In recent years, the US stock market has seen unprecedented growth, sparking debates about whether it's teetering on the edge of a bubble. This article delves into the factors contributing to this growth, examines the signs of a bubble, and provides insights into the potential consequences if the market were to burst.

The Bull Market and Its Roots

The US stock market has been on a remarkable bull run for over a decade. This prolonged period of growth can be attributed to several factors:

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has made borrowing cheaper, encouraging businesses and consumers to spend and invest.

- Corporate Earnings: Companies have reported strong earnings, fueling investor confidence.

- Technological Advancements: The rise of technology has driven innovation and created new markets, boosting stock prices.

Signs of a Bubble

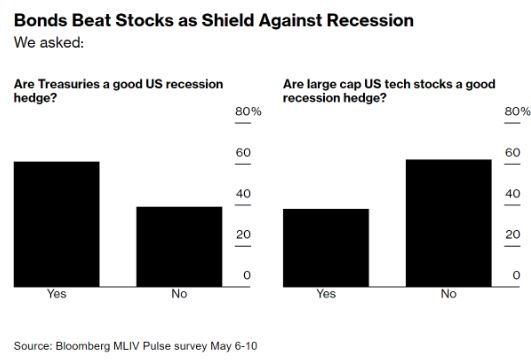

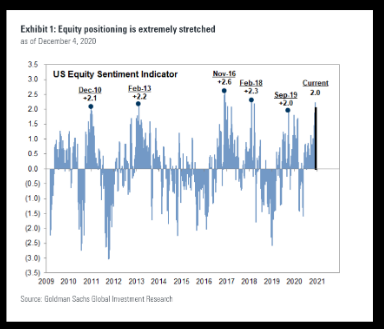

Despite the market's robust performance, some experts argue that it may be overvalued. Here are some signs that the US stock market could be a bubble:

- High Valuations: The stock market's price-to-earnings (P/E) ratio is at or near historic highs, indicating that stocks are expensive relative to their earnings.

- Speculative Investing: Investors are chasing high-risk, high-reward investments, reminiscent of the dot-com bubble.

- Lack of Fundamental Analysis: Many investors are focused on short-term gains, rather than conducting thorough fundamental analysis.

Case Studies

To illustrate the potential consequences of a stock market bubble, let's look at two historical examples:

- The Dot-Com Bubble: In the late 1990s, the tech sector experienced explosive growth, driven by speculative investing. When the bubble burst in 2000, the NASDAQ Composite Index plummeted by nearly 80%.

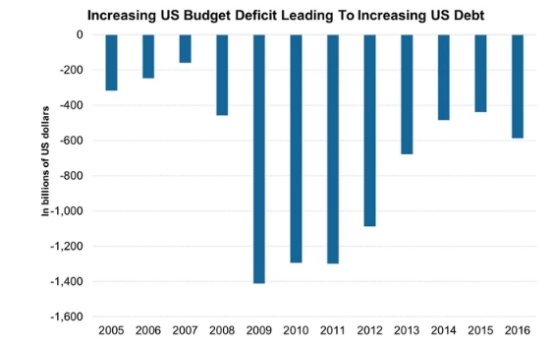

- The Housing Bubble: In the mid-2000s, the housing market experienced a similar boom, fueled by excessive lending and speculative investing. The bubble burst in 2008, leading to the Great Recession.

The Potential Consequences

If the US stock market were to burst, the consequences could be severe:

- Economic Slowdown: A stock market crash could lead to a decrease in consumer spending and business investment, potentially leading to an economic slowdown.

- Loss of Wealth: Investors could lose significant amounts of money, leading to financial hardship and increased debt.

- Market Confidence: A burst bubble could erode investor confidence, making it difficult for companies to raise capital.

Conclusion

While the US stock market has experienced remarkable growth, there are concerns that it may be overvalued and at risk of bursting. Investors should be cautious and conduct thorough research before making investment decisions. By understanding the signs of a bubble and its potential consequences, investors can better protect their wealth and make informed decisions.