As we delve into the final quarter of 2025, investors are keenly focusing on the US stock market's trajectory for October. This analysis aims to provide a comprehensive overview of the current market conditions, potential trends, and key factors that could influence stock prices in the upcoming months.

Market Overview

The US stock market has been witnessing a rollercoaster ride in recent years, and October 2025 is shaping up to be no different. The S&P 500, the most widely followed index of large-cap companies in the US, has been a key indicator of market performance. As of the beginning of October, the index stood at around 4,000 points, reflecting a mixture of optimism and uncertainty.

Trends to Watch

Economic Indicators: The US economy has been on a steady growth trajectory, with a strong labor market and moderate inflation. However, rising interest rates by the Federal Reserve remain a concern. As the Fed continues to raise rates to combat inflation, it could potentially slow down economic growth and impact stock prices.

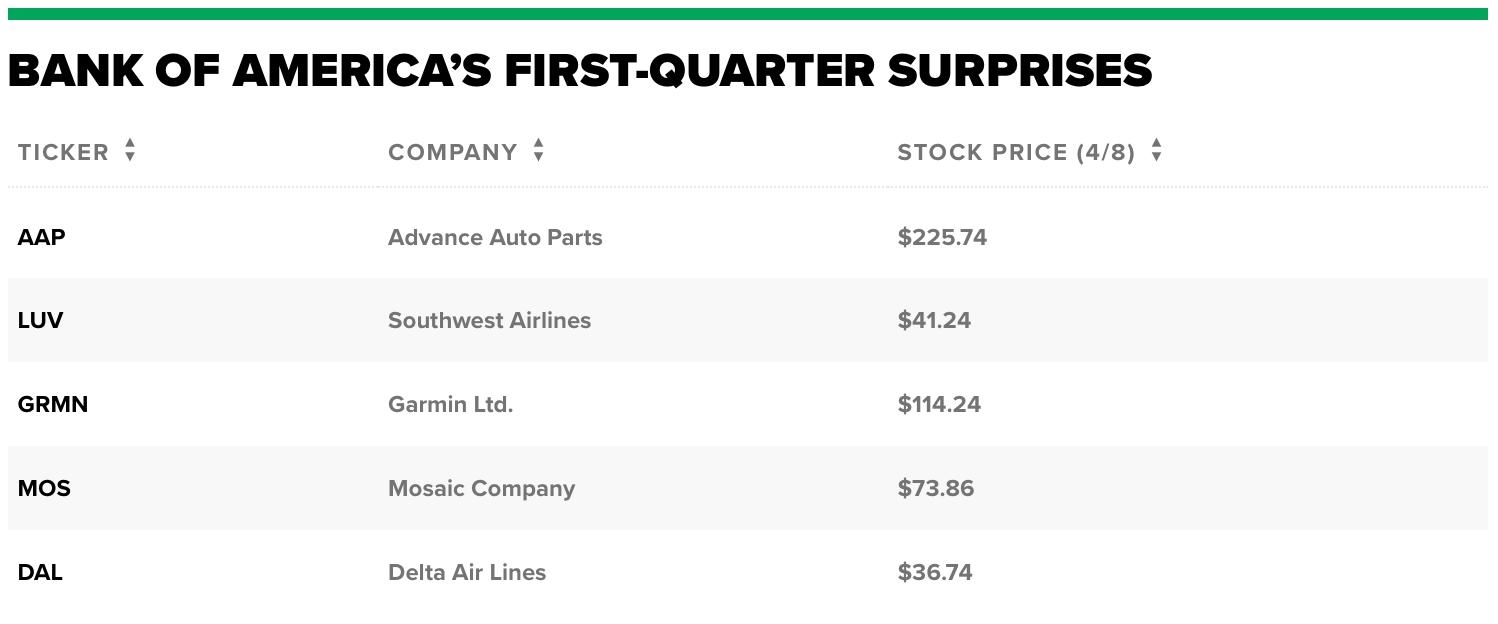

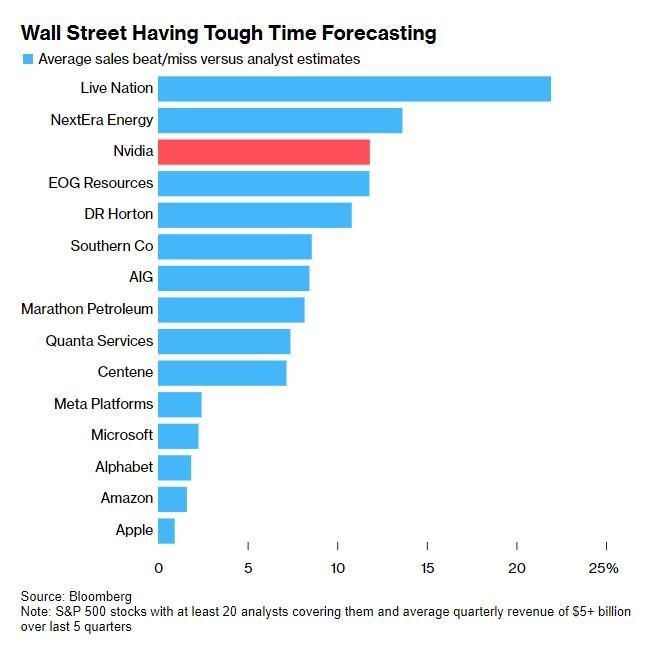

Corporate Earnings: The third quarter of 2025 is expected to see strong corporate earnings, driven by a robust economic recovery. Companies in sectors such as technology, healthcare, and consumer discretionary are likely to outperform.

Sector Performance: Tech stocks have been a significant driver of the market's performance, but their outperformance might be waning. In contrast, value stocks, particularly those in the financial and industrial sectors, could see a rebound in October.

Key Factors Influencing the Market

Monetary Policy: The Federal Reserve's monetary policy decisions remain a key factor in shaping market trends. Investors will be closely monitoring any signs of a potential shift in policy direction.

Geopolitical Events: The global political landscape, particularly tensions in Eastern Europe and the Middle East, could impact investor sentiment and market performance.

Economic Data: Economic data releases, including employment figures, inflation rates, and consumer spending, will be closely watched for any signs of a shift in economic trends.

Case Studies

Apple Inc.: As one of the largest companies in the US, Apple's performance has a significant impact on the tech sector and the broader market. In October 2025, investors will be looking for signs of strong growth in Apple's revenue and earnings, which could drive the stock price higher.

Walmart Inc.: The retail giant has been facing challenges due to the rise of e-commerce. However, Walmart's recent initiatives to expand its online presence could turn the tide in its favor.

Conclusion

In conclusion, October 2025 promises to be a pivotal month for the US stock market. While there are numerous factors at play, a careful analysis of economic indicators, corporate earnings, and market trends can help investors make informed decisions. As always, diversification and a well-thought-out investment strategy are key to navigating the volatile stock market landscape.