In today's fast-paced financial world, having access to real-time stock data is crucial for investors, traders, and financial analysts. This is where US stock data APIs come into play, offering a seamless and efficient way to gather and analyze stock market information. In this article, we'll explore the benefits of using US stock data APIs, how they work, and provide some practical examples of their applications.

Understanding US Stock Data APIs

A US stock data API (Application Programming Interface) is a set of protocols and tools that allows developers to access and integrate stock market data into their applications. These APIs provide real-time and historical data on stocks, indices, and other financial instruments listed on US exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ.

Benefits of Using US Stock Data APIs

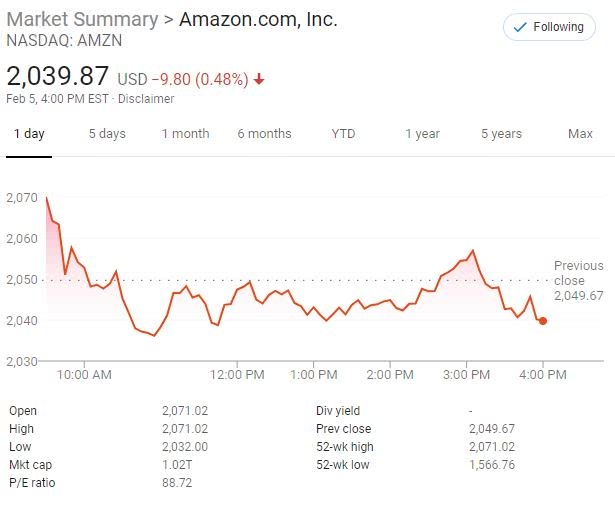

- Real-time Data: One of the primary advantages of using US stock data APIs is the ability to access real-time data. This means you can make informed decisions based on the latest market trends and price movements.

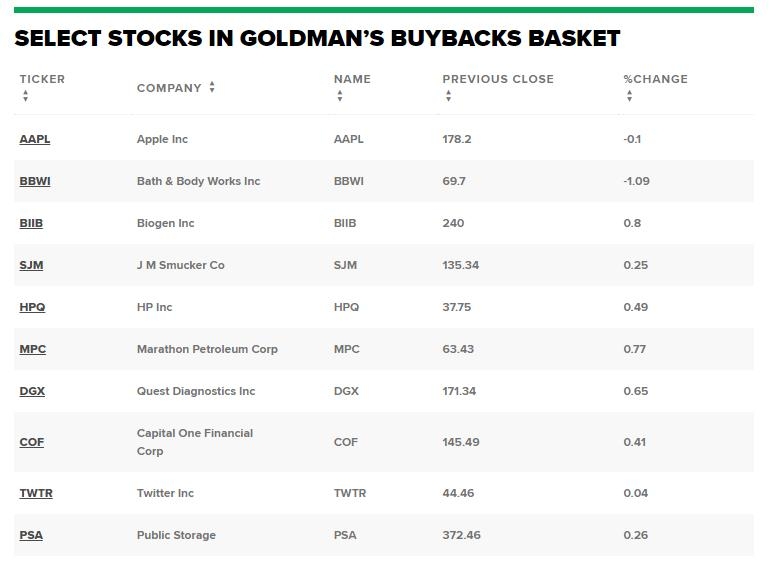

- Customization: APIs allow you to customize the data you receive, such as selecting specific stocks, time frames, and data points. This flexibility is particularly useful for advanced traders and analysts who require tailored information.

- Efficiency: By automating the process of gathering stock data, APIs save you time and effort. This allows you to focus on other aspects of your financial analysis or investment strategy.

- Scalability: US stock data APIs are designed to handle large volumes of data, making them suitable for both small-scale and large-scale applications.

How US Stock Data APIs Work

US stock data APIs work by providing a set of endpoints that developers can access to retrieve stock market information. These endpoints are typically RESTful, meaning they use HTTP requests to send and receive data. Here's a basic overview of how the process works:

- Authentication: Before accessing the API, you'll need to authenticate your request. This usually involves providing a unique API key or token.

- Endpoint Selection: Choose the appropriate endpoint based on the type of data you need, such as stock prices, market indices, or historical data.

- Data Retrieval: Send a request to the selected endpoint, specifying any required parameters, and receive the requested data in a structured format, such as JSON or XML.

- Data Integration: Integrate the retrieved data into your application, where you can analyze, display, or use it for other purposes.

Practical Examples of US Stock Data API Applications

- Portfolio Tracking: Use a US stock data API to track the performance of your investment portfolio in real-time, allowing you to make informed decisions based on the latest market trends.

- Market Analysis: Analyze historical stock data to identify patterns and trends that can help you predict future market movements.

- Automated Trading: Build an automated trading system that uses US stock data APIs to execute trades based on predefined rules and strategies.

Conclusion

US stock data APIs are a powerful tool for anyone interested in the stock market. By providing real-time, customizable, and efficient access to stock market information, these APIs can help you make informed decisions and gain a competitive edge in the financial world. Whether you're an individual investor, a financial analyst, or a developer, US stock data APIs offer a valuable resource for your financial needs.