In today's globalized economy, investing in enterprise stocks has become a popular choice for many investors. With the United States being one of the world's leading economic powers, investing in American companies offers numerous opportunities for growth and stability. This comprehensive guide will explore the key aspects of investing in enterprise stocks in the US, including market trends, popular sectors, and tips for successful investing.

Understanding Enterprise Stocks

Enterprise stocks, also known as common stocks, represent ownership in a company. When you purchase shares of an enterprise stock, you become a partial owner of that company. This ownership entitles you to a portion of the company's profits, which are distributed as dividends, and the potential for capital gains if the stock price increases.

Market Trends in the US

The US stock market is known for its robustness and diversity. Over the years, it has showcased strong growth, with some sectors outperforming others. Here are some current market trends:

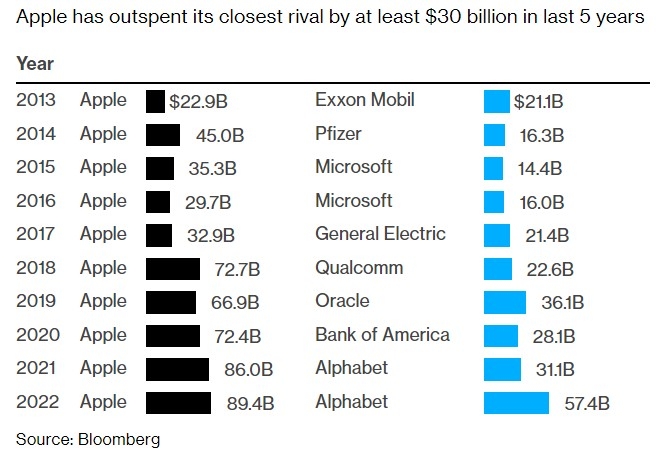

- Technology: The technology sector has been a significant driver of growth in the US stock market. Companies like Apple, Microsoft, and Amazon have seen substantial growth, making them attractive investment options.

- Healthcare: The healthcare industry is another sector that has shown remarkable growth. With an aging population and advancements in medical technology, healthcare stocks present a promising investment opportunity.

- Energy: The energy sector has been experiencing a resurgence, thanks to the increase in domestic oil and gas production. Companies involved in renewable energy are also gaining traction.

Popular Sectors for Enterprise Stocks

Investors looking to diversify their portfolios often consider the following sectors when investing in enterprise stocks:

- Technology: As mentioned earlier, the technology sector is a favorite among investors due to its potential for high growth.

- Healthcare: This sector offers stability and growth potential, with a focus on biotechnology, pharmaceuticals, and medical devices.

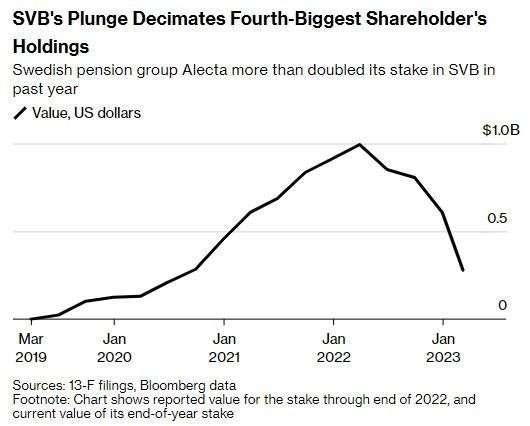

- Financials: The financial sector includes banks, insurance companies, and real estate investment trusts (REITs). These companies often provide attractive dividend yields and have a strong presence in the US market.

- Consumer Goods: The consumer goods sector encompasses companies that produce and sell everyday products, such as food, beverages, and household goods.

Tips for Successful Investing in Enterprise Stocks

To succeed in investing in enterprise stocks, consider the following tips:

- Research: Conduct thorough research on the companies you are interested in. Look at their financial statements, market trends, and management team.

- Diversify: Diversify your portfolio to reduce risk. This means investing in different sectors and geographical regions.

- Stay Informed: Keep up-to-date with market news and economic indicators that may impact the companies you are invested in.

- Be Patient: Investing in enterprise stocks requires patience and discipline. Avoid making impulsive decisions based on short-term market fluctuations.

Case Studies

To illustrate the potential of investing in enterprise stocks, let's consider two case studies:

- Apple Inc.: Since its IPO in 1980, Apple has grown to become one of the most valuable companies in the world. Its innovative products and strong brand have made it a favorite among investors.

- Tesla, Inc.: Tesla has seen remarkable growth in recent years, thanks to its electric vehicles and renewable energy solutions. Its stock has become a popular investment option for those looking to invest in the future of transportation and energy.

In conclusion, investing in enterprise stocks in the US can be a rewarding endeavor. By understanding market trends, diversifying your portfolio, and staying informed, you can increase your chances of success. Remember to conduct thorough research and be patient, and you'll be well on your way to making wise investment decisions.