Introduction

As we step into the new year, investors are eager to see what the US stock market has in store for 2024. With economic uncertainties and geopolitical tensions looming, the stock market is poised for a year of both challenges and opportunities. In this article, we will explore the key factors that could influence the US stock market in 2024 and provide insights into potential trends and investments.

Economic Outlook

The economic landscape for 2024 is complex, with various factors at play. The Federal Reserve's monetary policy, inflation rates, and global economic conditions are all critical elements that could impact the stock market.

1. Federal Reserve Policy

The Federal Reserve's actions in 2024 will be closely watched by investors. With inflation still a concern, the Fed may continue to raise interest rates, which could affect borrowing costs and corporate profitability. However, a balanced approach is crucial to avoid a recession.

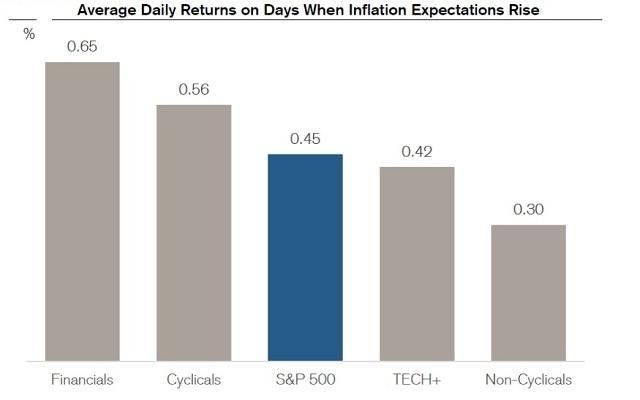

2. Inflation Rates

Inflation remains a significant challenge for the US economy. If inflation continues to rise, it could lead to higher interest rates and a slowdown in economic growth. Conversely, if inflation begins to cool, it could signal a period of economic stability and growth.

3. Global Economic Conditions

Global economic conditions, particularly in key trading partners like China and the European Union, will also play a role in the US stock market. A slowdown in these regions could impact US exports and corporate earnings.

Sector Trends

Several sectors are expected to perform well in 2024, driven by technological advancements, changing consumer preferences, and government policies.

1. Technology

The technology sector remains a key driver of the US stock market. With advancements in artificial intelligence, cloud computing, and 5G technology, companies in this sector are well-positioned for growth.

2. Healthcare

The healthcare sector is also expected to perform well, driven by an aging population and increasing demand for healthcare services. Biotechnology and pharmaceutical companies are likely to benefit from these trends.

3. Renewable Energy

The renewable energy sector is gaining momentum, with increasing government support and technological advancements. Companies involved in solar, wind, and other renewable energy sources are expected to see significant growth.

Case Studies

To illustrate the potential of these sectors, let's consider a few case studies:

- Tesla (TSLA): As a leader in electric vehicles and renewable energy, Tesla is well-positioned to benefit from the growing demand for sustainable transportation and energy solutions.

- Moderna (MRNA): The biotechnology company has made significant advancements in mRNA vaccine technology, which could lead to new breakthroughs in healthcare.

- First Solar (FSLR): As a leading manufacturer of solar panels, First Solar is benefiting from the increasing global demand for renewable energy.

Conclusion

The US stock market in 2024 is expected to be influenced by a variety of factors, including economic conditions, sector trends, and technological advancements. By staying informed and focusing on well-performing sectors, investors can navigate the challenges and opportunities that lie ahead.