The recent announcement of a potential US-EU trade deal has sent shockwaves through the financial markets, particularly affecting stock futures. As investors closely monitor the developments, it's crucial to understand the potential impact of such a deal on the stock market. This article delves into the details of the US-EU trade deal and its implications for stock futures.

Understanding the US-EU Trade Deal

The US-EU trade deal, also known as the Transatlantic Trade and Investment Partnership (TTIP), is a comprehensive agreement aimed at enhancing economic cooperation between the United States and the European Union. The deal covers a wide range of areas, including trade in goods and services, digital trade, investment, and regulatory cooperation.

Potential Benefits of the US-EU Trade Deal

One of the primary benefits of the US-EU trade deal is the removal of tariffs and non-tariff barriers. This could lead to increased trade volumes between the two regions, benefiting companies operating in both markets. Additionally, the deal is expected to promote regulatory alignment, making it easier for businesses to operate across the Atlantic.

Impact on Stock Futures

The potential US-EU trade deal has significant implications for stock futures. Here's how it could affect various sectors:

1. Technology and Telecommunications

Technology companies are likely to benefit from the deal, as it could open up new markets and reduce regulatory barriers. Companies like Apple, Microsoft, and Google could see increased sales and revenue as a result of the deal.

Telecommunications companies could also benefit from the deal, as it could lead to increased cross-border investments and infrastructure development.

2. Energy and Utilities

Energy companies could see a boost in investment as a result of the deal. The agreement could lead to increased trade in energy products, benefiting companies like ExxonMobil and Royal Dutch Shell.

Utilities companies could also benefit from the deal, as it could lead to increased investment in renewable energy projects and infrastructure.

3. Automotive Industry

The automotive industry could see significant benefits from the US-EU trade deal. The agreement could lead to increased trade in vehicles and parts, benefiting companies like Ford, General Motors, and Tesla.

4. Retail and Consumer Goods

Retailers and consumer goods companies could see increased sales and revenue as a result of the deal. Companies like Walmart, Amazon, and Unilever could benefit from the increased trade and investment opportunities.

Case Studies

To illustrate the potential impact of the US-EU trade deal on stock futures, let's consider a few case studies:

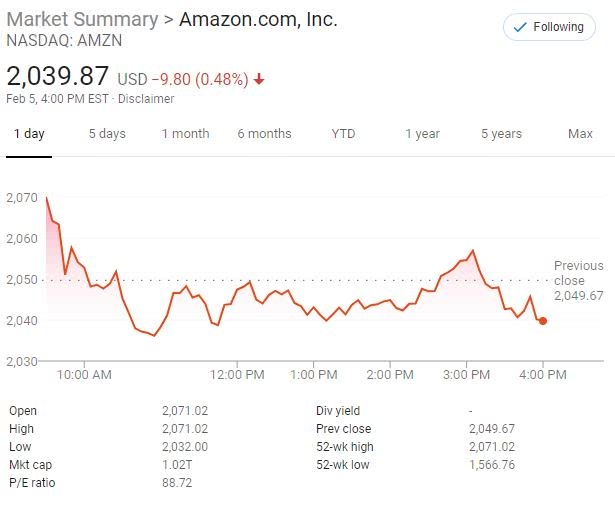

Case Study 1: Apple

Apple has a significant presence in both the US and the EU. A successful US-EU trade deal could lead to increased sales of Apple products in Europe, driving up the company's stock price.

Case Study 2: General Motors

General Motors operates in both the US and the EU. The deal could lead to increased trade in vehicles and parts, boosting the company's revenue and stock price.

Conclusion

The potential US-EU trade deal has the potential to significantly impact stock futures. As investors closely monitor the developments, it's crucial to understand the potential benefits and risks associated with the deal. By analyzing the impact on various sectors, investors can make informed decisions about their investments.