In recent years, there has been a significant trend of money being removed from US stock markets. This shift has sparked various discussions and debates among investors, financial experts, and policymakers. Understanding the reasons behind this trend and its implications is crucial for anyone invested in the stock market. This article delves into the factors contributing to the removal of money from US stock markets and explores the potential consequences.

The Factors Behind the Trend

Several factors have contributed to the removal of money from US stock markets:

Rising Interest Rates: The Federal Reserve has been gradually increasing interest rates to combat inflation. Higher interest rates make bonds and other fixed-income investments more attractive, drawing investors away from the stock market.

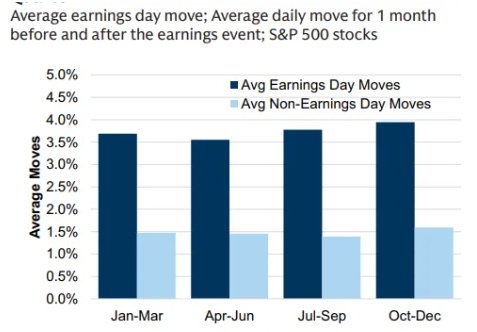

Market Volatility: The stock market has experienced increased volatility in recent years, causing some investors to withdraw their money in search of safer investments.

Economic Uncertainty: Concerns about the global economy, trade tensions, and political instability have led to uncertainty, prompting investors to remove money from the stock market.

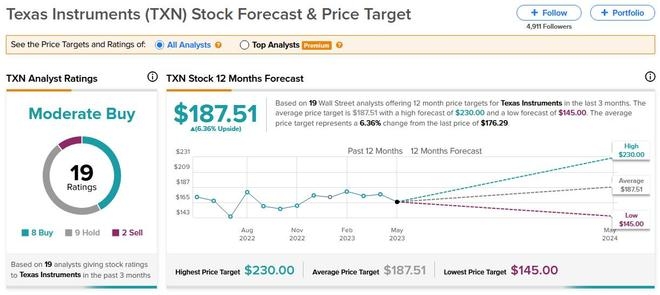

Corporate Earnings: Some investors are concerned about the sustainability of corporate earnings, particularly as the economy approaches its late-stage phase.

The Implications of Removing Money from US Stock Markets

The removal of money from US stock markets has several implications:

Impact on Stock Prices: As investors withdraw their money, stock prices may fall, leading to potential losses for investors.

Impact on Corporate America: With less money flowing into the stock market, companies may find it harder to raise capital for expansion and innovation.

Impact on the Economy: A decrease in investment in the stock market can have a ripple effect on the broader economy, potentially leading to slower economic growth.

Case Studies

Several case studies illustrate the impact of removing money from the stock market:

2008 Financial Crisis: During the financial crisis, investors rushed to withdraw their money from the stock market, leading to a significant decline in stock prices. This, in turn, contributed to the broader economic downturn.

COVID-19 Pandemic: As the pandemic hit, investors again withdrew money from the stock market, leading to volatility and a temporary bear market. However, the market eventually recovered as the economy stabilized.

Conclusion

Removing money from US stock markets is a complex trend with several contributing factors and implications. Understanding these factors and their potential consequences is crucial for investors and policymakers alike. As the market continues to evolve, staying informed and adapting to changing conditions will be key to navigating this dynamic environment.