The Dow Jones Industrial Average (DJIA), often simply referred to as "the Dow," has been a key indicator of the U.S. stock market's performance for over a century. However, in recent years, the Dow has experienced significant fluctuations, sparking questions among investors and market watchers alike. This article delves into the factors that have influenced the Dow's movements, providing a comprehensive analysis of what has happened to the Dow.

Historical Context

To understand the current state of the Dow, it's essential to look back at its historical context. The Dow was first published in 1896 by Charles Dow, a journalist and financial analyst. Initially, it included just 12 companies, representing a diverse range of industries. Over the years, the Dow has expanded to include 30 companies, with regular adjustments to reflect changes in the market.

Recent Fluctuations

In recent years, the Dow has experienced several notable fluctuations. One of the most significant events was the 2020 stock market crash, triggered by the COVID-19 pandemic. The Dow plummeted by nearly 35% in just a few weeks, before recovering to pre-pandemic levels within a year.

Factors Influencing the Dow

Several factors have contributed to the Dow's recent movements. Here are some of the key factors:

1. Economic Indicators

Economic indicators, such as unemployment rates, inflation, and GDP growth, play a crucial role in influencing the Dow. For example, when the unemployment rate is low and GDP growth is strong, the Dow tends to perform well. Conversely, when economic indicators are weak, the Dow may suffer.

2. Geopolitical Events

Geopolitical events, such as elections, trade wars, and international conflicts, can also impact the Dow. For instance, the 2016 U.S. presidential election and the 2019 trade war between the U.S. and China caused significant volatility in the Dow.

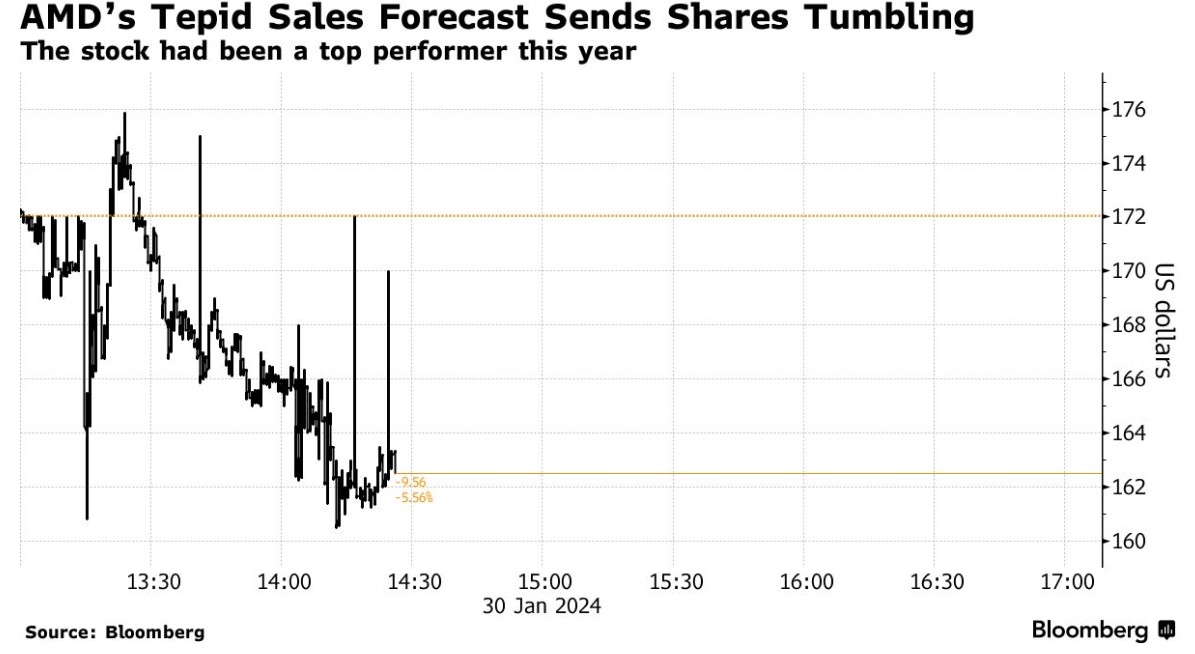

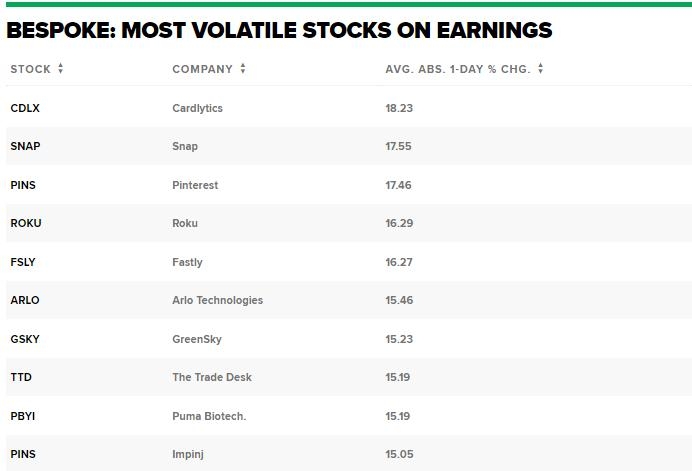

3. Corporate Earnings

Corporate earnings are another critical factor affecting the Dow. When companies report strong earnings, the Dow tends to rise. Conversely, when earnings are weak, the Dow may fall.

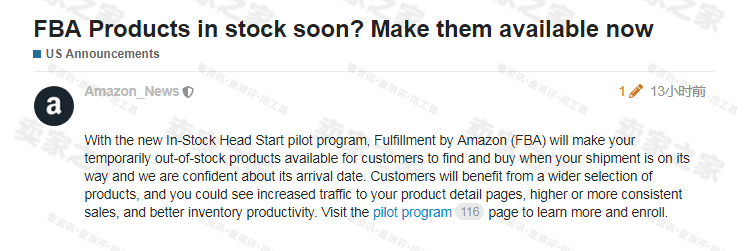

4. Technological Advancements

Technological advancements have also played a role in the Dow's movements. For example, the rise of social media and e-commerce companies has contributed to the growth of the Dow, as these companies are included in the index.

Case Studies

To illustrate the impact of these factors, let's consider a few case studies:

1. COVID-19 Pandemic

The COVID-19 pandemic caused a significant drop in the Dow, as investors worried about the economic impact of the virus. However, as the pandemic subsided and economies began to recover, the Dow recovered as well.

2. Trade War with China

The trade war between the U.S. and China in 2019 caused the Dow to experience significant volatility. However, as the two countries reached a trade deal, the Dow stabilized and began to rise again.

Conclusion

In conclusion, the Dow Jones Industrial Average has experienced significant fluctuations in recent years, influenced by a variety of factors. Understanding these factors can help investors make informed decisions about their investments. By keeping a close eye on economic indicators, geopolitical events, corporate earnings, and technological advancements, investors can better navigate the complexities of the stock market.