In today's fast-paced financial world, innovation is key to staying ahead. One such innovation is the integration of tokenized US stocks with Ethereum, brought to life by the groundbreaking platform Ondo Finance. This article delves into the intricacies of this revolutionary concept, exploring its benefits, challenges, and potential impact on the investment landscape.

Understanding Ondo Finance

Ondo Finance is a decentralized platform that leverages blockchain technology to tokenize traditional financial assets. By tokenizing assets such as stocks, bonds, and commodities, Ondo Finance enables investors to access previously inaccessible markets and opportunities. The platform's innovative approach has garnered significant attention, particularly for its integration with Ethereum, a leading cryptocurrency platform.

Tokenized US Stocks on Ethereum

The integration of tokenized US stocks with Ethereum opens up a world of possibilities for investors. By tokenizing US stocks, Ondo Finance allows investors to purchase fractions of these stocks, eliminating the need for large capital investments. This democratizes the stock market, making it more accessible to retail investors.

Benefits of Tokenized US Stocks on Ethereum

Accessibility: Tokenized US stocks on Ethereum make it easier for investors to diversify their portfolios without needing large amounts of capital. This accessibility fosters a more inclusive financial ecosystem.

Transparency: The blockchain technology used by Ondo Finance ensures transparency in all transactions. Investors can track the ownership of stocks and verify their investments with ease.

Efficiency: Ethereum's decentralized network facilitates faster and more efficient transactions compared to traditional stock exchanges. This can lead to significant time and cost savings for investors.

Interoperability: Tokenized US stocks on Ethereum can be easily integrated with other blockchain-based applications, expanding the range of investment opportunities available to users.

Challenges and Considerations

Despite the numerous benefits, tokenized US stocks on Ethereum face several challenges:

Regulatory Hurdles: The integration of traditional financial assets with blockchain technology requires compliance with existing regulations. Ondo Finance must navigate a complex regulatory landscape to ensure compliance.

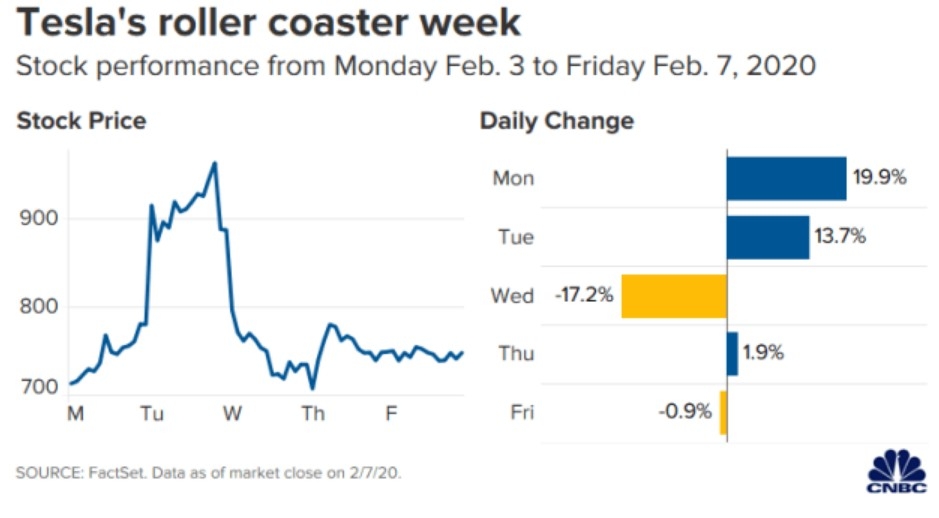

Market Volatility: Tokenized stocks are subject to the same market volatility as their underlying assets. This can be a significant risk for investors, particularly those with limited capital.

Technological Risks: Blockchain technology is still relatively new, and its reliability and security are subject to ongoing scrutiny. Ondo Finance must continuously monitor and improve its technology to ensure the safety of its users' investments.

Case Studies

Several notable case studies demonstrate the potential of tokenized US stocks on Ethereum:

Ondo Finance's Tokenized Bitcoin ETF: Ondo Finance successfully launched a tokenized Bitcoin ETF, allowing investors to invest in Bitcoin through its platform. This demonstrated the platform's ability to tokenize complex financial assets.

Tokenized US Stock Exchange: Another platform, Tokenize America, has launched a tokenized US stock exchange. This initiative aims to bring traditional stock trading to the blockchain, leveraging the benefits of tokenization.

In conclusion, the integration of tokenized US stocks with Ethereum through platforms like Ondo Finance represents a significant shift in the investment landscape. While challenges remain, the potential benefits of this innovative approach are hard to ignore. As blockchain technology continues to evolve, it's likely that tokenized US stocks on Ethereum will play an increasingly important role in the future of finance.