The US stock market has been experiencing a downturn recently, and many investors are wondering why. This article delves into the factors contributing to the current market volatility and provides insights into what might be driving the downward trend.

Economic Indicators and Interest Rates

One of the primary reasons behind the US stock market's decline is the Federal Reserve's recent decision to raise interest rates. This move has been anticipated for some time, and as a result, investors have been adjusting their portfolios accordingly. Higher interest rates typically lead to increased borrowing costs for companies, which can negatively impact their profitability.

Additionally, economic indicators such as inflation and unemployment rates have been causing concern among investors. The latest inflation figures have shown a steady rise, raising fears of a potential recession. These indicators, along with the Fed's decision to raise rates, have led to increased uncertainty in the stock market.

Global Economic Factors

The US stock market is heavily influenced by global economic events. The recent political turmoil in certain regions and the ongoing trade tensions between the US and China have created a sense of unease among investors. The uncertainty surrounding these issues has contributed to the downward trend in the stock market.

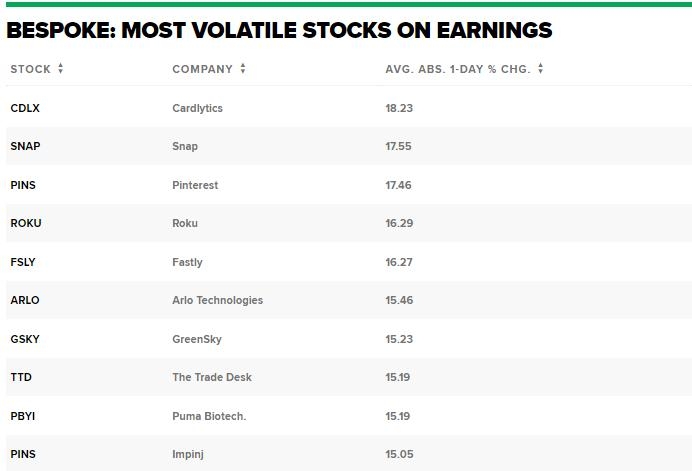

Sector-Specific Factors

Certain sectors have been particularly affected by the current market downturn. For example, the technology sector, which has been a major driver of the stock market's growth over the past few years, has seen a significant decline. This can be attributed to concerns about increasing competition and regulatory changes. The biotech and healthcare sectors have also been negatively impacted, as investors seek to diversify their portfolios and avoid potential risks.

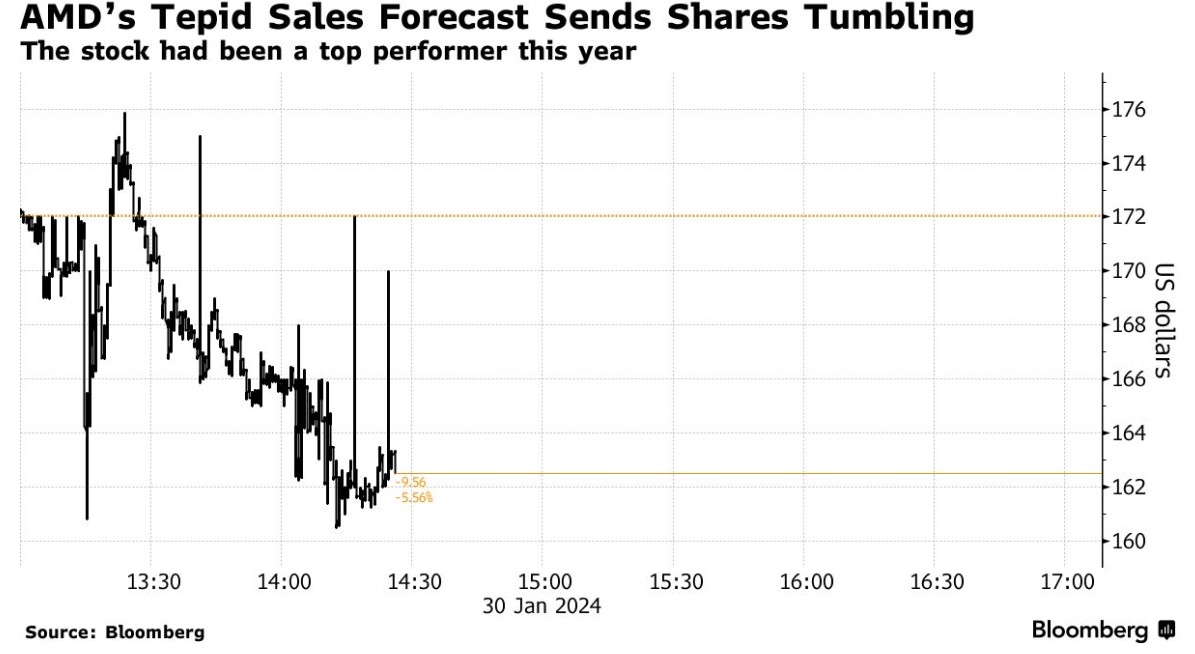

Company-Specific Issues

In addition to broader market and economic factors, company-specific issues have also played a role in the stock market's decline. High-profile companies such as Tesla and Amazon have reported lower-than-expected earnings, leading to sell-offs in their respective stocks. These incidents have further contributed to the overall downward trend in the stock market.

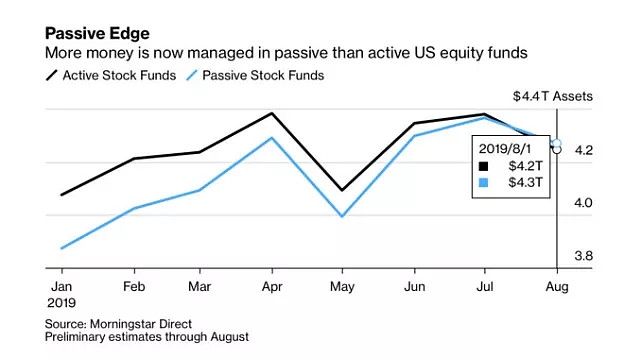

Market Sentiment and Technical Analysis

Another factor contributing to the current market downturn is the shift in investor sentiment. Many investors have become more risk-averse, leading to a sell-off in high-risk assets such as stocks. Technical analysis has also played a role, with some investors using indicators such as the RSI (Relative Strength Index) and moving averages to identify potential market trends.

In conclusion, the US stock market's downward trend can be attributed to a combination of economic indicators, global economic factors, sector-specific issues, and company-specific challenges. As investors navigate this uncertain environment, it is important to stay informed and maintain a diversified portfolio to mitigate potential risks.