In today's dynamic financial landscape, investors are always on the lookout for promising stocks that can offer substantial returns. One such stock that has caught the attention of many is US LawShield. But what exactly is US LawShield, and why is its stock generating so much buzz? This article delves into the intricacies of US LawShield stock, providing a comprehensive guide for potential investors.

What is US LawShield?

US LawShield is a leading provider of legal protection services for firearm owners. The company offers a membership program that provides legal representation, education, and resources to its members. By joining US LawShield, firearm owners gain access to a network of qualified attorneys who can help them navigate the complex legal landscape surrounding firearm ownership.

The Rise of US LawShield Stock

The demand for legal protection services has been on the rise, especially in the wake of increasing gun control debates. As a result, US LawShield has seen significant growth in its membership base, which has, in turn, driven up its stock value. Here are some key factors contributing to the surge in US LawShield stock:

Growing Membership Base: US LawShield has experienced exponential growth in its membership over the years. This expansion has been fueled by the increasing number of firearm owners seeking legal protection and education.

Strong Brand Recognition: US LawShield has established itself as a reputable and reliable provider of legal protection services. The company's strong brand recognition has helped attract new members and retain existing ones.

Strategic Partnerships: US LawShield has formed strategic partnerships with various firearm-related organizations, further expanding its reach and influence in the market.

Robust Financial Performance: The company has demonstrated consistent financial growth, with increasing revenue and profitability. This has bolstered investor confidence in the stock.

Key Factors to Consider Before Investing in US LawShield Stock

While US LawShield stock presents an attractive investment opportunity, it's essential to consider the following factors:

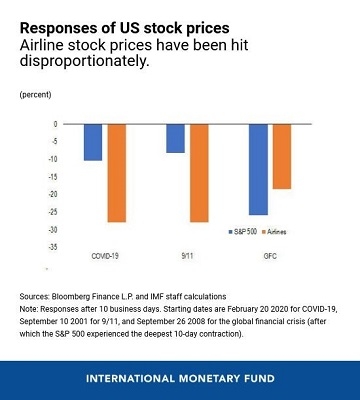

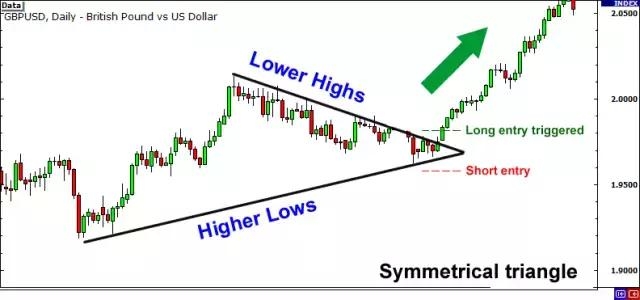

Market Volatility: The legal protection industry is subject to regulatory changes and political debates, which can lead to market volatility.

Competition: The legal protection industry is becoming increasingly competitive, with new players entering the market. This competition could impact US LawShield's market share.

Economic Factors: Economic downturns can affect consumer spending on non-essential services, including legal protection.

Case Studies: US LawShield in Action

To illustrate the impact of US LawShield, let's consider a few case studies:

John Doe: John Doe, a firearm owner, faced legal issues after a shooting incident. With US LawShield membership, he received legal representation and guidance, which helped him navigate the legal process successfully.

Jane Smith: Jane Smith, a new firearm owner, joined US LawShield to access legal education resources. The company's comprehensive program helped her understand her rights and responsibilities as a firearm owner.

In conclusion, US LawShield stock represents a promising investment opportunity in the legal protection industry. With a growing membership base, strong brand recognition, and robust financial performance, US LawShield has the potential to deliver substantial returns for investors. However, it's crucial to conduct thorough research and consider the factors mentioned above before making an investment decision.