Are you considering investing in the US stock exchange, but you're unsure about where to start? Look no further! In this article, we will delve into the world of the Target US Stock Exchange, providing you with a comprehensive guide to help you make informed investment decisions.

Understanding the Target US Stock Exchange

The Target US Stock Exchange, often referred to as the "NASDAQ," is one of the world's largest stock exchanges. It is home to some of the most innovative and successful companies in the tech industry, such as Apple, Microsoft, and Amazon. The exchange offers a wide range of investment opportunities, from individual stocks to exchange-traded funds (ETFs).

Key Features of the Target US Stock Exchange

Market Capitalization: The Target US Stock Exchange is known for its high market capitalization, which means it attracts large institutional investors and offers significant liquidity.

Technology-Driven: The exchange is a hub for technology companies, making it an attractive destination for investors interested in the tech industry.

Innovation: The Target US Stock Exchange is at the forefront of innovation, with a focus on emerging sectors such as biotechnology, renewable energy, and artificial intelligence.

Regulatory Environment: The exchange operates under strict regulatory guidelines, ensuring a fair and transparent trading environment.

How to Invest in the Target US Stock Exchange

Open a Brokerage Account: The first step is to open a brokerage account with a reputable firm. This will provide you with access to the Target US Stock Exchange and its vast array of investment options.

Research and Analyze: Conduct thorough research on the companies you are interested in. Look at their financial statements, market trends, and competitive landscape.

Diversify Your Portfolio: Diversification is key to mitigating risk. Consider investing in a mix of stocks, ETFs, and other assets to spread out your risk.

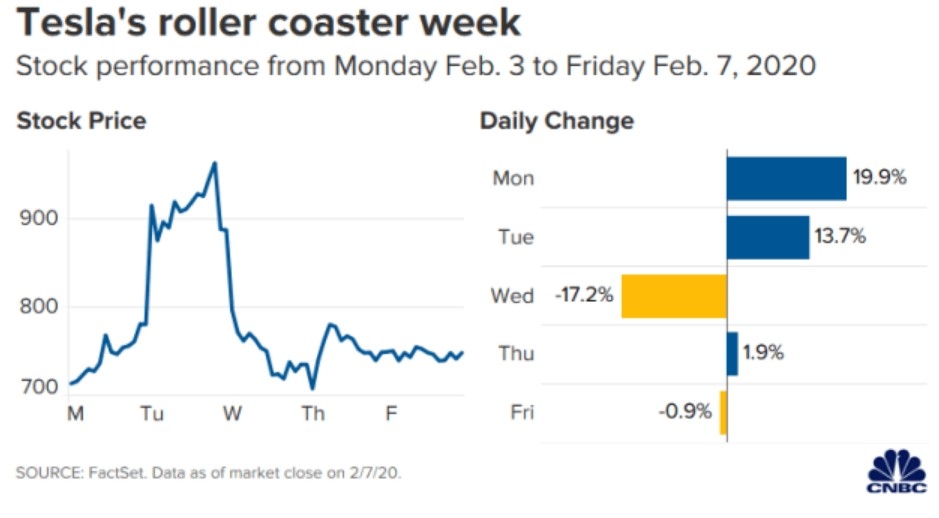

Stay Informed: Keep up-to-date with market news and developments. This will help you make informed decisions and stay ahead of the curve.

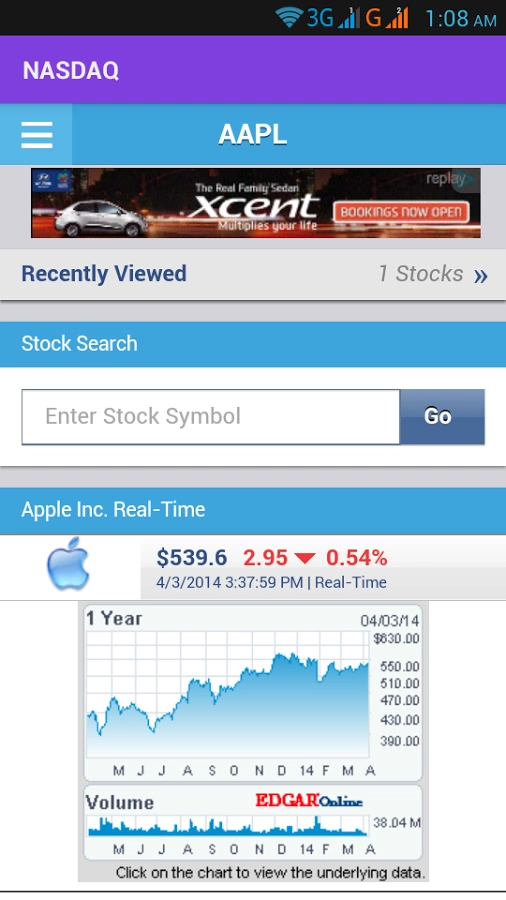

Case Study: Apple Inc.

One of the most notable companies listed on the Target US Stock Exchange is Apple Inc. Since its initial public offering (IPO) in 1980, Apple has become one of the world's most valuable companies. Its success can be attributed to its innovative products, strong brand, and strategic investments in emerging technologies.

Conclusion

The Target US Stock Exchange offers a wealth of investment opportunities for both novice and experienced investors. By understanding the key features of the exchange and following a disciplined investment strategy, you can achieve your financial goals. Remember to conduct thorough research, diversify your portfolio, and stay informed to make the most of your investment journey.