In today's volatile financial landscape, understanding the value of Dow stocks is crucial for investors seeking to maximize their returns. The Dow Jones Industrial Average, often simply referred to as the "Dow," is one of the most influential stock market indices, representing the performance of 30 large companies in the United States. But what exactly does the value of Dow stocks mean, and how can you assess it effectively? This comprehensive guide will delve into the intricacies of Dow value, offering valuable insights and strategies for investors.

What is the Dow Jones Industrial Average (DJIA)?

The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks, selected for their broad representation of the overall economy. The Dow includes some of the most prominent companies in the United States, such as Apple, Microsoft, and Coca-Cola. It's important to note that the composition of the Dow can change over time, reflecting the evolving economic landscape.

Assessing the Value of Dow Stocks

The value of Dow stocks is determined by a combination of factors, including:

Market Capitalization: The market capitalization of a company is the total value of all its shares of stock. This is an important factor in assessing the value of Dow stocks, as larger companies often contribute more to the index.

Price-to-Earnings (P/E) Ratio: The P/E ratio is a valuation metric that compares a company's share price to its earnings per share (EPS). A lower P/E ratio suggests that the stock may be undervalued, while a higher P/E ratio may indicate that the stock is overvalued.

Dividend Yield: The dividend yield is the percentage return on an investment, calculated by dividing the annual dividends per share by the share price. Companies with higher dividend yields can be attractive to income investors.

Economic Indicators: The performance of the Dow can also be influenced by broader economic indicators, such as unemployment rates, inflation, and interest rates.

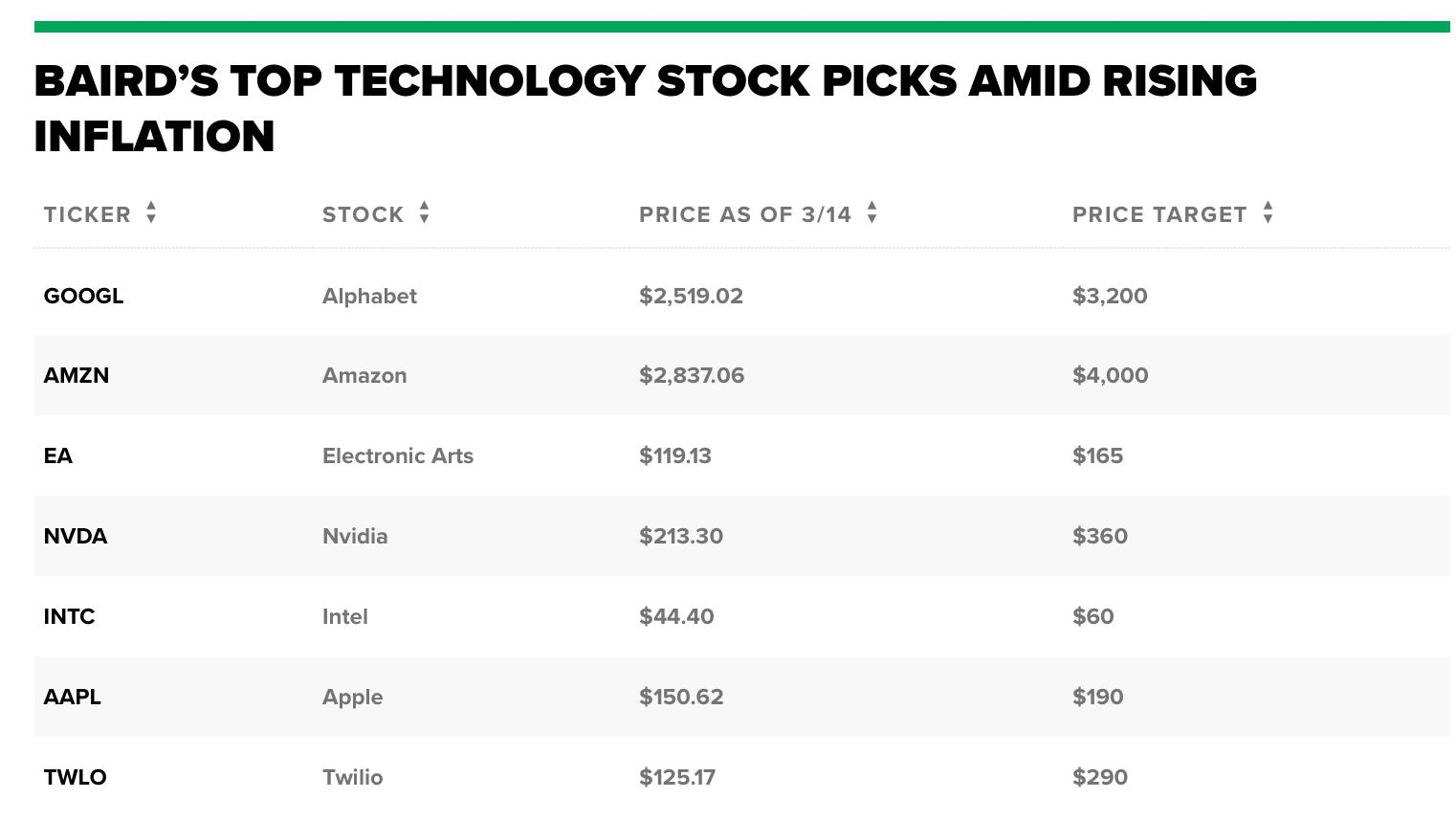

Case Study: Apple (AAPL)

To illustrate how to assess the value of Dow stocks, let's consider Apple (AAPL). As of the latest available data:

- Market Capitalization: $2.8 trillion

- P/E Ratio: 28.4

- Dividend Yield: 0.53%

Based on these metrics, we can make some conclusions about the value of Apple's stock. With a relatively high P/E ratio, Apple's stock may be considered overvalued in the short term. However, its strong market capitalization and substantial dividend yield make it an attractive investment for long-term investors.

Conclusion

Understanding the value of Dow stocks is essential for investors looking to navigate the complexities of the stock market. By considering factors such as market capitalization, P/E ratio, and dividend yield, investors can make informed decisions about their investments. While the Dow Jones Industrial Average is a valuable tool for tracking the overall performance of the stock market, it's important to conduct thorough research before making investment decisions.