In the dynamic world of finance, it's crucial for investors to identify undervalued assets. One such category is undervalued US bank stocks. These stocks, often overlooked by the market, present exciting opportunities for investors looking to capitalize on the financial sector's growth potential. This article delves into the reasons why some US bank stocks might be undervalued and explores potential investment opportunities.

Understanding Undervalued Bank Stocks

Undervalued bank stocks are those that are trading below their intrinsic value. This can happen due to various reasons, including market sentiment, economic conditions, or specific company issues. Investors can find these stocks by analyzing financial metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield.

Reasons for Undervaluation

Several factors can contribute to the undervaluation of US bank stocks:

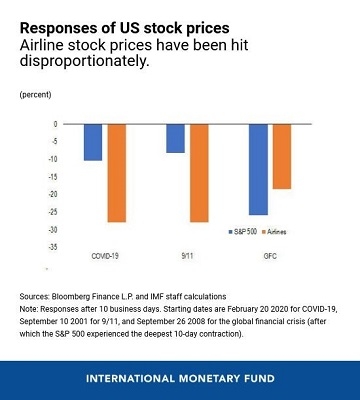

- Market Sentiment: The financial sector often faces negative sentiment during economic downturns. Investors might sell off bank stocks, leading to undervaluation.

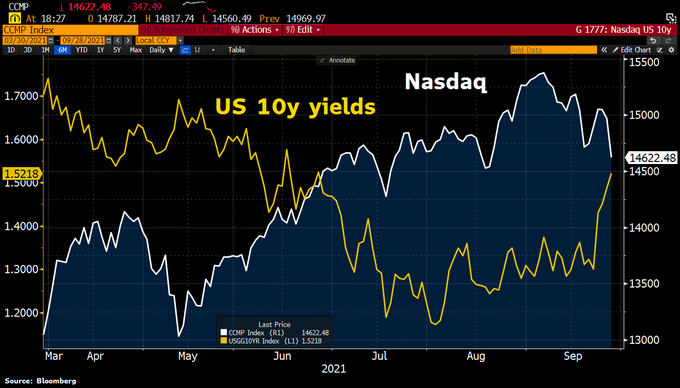

- Economic Conditions: Economic instability, such as high inflation or interest rates, can impact bank profitability, leading to undervaluation.

- Company-Specific Issues: Poor management, regulatory challenges, or a decline in earnings can also cause a stock to be undervalued.

Investment Opportunities

Despite the reasons for undervaluation, some US bank stocks offer compelling investment opportunities:

- Wells Fargo (WFC): Despite facing regulatory challenges in the past, Wells Fargo has shown resilience and has a strong dividend yield of 2.4%.

- Bank of America (BAC): Bank of America has a strong presence in retail banking and offers a dividend yield of 2.2%.

- JPMorgan Chase (JPM): JPMorgan Chase is one of the largest banks in the US and has a diversified business model, making it a stable investment with a dividend yield of 2.1%.

Case Study: Citigroup (C)

Citigroup (C) is another undervalued US bank stock worth considering. The bank has faced challenges in the past, but it has a strong global presence and a diverse revenue stream. Citigroup offers a dividend yield of 1.8%, and its P/E ratio of 8.4 suggests it is undervalued compared to its peers.

Conclusion

Investing in undervalued US bank stocks requires thorough research and analysis. By understanding the reasons for undervaluation and identifying promising opportunities, investors can capitalize on the financial sector's growth potential. As always, it's essential to consult with a financial advisor before making any investment decisions.