In the fast-paced world of finance, unusual options activity can often signal significant moves in the stock market. Today, we take a closer look at some of the most notable unusual options sweeps affecting US stocks. These sweeps provide valuable insights into where investors are placing their bets and what sectors are currently attracting attention.

What Are Unusual Options Sweeps?

Before diving into the details, let's define what we mean by "unusual options sweeps." These are instances where a significant number of options are being traded at the same strike price within a short period. This unusual activity can be indicative of a potential price movement in the underlying stock.

Today's Notable Sweeps

Apple Inc. (AAPL): One of the most notable unusual options sweeps today involved Apple Inc. Traders are placing bets on a significant move in AAPL's stock price, with a notable increase in put options being traded. This suggests that some investors are expecting a potential downturn in the tech giant's shares.

Tesla Inc. (TSLA): The electric vehicle manufacturer also saw unusual options activity, with a surge in call options being traded. This indicates that investors are bullish on TSLA's future and believe the stock price will rise.

Microsoft Corporation (MSFT): Tech giant Microsoft experienced a similar trend, with an increase in call options being traded. This reflects the optimism surrounding the software giant's prospects.

Sector Analysis

The unusual options activity today is primarily concentrated in the technology sector, with notable activity also observed in healthcare and consumer discretionary stocks. This suggests that investors are focusing on companies with strong growth potential in the coming years.

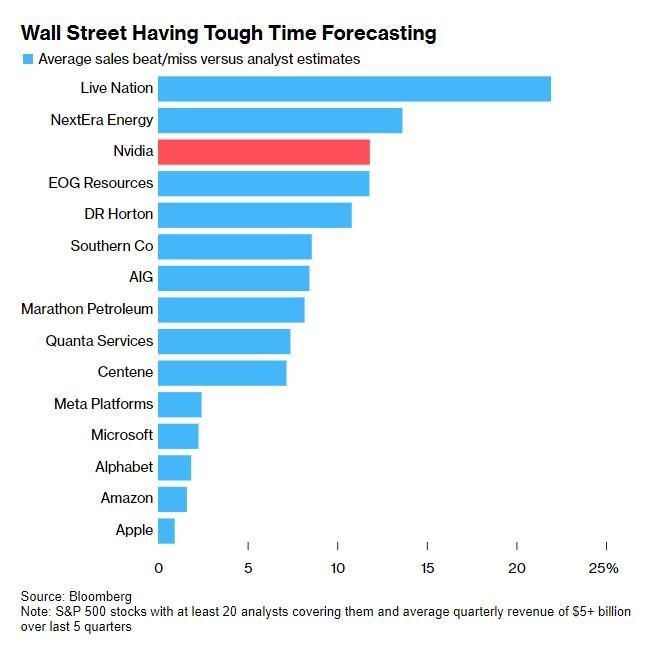

Case Study: NVIDIA Corporation (NVDA)

A prime example of unusual options activity today is NVIDIA Corporation, a leading player in the tech industry. Traders have been placing bets on a significant move in NVDA's stock price, with an increase in both call and put options being traded. This could be due to a range of factors, including the company's upcoming earnings report and the broader market sentiment towards the tech sector.

Conclusion

Unusual options sweeps provide valuable insights into the market's expectations and potential price movements in US stocks. Today's activity, particularly in the technology sector, suggests that investors are optimistic about the future prospects of some of the biggest players in the industry. As always, it's important to do your own research and consult with a financial advisor before making any investment decisions.