As we approach the second half of 2025, investors are eagerly analyzing the potential trends and outlook for the US stock market. With a mix of economic factors, technological advancements, and geopolitical uncertainties, the landscape looks promising yet challenging. This article delves into the key factors that could shape the US stock market in the coming months.

Economic Indicators and Interest Rates

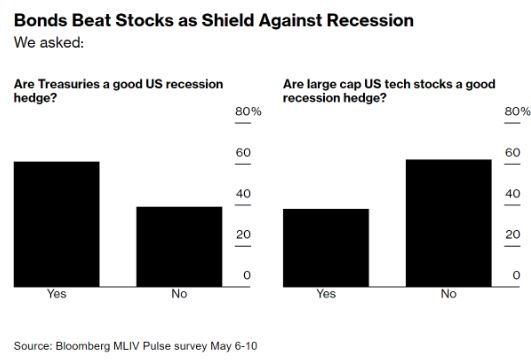

The Federal Reserve's monetary policy continues to be a crucial factor in the stock market. With the Fed's recent decisions to raise interest rates, investors are closely watching for any signs of inflation or economic slowdown. Historically, higher interest rates have negatively impacted stock prices, as borrowing costs increase and consumer spending slows down. However, if the economy remains robust, companies with strong fundamentals may be able to weather the higher interest rate environment.

Sector Analysis

Technology* remains a dominant sector in the US stock market, with companies like Apple, Microsoft, and Amazon leading the charge. Emerging technologies such as artificial intelligence, blockchain, and quantum computing are also expected to drive growth in this sector. Meanwhile, healthcare and energy sectors are poised for expansion, driven by increasing demand for healthcare services and the shift towards renewable energy sources.

Geopolitical Uncertainties

The ongoing geopolitical tensions and trade disputes between the US and other major economies remain a significant concern. These uncertainties can lead to volatility in the stock market, as investors react to news and policy changes. However, companies with a global presence may be able to navigate these challenges more effectively, as they have a diverse customer base and operations across various regions.

Emerging Trends

Green technologies and sustainable investing are gaining traction in the stock market. As investors become more environmentally conscious, companies that prioritize sustainability are likely to see increased interest and investment. This shift is reflected in the growing number of ESG (Environmental, Social, and Governance) funds available to investors.

Case Study: Tesla

A prime example of a company that has thrived in the current market environment is Tesla, Inc.. Despite facing challenges such as production delays and regulatory issues, Tesla has continued to grow its market share and attract investors. This can be attributed to the company's strong brand, innovative technology, and commitment to sustainability.

Conclusion

The second half of 2025 presents a complex yet promising outlook for the US stock market. While economic factors, geopolitical uncertainties, and emerging trends play a significant role, investors must remain vigilant and stay informed. By focusing on companies with strong fundamentals and a clear vision for the future, investors can navigate the market's ups and downs and achieve their investment goals.