns. Keep in mind that investing always involves risks, so it’s important to do your due diligence and consider your own financial situation before making any investment decisions.