The upcoming US election is a pivotal moment not only for the nation but also for the global stock market. As investors and traders alike brace for the political showdown, the question on everyone's mind is: How will the stock market react to the election results? In this comprehensive guide, we'll delve into the various factors that could influence stock market movements post-election, and provide insights on how to predict potential market trends.

Understanding the Connection Between US Elections and the Stock Market

The relationship between the US elections and the stock market is a complex one. While it's impossible to predict the exact outcome, historical data and market trends can offer valuable insights. Here are some key factors to consider:

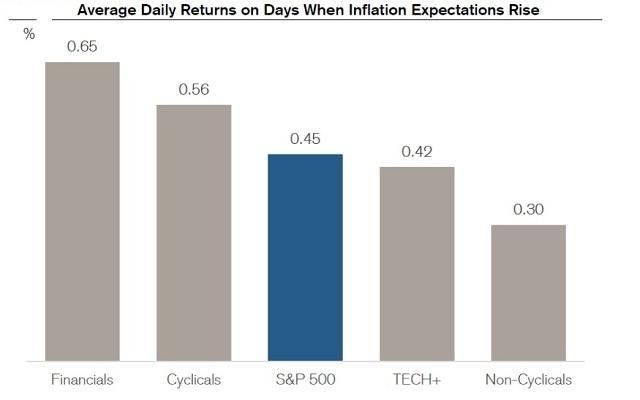

- Economic Policies: Presidential candidates often tout their economic policies during campaigns. These policies, such as tax reforms, trade agreements, and spending plans, can significantly impact the stock market. For instance, a candidate advocating for lower taxes and increased government spending may be seen as bullish for the market, while a candidate pushing for higher taxes and stricter regulations may be seen as bearish.

- Interest Rates: The Federal Reserve sets interest rates, and these rates can have a profound impact on the stock market. Candidates' positions on monetary policy can influence the direction of interest rates, which in turn affects investor sentiment and stock prices.

- Geopolitical Stability: The US plays a crucial role in global politics and economics. The election outcome can affect geopolitical stability, which can have ripple effects on the stock market. For example, a candidate seen as supportive of international trade and cooperation may be seen as positive for the market, while a candidate seen as isolationist may be seen as negative.

Predicting Stock Market Movements Post-Election

While it's impossible to predict the exact stock market movements post-election, there are several methodologies and tools that investors can use to gain insights:

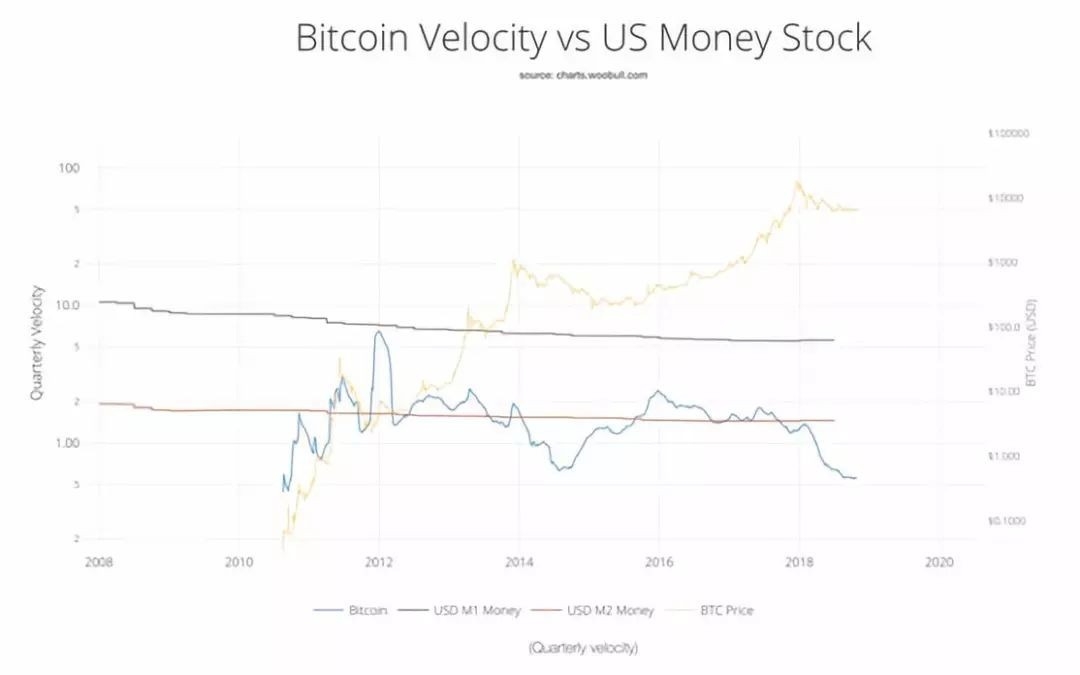

- Historical Data: Analyzing historical stock market movements during previous elections can provide valuable insights. For instance, if the stock market has generally performed well after a particular political party has won, investors may be more inclined to favor that party's candidate.

- Market Sentiment: Keeping an eye on market sentiment can help investors gauge potential stock market movements. Positive market sentiment can lead to increased stock prices, while negative sentiment can lead to declines.

- Technical Analysis: Technical analysis involves analyzing historical stock price data to identify patterns and trends. This can help investors predict potential stock market movements post-election.

Case Studies

To illustrate the potential impact of the election on the stock market, let's look at two historical case studies:

- 2008 Election: The 2008 election was a turning point for the US stock market. As Barack Obama was elected president, the stock market experienced a significant rally, as investors bet on his economic stimulus plan. However, the market took several months to fully recover from the financial crisis.

- 2016 Election: The 2016 election was marked by uncertainty, as Donald Trump won the presidency. Despite initial market volatility, the stock market eventually rallied, as investors bet on Trump's pro-growth policies.

Conclusion

The upcoming US election is a critical moment for the stock market. While it's impossible to predict the exact outcome, understanding the various factors at play can help investors make informed decisions. By analyzing historical data, market sentiment, and technical analysis, investors can gain insights into potential stock market movements post-election. As always, it's crucial to do your research and consult with a financial advisor before making any investment decisions.