Introduction:

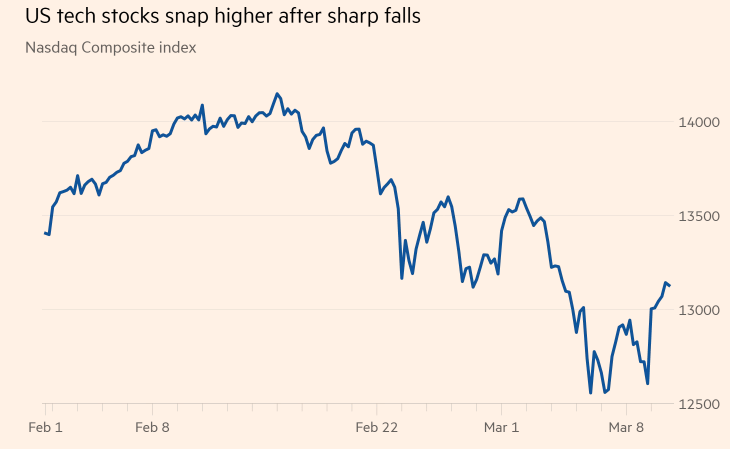

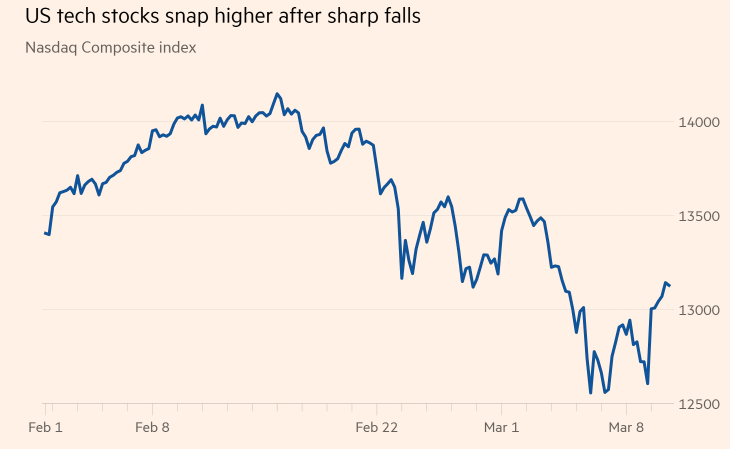

Market Performance: January and February are typically characterized by volatile market movements. This period often sees investors repositioning their portfolios and speculating on the year's economic outlook. The performance of the US stock exchange during these months can be attributed to various factors, including economic indicators, corporate earnings, and geopolitical events.

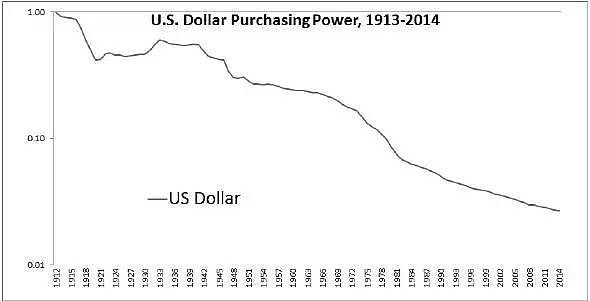

Economic Indicators: Economic indicators play a significant role in shaping market sentiment. In January and February, investors closely monitored key indicators such as GDP growth, unemployment rates, and inflation data. For instance, the US GDP growth rate during these months can provide insights into the overall economic health of the country.

Corporate Earnings: Corporate earnings reports are another critical factor that influences stock market movements. During January and February, many companies release their earnings reports for the previous fiscal quarter. These reports provide valuable insights into the financial performance and outlook of individual companies and the broader market.

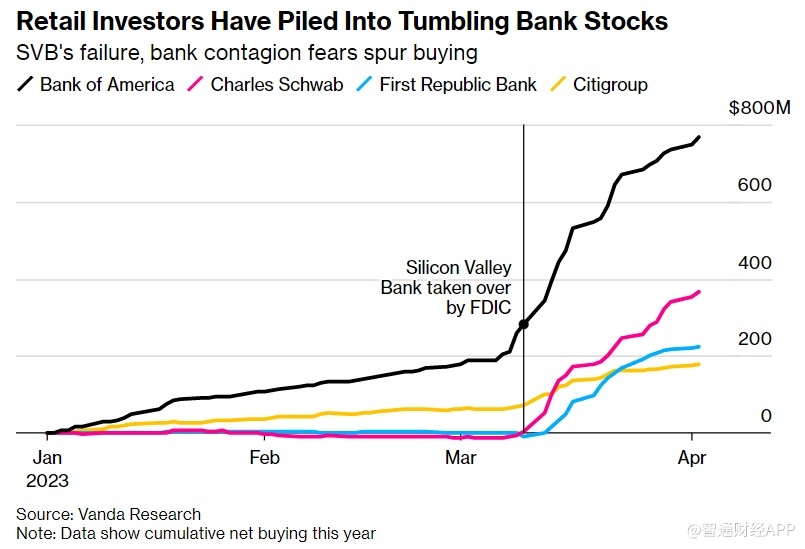

Geopolitical Events: Geopolitical events can have a profound impact on the US stock exchange. In January and February, investors often pay close attention to global events, such as trade negotiations, political developments, and international conflicts. These events can lead to market volatility and influence investment decisions.

Sector Performance: Different sectors within the US stock exchange tend to perform differently during January and February. For instance, the technology sector has often been a strong performer during these months, driven by strong earnings reports and positive outlooks from leading companies.

Case Studies: To illustrate the dynamics of the US stock exchange during January and February, let's consider a few case studies:

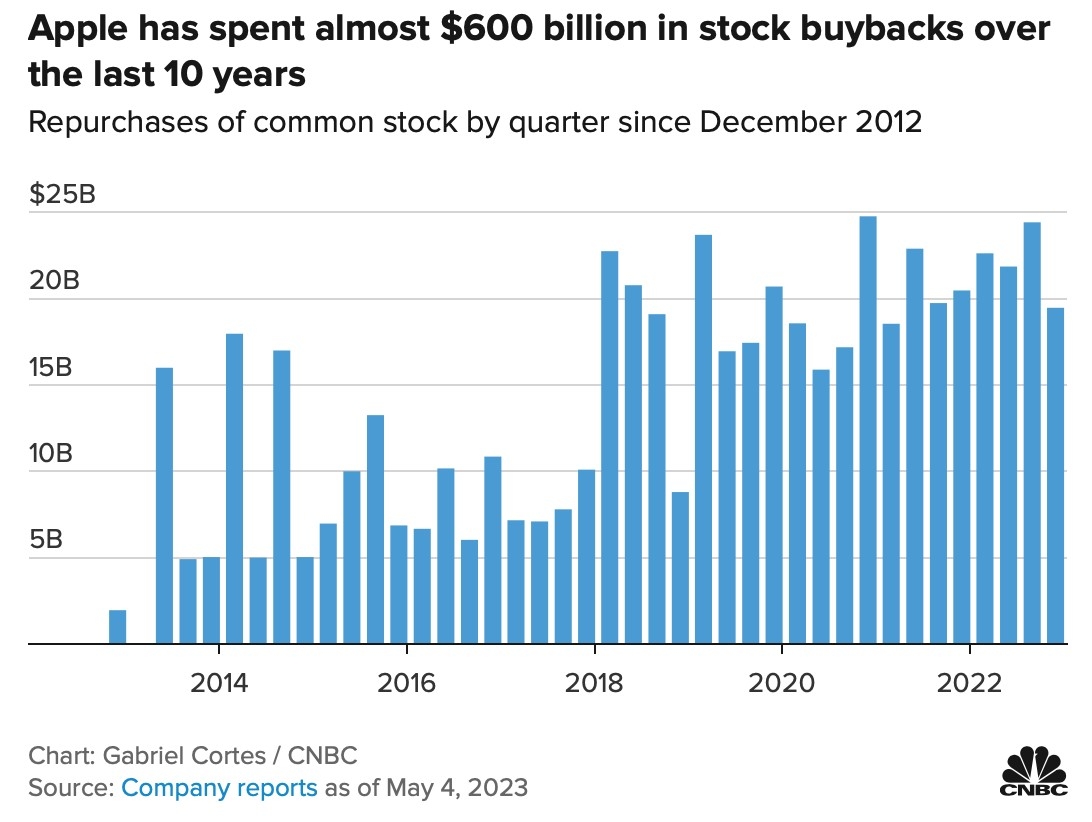

Technology Sector: In January 2022, the technology sector experienced significant growth, driven by strong earnings reports from major companies like Apple and Microsoft. This trend continued into February, with the sector witnessing further gains.

Energy Sector: The energy sector faced volatility during January and February 2022, primarily due to geopolitical tensions in Eastern Europe. However, the sector eventually recovered, with oil prices stabilizing and positive earnings reports from major energy companies.

Healthcare Sector: The healthcare sector remained a stable performer during these months, with several companies reporting strong earnings and positive outlooks. This trend can be attributed to the growing demand for pharmaceuticals and biotechnology products.

Conclusion: January and February are critical months for the US stock exchange, as they set the stage for the rest of the year. By analyzing market performance, economic indicators, corporate earnings, and geopolitical events, investors can gain valuable insights into the US stock exchange during these pivotal months. As always, it is crucial to stay informed and adapt investment strategies accordingly.