In the world of biotechnology and pharmaceuticals, CSL Behring stands out as a leading company. For investors interested in the US stock market, understanding the potential of CSL Behring’s stock is crucial. This article delves into a comprehensive analysis of CSL Behring’s US stock, exploring its market position, financial performance, and future prospects.

Understanding CSL Behring

CSL Behring is a global leader in the development and manufacturing of biotherapies. Based in the United States, the company has a strong presence in the healthcare industry, offering a wide range of products and services. Its portfolio includes treatments for hemophilia, von Willebrand disease, immune disorders, and more.

Market Position

CSL Behring has established itself as a key player in the biotechnology sector. The company’s strong research and development capabilities, coupled with its innovative product offerings, have helped it maintain a competitive edge.

One of the key factors contributing to CSL Behring’s market position is its commitment to patient care. The company’s focus on improving the quality of life for individuals with rare and life-threatening diseases has garnered it a loyal customer base.

Financial Performance

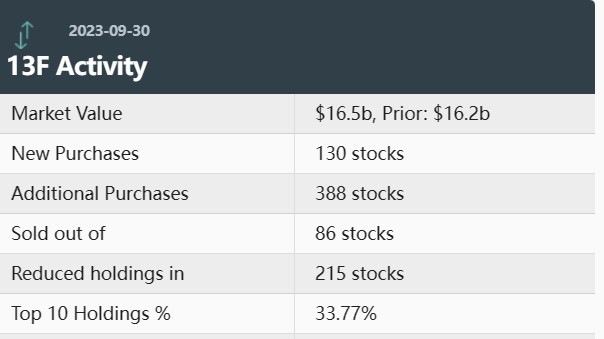

When analyzing CSL Behring’s US stock, it’s essential to consider its financial performance. Over the past few years, the company has demonstrated consistent growth in revenue and profitability.

In the last fiscal year, CSL Behring reported a revenue of

Key Drivers of Growth

Several factors have contributed to CSL Behring’s growth. Firstly, the company’s product portfolio has expanded significantly, with several new products entering the market. This expansion has helped the company tap into new markets and increase its revenue streams.

Secondly, CSL Behring’s focus on research and development has led to the development of innovative therapies. The company has a robust pipeline of potential new products, which could further enhance its market position.

Thirdly, the company’s strong distribution network and strategic partnerships have helped it reach a wider audience. These partnerships have also facilitated the introduction of new products and technologies into the market.

Case Study: Hemlibra

One of CSL Behring’s most notable products is Hemlibra, a treatment for hemophilia A. Hemlibra has been well-received by both healthcare professionals and patients, thanks to its efficacy and convenience. The product’s success in the market is a testament to CSL Behring’s commitment to innovation and patient care.

Conclusion

Investing in CSL Behring’s US stock presents several opportunities. The company’s strong market position, impressive financial performance, and promising future prospects make it an attractive investment for investors seeking exposure to the biotechnology sector. As the company continues to innovate and expand its product portfolio, its US stock is likely to remain a compelling investment option for years to come.