Introduction

The stock market is often unpredictable, and fluctuations are a regular occurrence. One such occurrence was the recent decline in US dollar stocks, triggered by various data points. In this article, we delve into the factors contributing to this downturn and the potential implications for investors.

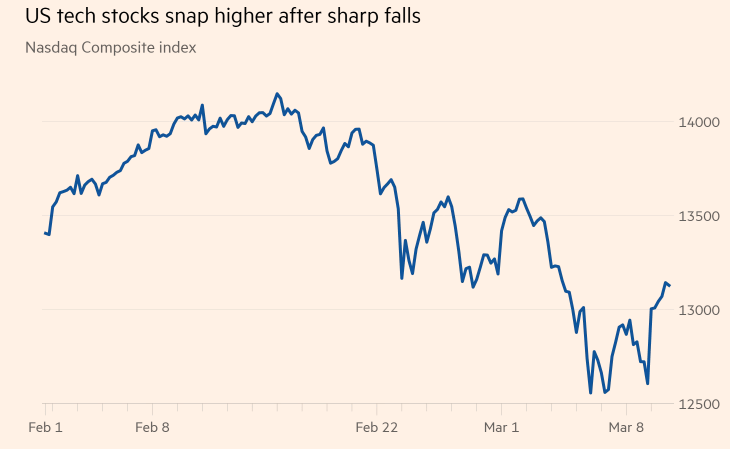

The Downturn

US dollar stocks slipped on data, reflecting a broader market trend. The decline was attributed to a mix of economic indicators and corporate earnings reports. The situation highlights the importance of staying informed about financial data and its impact on the stock market.

Economic Indicators

Several economic indicators contributed to the downward trend in US dollar stocks. For instance, the latest jobs report revealed slower-than-expected job growth, causing investors to reassess their expectations for economic growth. Additionally, rising inflation and falling consumer confidence further contributed to the market downturn.

Corporate Earnings Reports

Another significant factor was the earnings reports from major companies. Several companies missed their earnings estimates, leading to a sell-off in their stocks. This situation highlighted the vulnerability of the stock market to corporate performance, and the importance of thorough analysis before investing.

Impact on Investors

The recent downturn in US dollar stocks has had a significant impact on investors. Those who were overexposed to stocks saw their portfolios shrink, while others had to navigate through the uncertainty. The situation underscores the importance of diversification and risk management in investment strategies.

Case Studies

To illustrate the impact of data on stock market movements, let's consider a few case studies:

- Apple Inc. – The tech giant reported lower-than-expected revenue for the first time in 13 years, sending its stock into a tailspin. The decline was attributed to slower iPhone sales and a stronger US dollar.

- Walmart Inc. – The retail giant missed its earnings estimates, largely due to higher operating costs and a softer consumer spending environment. This situation caused its stock to drop significantly.

Conclusion

In conclusion, the recent downturn in US dollar stocks is a testament to the importance of staying informed about financial data. Investors need to pay close attention to economic indicators and corporate earnings reports to make informed decisions. By understanding the factors contributing to market movements, investors can better navigate the uncertainty and protect their portfolios.