The stock market is a crucial indicator of a country's economic health and investment potential. When comparing the Chinese stock market to that of the United States, it's essential to look at various factors such as market structure, performance, and investor sentiment. This article aims to provide a comprehensive analysis of these aspects to help investors understand the nuances of both markets.

Market Structure and Size

The Chinese stock market, primarily represented by the Shanghai and Shenzhen stock exchanges, has seen significant growth over the past few decades. Shanghai Stock Exchange is one of the world's largest exchanges by market capitalization, with a wide array of companies listed across various sectors. The Shenzhen Stock Exchange, on the other hand, focuses on technology and growth-oriented companies.

In contrast, the US stock market is home to some of the most recognized and influential companies globally. The New York Stock Exchange (NYSE) and the NASDAQ are the two primary exchanges, offering a diverse range of companies across different industries. The US market is characterized by its robust regulatory framework and liquidity.

Performance and Returns

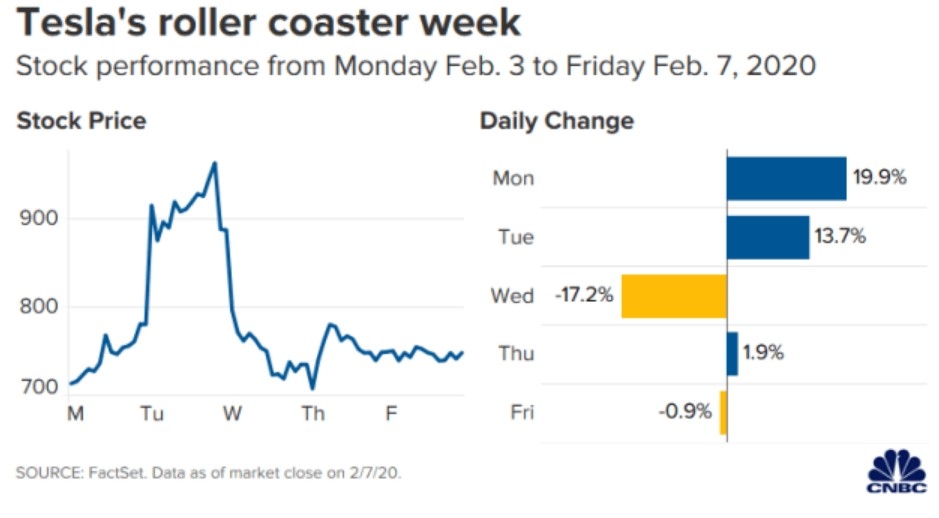

The performance of the Chinese stock market has been quite volatile compared to the US. Over the past decade, the Chinese market has experienced periods of rapid growth followed by significant corrections. The Shanghai Composite Index and the Shenzhen Component Index have shown strong returns, especially in the tech sector.

The US stock market, however, has been more stable and has delivered consistent returns over the long term. The S&P 500 and the Dow Jones Industrial Average have been among the best-performing indices globally, offering investors a wide range of investment opportunities.

Investor Sentiment and Risk Appetite

Investor sentiment plays a crucial role in shaping stock market trends. In the Chinese stock market, speculative trading and short-term investing are more prevalent, often driven by market sentiment and speculation. This has led to significant price volatility and high risk.

The US stock market, on the other hand, is characterized by a more institutionalized and long-term investment approach. Investors tend to focus on fundamental analysis and value investing, which has contributed to the market's stability and resilience.

Case Study: Alibaba vs. Amazon

A classic comparison between Chinese and US tech giants, Alibaba and Amazon, can provide insights into the differences between the two markets. Alibaba operates primarily in China and has a strong focus on e-commerce, while Amazon dominates the global e-commerce landscape.

Despite having a smaller market cap than Amazon, Alibaba has delivered impressive returns to investors. This highlights the high growth potential of companies in the Chinese market. However, it also reflects the higher risk associated with speculative trading and market sentiment.

In contrast, Amazon has demonstrated consistent growth and innovation, contributing to its status as one of the world's most valuable companies. This exemplifies the more stable and long-term investment approach prevalent in the US market.

Conclusion

When comparing the Chinese stock market to the US, it's evident that both markets have unique characteristics and opportunities. Investors should consider their risk tolerance, investment horizon, and market exposure when deciding where to allocate their capital. Understanding the nuances of each market is crucial for making informed investment decisions.

Note: This article is for informational purposes only and should not be considered as financial advice.