The recent turmoil in the Chinese real estate market, sparked by the financial difficulties of Evergrande Group, has sent shockwaves through global financial markets, including the US stock market. The impact of the Evergrande crisis on the US stock market is a topic of great concern for investors and analysts alike. This article delves into the potential implications of the Evergrande effect on the US stock market, offering insights into how it might affect various sectors and what investors can expect in the coming months.

Understanding the Evergrande Crisis

Evergrande Group, one of China's largest real estate developers, has been facing a liquidity crunch that has raised concerns about the stability of the Chinese real estate sector. The company's massive debt burden and delayed payments on its projects have sparked fears of a potential default, which could have significant repercussions on the global economy.

Impact on the US Stock Market

The Evergrande crisis has had a notable impact on the US stock market, primarily affecting sectors that have a significant exposure to Chinese real estate and the broader Asian economy. Here are some key areas where the Evergrande effect has been observed:

- Real Estate Sector: The US real estate sector, which includes both residential and commercial properties, has been affected by the crisis. Investors are concerned about the potential for a broader real estate downturn in China, which could lead to lower demand for US real estate investment trusts (REITs) and other real estate-related assets.

- Financial Sector: The US financial sector, particularly banks and insurance companies, has exposure to Chinese debt through their investments in Chinese financial institutions. A potential default by Evergrande could lead to significant losses for these institutions, affecting their financial performance and stability.

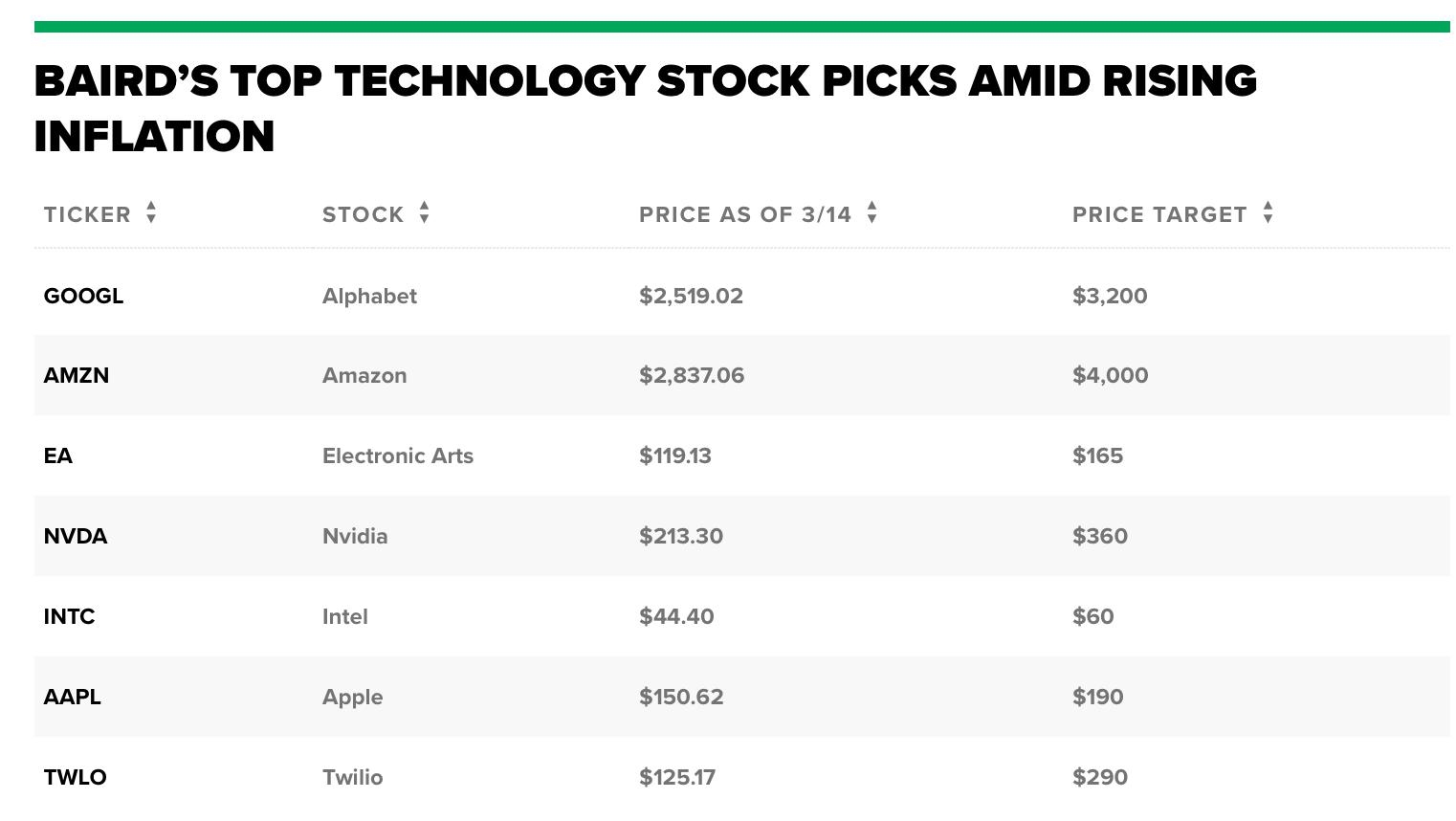

- Technology Sector: The technology sector, particularly companies with significant operations in China, has also been impacted by the crisis. Investors are concerned about the potential for a broader slowdown in the Chinese economy, which could affect demand for these companies' products and services.

Case Studies

One notable example of the Evergrande effect on the US stock market is the case of the video gaming company, NVIDIA. NVIDIA has significant operations in China and has been affected by the broader economic slowdown in the country. The company's stock price has experienced volatility in recent months, reflecting concerns about the potential impact of the Evergrande crisis on its business.

Another example is the case of the tech giant, Apple. Apple has significant operations in China and has been affected by the broader economic uncertainty in the country. The company's stock price has also experienced volatility in recent months, reflecting concerns about the potential impact of the Evergrande crisis on its business.

Conclusion

The Evergrande crisis has had a significant impact on the US stock market, raising concerns about the potential for a broader economic downturn in China. While the immediate impact of the crisis has been limited, investors should remain vigilant and stay informed about the evolving situation. By understanding the potential implications of the Evergrande effect on the US stock market, investors can better position themselves to navigate the challenges ahead.