The US stock exchange is a cornerstone of the global financial system, offering investors a wide array of opportunities to grow their wealth. In this article, we delve into the history, types, and impact of the US stock exchanges, providing you with a comprehensive overview of this vital market.

The Evolution of US Stock Exchanges

The first stock exchange in the United States was the New York Stock Exchange (NYSE), founded in 1792. Since then, the market has evolved significantly, with numerous exchanges popping up across the nation. Today, the most prominent US stock exchanges include the NYSE, NASDAQ, and the American Stock Exchange (AMEX).

The New York Stock Exchange (NYSE)

The NYSE is the oldest and most iconic stock exchange in the United States. It is located in Lower Manhattan, New York City, and has been the epicenter of the financial world since its inception. The NYSE is home to many of the world's largest and most influential companies, including Apple, ExxonMobil, and General Electric.

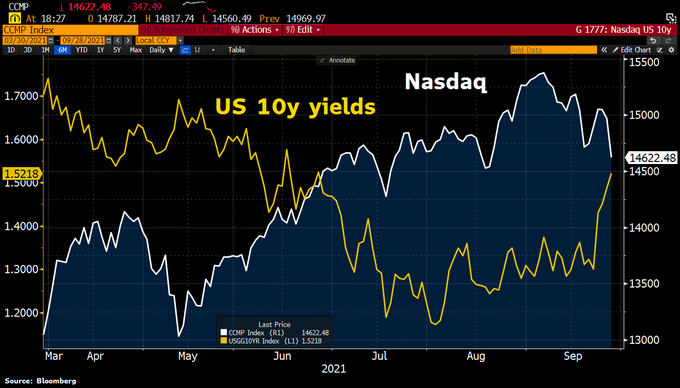

The NASDAQ Stock Market

The NASDAQ Stock Market, founded in 1971, is the largest electronic stock exchange in the world by market capitalization. It is known for its technology-focused companies, such as Microsoft, Apple, and Google. The NASDAQ is based in the Silicon Valley area of California, making it the go-to exchange for tech companies.

The American Stock Exchange (AMEX)

The AMEX, acquired by the NYSE in 1998, is a smaller exchange that focuses on smaller companies and specialized sectors. It is known for its diverse range of industries, including financial services, healthcare, and consumer goods.

Impact of US Stock Exchanges

The US stock exchanges have a significant impact on the global economy. They provide a platform for companies to raise capital, which in turn stimulates economic growth. Additionally, they offer investors the opportunity to diversify their portfolios and earn returns on their investments.

Types of US Stock Exchanges

There are several types of US stock exchanges, including:

- Primary Market: Where companies issue new shares to the public for the first time.

- Secondary Market: Where investors trade existing shares of publicly listed companies.

- Over-the-Counter (OTC) Market: Where companies trade without a formal exchange, often involving smaller companies or thinly traded stocks.

Case Studies

To illustrate the impact of US stock exchanges, let's consider a few case studies:

- Facebook's IPO: In 2012, Facebook became the biggest tech IPO in history, raising $16 billion. The company's listing on the NASDAQ marked a significant milestone for both Facebook and the tech industry.

- Tesla's Market Cap: Tesla, a company known for its electric vehicles, has seen its market capitalization soar. As of 2021, Tesla's market cap is over $800 billion, making it one of the most valuable companies in the world.

Conclusion

The US stock exchange is a vital component of the global financial system, offering investors and companies numerous opportunities to grow and thrive. By understanding the history, types, and impact of these exchanges, investors can make informed decisions and potentially reap substantial returns.