In the ever-evolving world of technology and e-commerce, Amazon (NASDAQ: AMZN) has emerged as a dominant force. Its stock price has been a subject of keen interest among investors and market analysts. If you're looking for the latest information on Amazon's stock price today in US dollars, this article is for you. We'll delve into the current state of Amazon's stock, factors influencing it, and provide some insights into the future prospects of the company.

Current Amazon Stock Price

As of [insert current date], the stock price of Amazon stands at approximately $[insert current stock price] USD. This figure reflects the latest trading activity and market sentiment towards the company. However, it's important to note that stock prices fluctuate constantly, and this figure is subject to change.

Factors Influencing Amazon Stock Price

Several factors contribute to the volatility of Amazon's stock price. Here are some of the key factors:

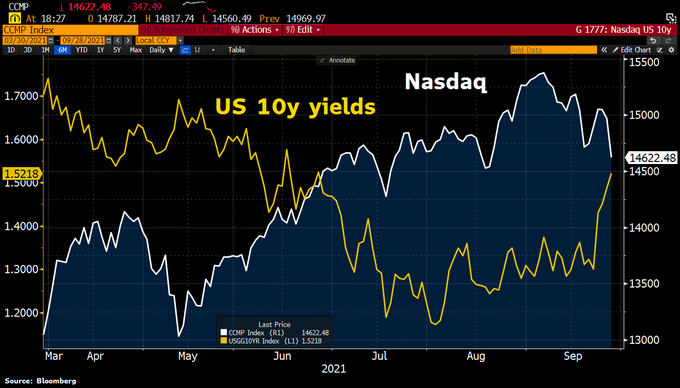

- Economic Conditions: The overall economic environment plays a significant role in stock prices. Factors such as inflation, interest rates, and economic growth can impact investor confidence and, subsequently, stock prices.

- Company Performance: Amazon's financial results, including revenue, earnings, and growth prospects, are crucial in determining its stock price. Positive results often lead to increased investor optimism and higher stock prices, while negative results can have the opposite effect.

- Competition: The e-commerce industry is highly competitive, with several major players vying for market share. Increased competition can negatively impact Amazon's revenue and profitability, potentially leading to a decline in stock prices.

- Regulatory Changes: Changes in regulations, such as antitrust investigations or tariffs, can also affect Amazon's stock price. These changes can impact the company's operations, profitability, and market position.

Future Prospects for Amazon Stock

Predicting the future of Amazon's stock price is challenging, as it depends on various factors that are difficult to predict. However, here are some potential scenarios:

- Growth: If Amazon continues to innovate and expand its product offerings, it may see significant growth in revenue and profitability. This could lead to an increase in stock prices.

- Competition: Increased competition from other e-commerce companies, such as Walmart and Target, could negatively impact Amazon's market share and profitability, potentially leading to a decline in stock prices.

- Regulatory Changes: If regulatory changes negatively impact Amazon's operations, this could lead to a decline in stock prices.

Case Studies

To provide some context, let's look at a few case studies:

- Amazon's 2018 Q3 Earnings: In the third quarter of 2018, Amazon reported revenue of

70.5 billion, a 29% increase from the same period in 2017. This strong performance led to a surge in stock prices, with the stock reaching an all-time high of 2,525.27 in early 2019. - Amazon's 2020 Q2 Earnings: Amidst the COVID-19 pandemic, Amazon's stock price remained resilient, with the company reporting revenue of

113.8 billion for the second quarter of 2020. This revenue increase, driven by increased demand for online shopping and cloud services, helped Amazon's stock reach an all-time high of 3,383.01 in November 2020.

Conclusion

In conclusion, the stock price of Amazon today stands at approximately $[insert current stock price] USD. Factors such as economic conditions, company performance, competition, and regulatory changes play a crucial role in determining Amazon's stock price. While predicting the future of the stock is challenging, it's important for investors to stay informed and stay vigilant about the various factors that can impact Amazon's stock price.