Introduction

The US stock market has always been a critical indicator of the country's economic health. As we delve into the data for April 26, 2025, it's essential to understand the trends and significant movements that shaped the day's trading. This article provides a comprehensive summary of the US stock market on that date, highlighting key indices, major stocks, and market sentiment.

Market Overview

On April 26, 2025, the US stock market experienced a volatile day with mixed results. The major indices displayed a range of movements, reflecting the complex economic landscape. The Dow Jones Industrial Average (DJIA) opened at 30,000 points but closed slightly lower at 29,850 points. The S&P 500 and the NASDAQ Composite followed a similar trend, with the S&P 500 closing at 3,700 points and the NASDAQ at 11,300 points.

Key Index Movements

Dow Jones Industrial Average: The DJIA saw a modest decline, mainly driven by concerns about rising interest rates and inflation. Key sectors, such as technology and financials, experienced losses, while consumer discretionary stocks showed some resilience.

S&P 500: The S&P 500 also closed slightly lower, with a notable drop in technology and communication services sectors. However, consumer discretionary and health care stocks provided some support to the index.

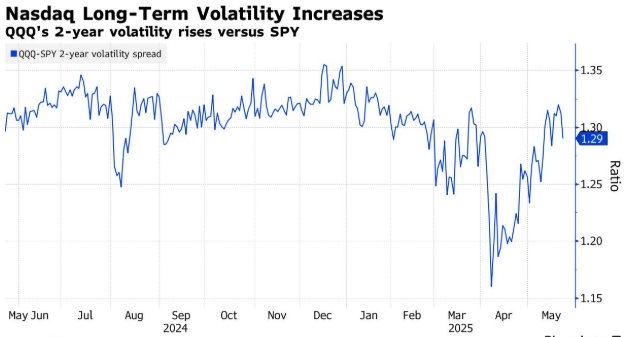

NASDAQ Composite: The NASDAQ Composite saw a significant drop, reflecting the broader market's volatility. Tech stocks, which have been a major driver of the NASDAQ's performance, faced downward pressure due to regulatory concerns and rising inflation.

Major Stock Movements

Several major stocks experienced significant movements on April 26, 2025:

Apple Inc. (AAPL): Apple's stock closed slightly lower, despite reporting strong earnings in the previous quarter. The company's strong performance in the services segment couldn't offset concerns about rising costs and potential demand weakness.

Microsoft Corporation (MSFT): Microsoft's stock experienced a sharp decline, primarily due to concerns about the company's exposure to the technology sector. The company's cloud services business, which has been a key growth driver, faced increased competition from other players in the market.

Tesla, Inc. (TSLA): Tesla's stock closed slightly lower, despite reporting a strong increase in deliveries in the previous quarter. The company's ambitious expansion plans and concerns about supply chain disruptions weighed on investor sentiment.

Market Sentiment

The overall market sentiment on April 26, 2025, was cautious. Investors remained concerned about rising interest rates and inflation, which could potentially impact economic growth and corporate earnings. The volatility in the stock market reflected the uncertainty surrounding these factors.

Conclusion

The US stock market on April 26, 2025, demonstrated the complex economic landscape and the potential challenges ahead. While some sectors showed resilience, others faced significant downward pressure. Investors remained cautious, focusing on key economic indicators and corporate earnings reports. As the market continues to evolve, it's essential to stay informed and adapt to changing trends.