Introduction

The US stock market has been a hot topic of discussion in recent years, with many investors questioning whether a bubble is forming. The term "bubble" refers to a situation where asset prices are significantly higher than their intrinsic value, driven by speculative buying rather than fundamental economic factors. In this article, we will explore the factors contributing to the current market conditions and analyze whether a bubble is indeed forming in the US stock market.

Economic Factors

One of the primary reasons for the concern about a bubble in the stock market is the low-interest-rate environment. The Federal Reserve has kept interest rates near zero since the 2008 financial crisis, and this has encouraged investors to seek higher returns in riskier assets such as stocks. Additionally, the government's stimulus measures during the COVID-19 pandemic have provided a significant boost to the economy, which has also contributed to the rise in stock prices.

Valuation Metrics

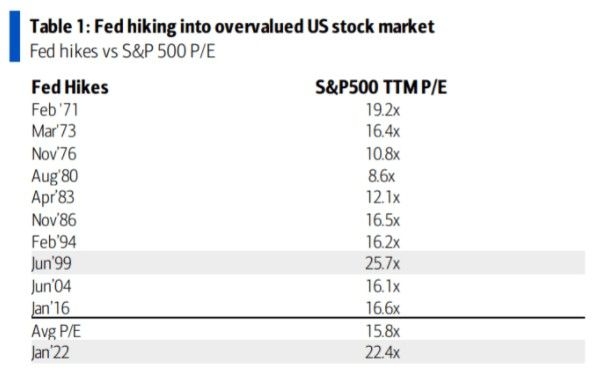

Another factor that has raised concerns about a bubble is the valuation of stocks. The price-to-earnings (P/E) ratio, a common valuation metric, has reached record highs in recent years. For instance, the P/E ratio for the S&P 500 index has exceeded 30, which is well above its long-term average of around 15-20. This suggests that stocks are overvalued, which could be a sign of a bubble.

Sector Analysis

To further understand whether a bubble is forming, we can analyze specific sectors within the stock market. The technology sector, for example, has seen significant growth in recent years, with companies like Apple, Amazon, and Google leading the way. However, some critics argue that this growth is driven by speculative buying rather than fundamentals, which could indicate a bubble.

Case Study: Tech Bubble of 2000

To illustrate the potential risks associated with a stock market bubble, let's look at the tech bubble of 2000. During this period, technology stocks experienced rapid growth, driven by speculative buying and excessive optimism. However, this bubble eventually burst, leading to a significant decline in stock prices and a bear market. The lessons learned from this event serve as a reminder of the risks associated with a bubble.

Market Sentiment

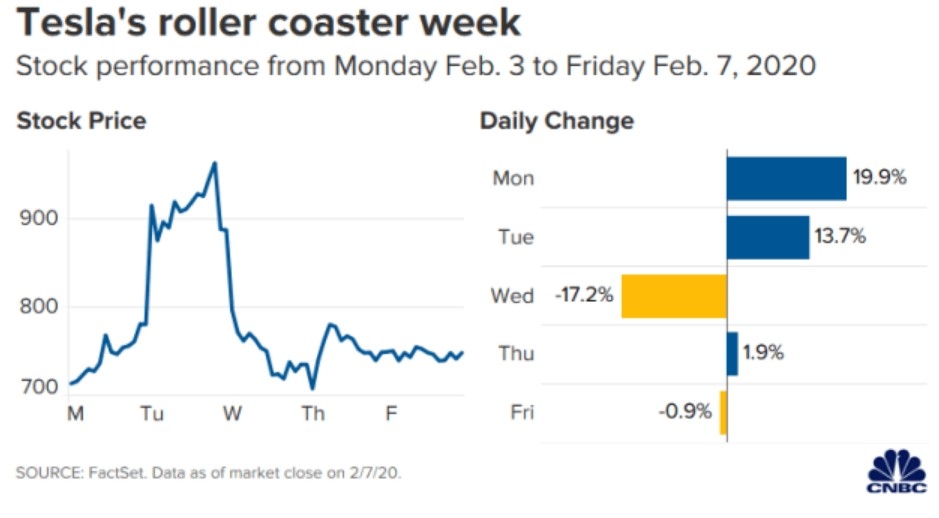

Market sentiment also plays a crucial role in the formation of a bubble. When investors become overly optimistic and believe that prices will continue to rise indefinitely, it can lead to a speculative bubble. Currently, there is a strong sense of optimism in the market, with many investors expecting further growth. However, this optimism could be a sign of a bubble forming.

Conclusion

In conclusion, while there are concerns about a bubble forming in the US stock market, it is important to consider various factors before drawing a definitive conclusion. The low-interest-rate environment, high valuation metrics, and sector-specific trends all contribute to the debate. As investors, it is crucial to remain vigilant and conduct thorough research before making investment decisions. The lessons learned from past bubbles serve as a reminder of the potential risks associated with speculative markets.