In a stunning turn of events, former President Donald Trump has emerged victorious in the 2024 presidential election, sending US stock futures soaring. The market's immediate reaction to Trump's win is a testament to the significant influence the political landscape can have on the financial world. This article delves into the implications of Trump's win on the stock market and the potential long-term effects.

Trump's Win and Market Sentiment

The stock market has historically responded positively to Trump's presidency, and this election win is no exception. Investors are optimistic about the potential for continued tax cuts, deregulation, and pro-business policies that have characterized Trump's tenure. The S&P 500, a key benchmark for the US stock market, has seen significant gains under Trump's administration, and many believe this trend will continue.

Key Market Indicators

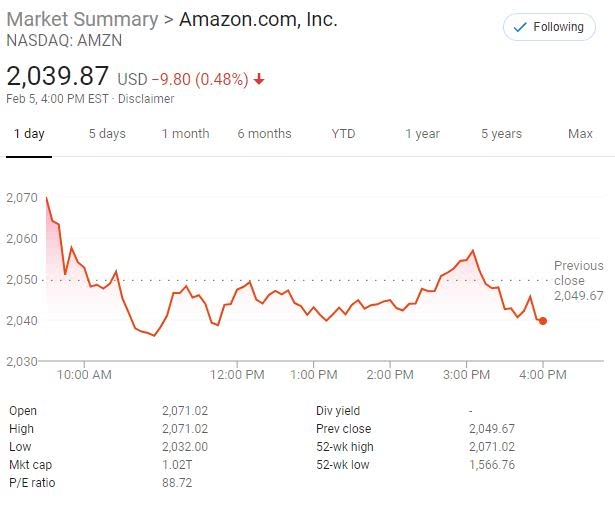

Several key market indicators have already shown signs of a positive reaction to Trump's win. The NASDAQ, which is heavily weighted towards technology stocks, has seen a notable increase in trading volume and prices. Additionally, the dollar has strengthened against other major currencies, reflecting investor confidence in the US economy.

Sector-Specific Impacts

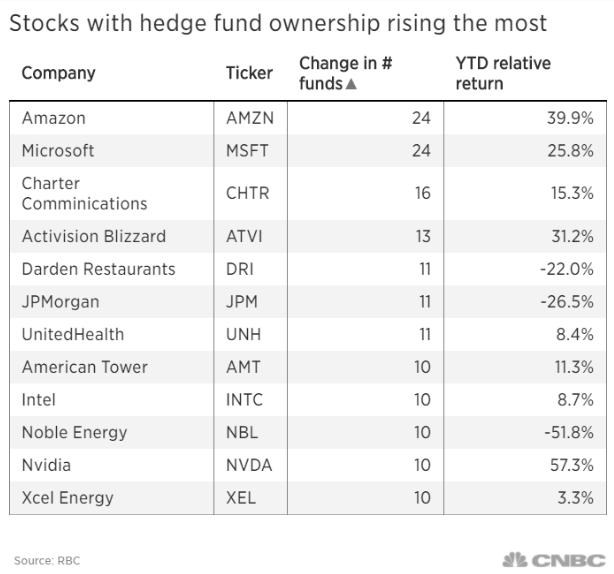

The impact of Trump's win on the stock market is not uniform across all sectors. The technology sector, which has faced increased scrutiny under the current administration, is expected to see a boost. Companies like Apple and Microsoft, which have been targeted by antitrust investigations, may benefit from a more favorable regulatory environment. On the other hand, sectors like healthcare and energy are likely to face increased regulation and scrutiny.

Potential Long-Term Effects

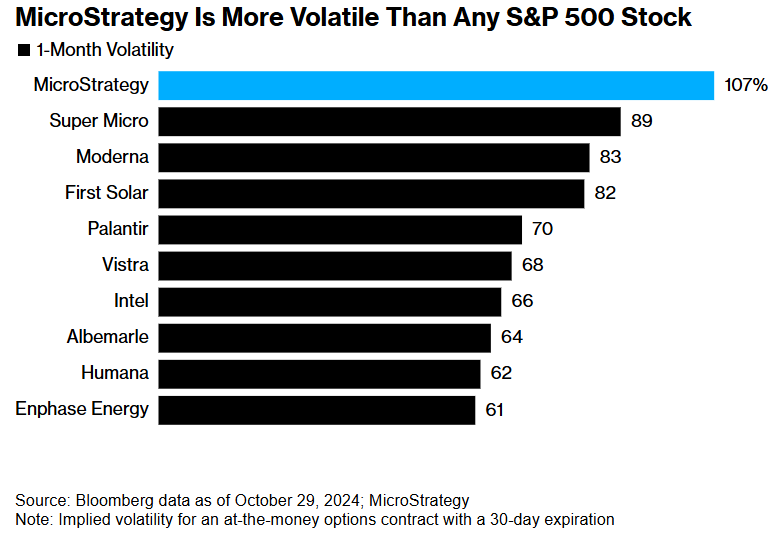

While the immediate reaction to Trump's win is positive, the long-term effects on the stock market are less clear. Historically, markets have been volatile during election years, and the 2024 election has been no different. However, Trump's win is expected to lead to a more stable political environment, which could benefit the stock market in the long run.

Case Studies

To illustrate the potential impact of Trump's win on the stock market, let's consider two case studies. During Trump's first term, the S&P 500 gained nearly 50%, outperforming the market's historical average. In contrast, during the 2020 election, the stock market experienced significant volatility, with the S&P 500 falling nearly 20% in the days following Joe Biden's victory. This highlights the significant influence that political events can have on the stock market.

Conclusion

In conclusion, the US stock market has responded positively to Trump's win in the 2024 presidential election. While the immediate reaction is optimistic, the long-term effects on the market are less clear. Investors should closely monitor market indicators and sector-specific developments to make informed decisions. As always, it's important to consider the potential risks and rewards associated with any investment.